e information in Exercise 6, but assume instead that a 20% stock dividend was declared. Answer the same requirements. (see attached images especially for the information in Exercise 6 in the uploaded images. Please answer it. thank you so much) NOTE: Please answer l

e information in Exercise 6, but assume instead that a 20% stock dividend was declared. Answer the same requirements. (see attached images especially for the information in Exercise 6 in the uploaded images. Please answer it. thank you so much) NOTE: Please answer l

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter16: Retained Earnings And Earnings Per Share

Section: Chapter Questions

Problem 4RE: Use the same facts as in RE 16-3, but instead assume that Pickens declares and issues a 50% stock...

Related questions

Question

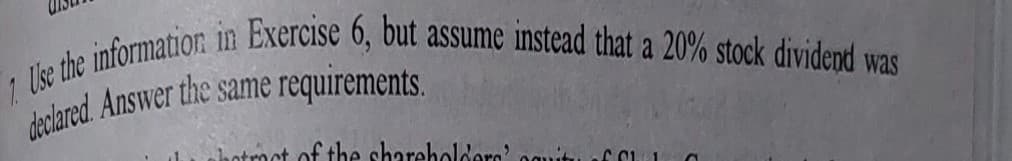

7. Use the information in Exercise 6, but assume instead that a 20% stock dividend was declared. Answer the same requirements.

(see attached images especially for the information in Exercise 6 in the uploaded images. Please answer it. thank you so much)

NOTE: Please answer letter a to b

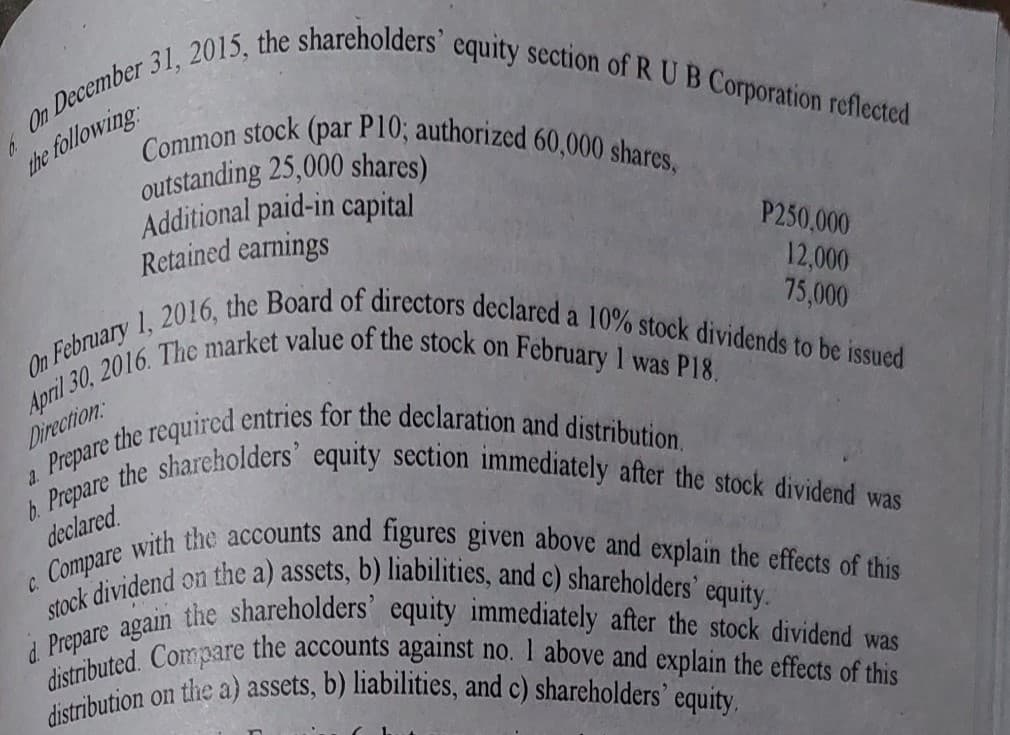

Transcribed Image Text:On February 1, 2016, the Board of directors declared a 10% stock dividends to be issued

b. Prepare the shareholders' equity section immediately after the stock dividend was

d Prepare again the shareholders' equity immediately after the stock dividend was

On 31, 2015, the shareholders' equity section of RUB Corporation reflected

Common stock (par P10; authorized 60,000 shares,

distributed. Compare the accounts against no. 1 above and explain the effects of this

c. Compare with the accounts and figures given above and explain the effects of this

stock dividend on the a) assets, b) liabilities, and c) shareholders' equity.

distribution on the a) assets, b) liabilities, and c) shareholders' equity.

following

outstanding 25,000 shares)

Additional paid-in capital

Retained earnings

the follow

P250,000

12,000

75,000

on

Direction:

declared

Transcribed Image Text:1 Use the information in Exercise 6, but assume instead that a 20% stock dividend was

ot of the shoreholdere

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning