e) If MSC Inc. would have been sold on December 31", 2020 for $9,250,000 by buylT Inc., calculate how much Goodwill would need to be added to the next buylT Inc. balance sheet. ) It is not sufficient to make investment decisions based only on the balance sheet. One common weakness of the balance sheet are assets that are known to exist in the company but cannot legally be shown in the balance sheet. Explain and name an example for such a "missing asset" and explain at which point such an asset becomes visible in a balance sheet.

e) If MSC Inc. would have been sold on December 31", 2020 for $9,250,000 by buylT Inc., calculate how much Goodwill would need to be added to the next buylT Inc. balance sheet. ) It is not sufficient to make investment decisions based only on the balance sheet. One common weakness of the balance sheet are assets that are known to exist in the company but cannot legally be shown in the balance sheet. Explain and name an example for such a "missing asset" and explain at which point such an asset becomes visible in a balance sheet.

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter9: Long-term Liabilities

Section: Chapter Questions

Problem 46BE

Related questions

Question

100%

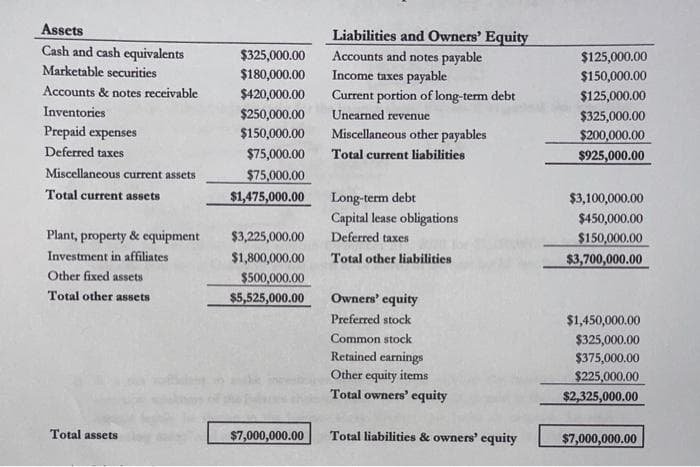

Transcribed Image Text:Assets

Liabilities and Owners' Equity

Accounts and notes payable

Income taxes payable

Current portion of long-term debt

Unearned revenue

Cash and cash equivalents

$325,000.00

$125,000.00

Marketable securities

$180,000.00

$150,000.00

Accounts & notes receivable

$420,000.00

$250,000.00

$125,000.00

Inventories

$325,000.00

Prepaid expenses

$150,000.00

Miscellaneous other payables

$200,000.00

$925,000.00

Deferred taxes

$75,000.00

Total current liabilities

Miscellaneous current assets

$75,000.00

$1,475,000.00

Total current assets

Long-term debt

Capital lease obligations

Deferred taxes

$3,100,000.00

$450,000.00

Plant, property & equipment

$3,225,000.00

$150,000.00

Investment in affiliates

$1,800,000.00

Total other liabilities

$3,700,000.00

Other fixed assets

$500,000.00

Total other assets

$5,525,000.00

Owners' equity

Preferred stock

$1,450,000.00

Common stock

$325,000.00

$375,000.00

Retained earnings

Other equity items

Total owners' equity

$225,000.00

$2,325,000.00

Total assets

$7,000,000.00

Total liabilities & owners' equity

$7,000,000.00

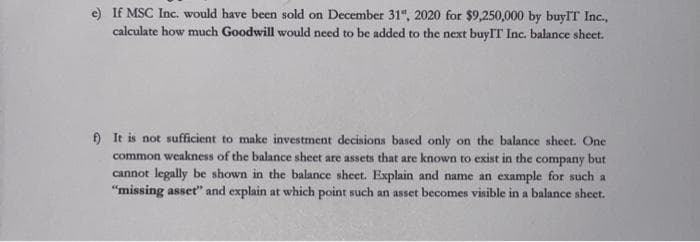

Transcribed Image Text:e) If MSC Inc. would have been sold on December 31", 2020 for $9,250,000 by buylT Inc.,

calculate how much Goodwill would need to be added to the next buyIT Inc. balance sheet.

) It is not sufficient to make investment decisions based only on the balance sheet. One

common weakness of the balance sheet are assets that are known to exist in the company but

cannot legally be shown in the balance sheet. Explain and name an example for such a

"missing asset" and explain at which point such an asset becomes visible in a balance sheet.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub