e interest rate is 0.20. H Tack ill D 150 100 100 75 had to stay together, where would they cho

e interest rate is 0.20. H Tack ill D 150 100 100 75 had to stay together, where would they cho

Chapter1: Federal Income Taxation—an Overview

Section: Chapter Questions

Problem 60P: Michiko and Saul are planning to attend the same university next year. The university estimates...

Related questions

Question

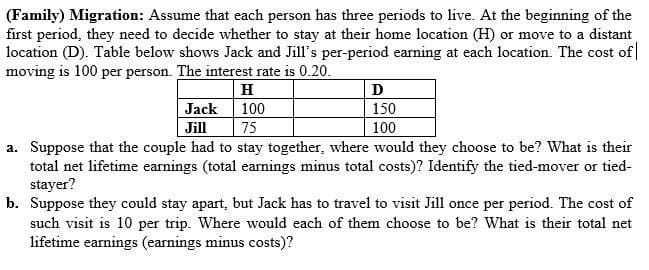

Transcribed Image Text:(Family) Migration: Assume that each person has three periods to live. At the beginning of the

first period, they need to decide whether to stay at their home location (H) or move to a distant

location (D). Table below shows Jack and Jill's per-period earning at each location. The cost of

moving is 100 per person. The interest rate is 0.20.

H

D

Jack

100

150

Jill

75

100

a. Suppose that the couple had to stay together, where would they choose to be? What is their

total net lifetime earnings (total earnings minus total costs)? Identify the tied-mover or tied-

stayer?

b. Suppose they could stay apart, but Jack has to travel to visit Jill once per period. The cost of

such visit is 10 per trip. Where would each of them choose to be? What is their total net

lifetime earnings (earnings minus costs)?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 1 images

Recommended textbooks for you