I for sale at the lower of carrying amount and recoverable amoun current asset that is to be abandoned shall not be classified as he ause it is unlikely that the noncurrent asset will be sold within twe

I for sale at the lower of carrying amount and recoverable amoun current asset that is to be abandoned shall not be classified as he ause it is unlikely that the noncurrent asset will be sold within twe

SWFT Essntl Tax Individ/Bus Entities 2020

23rd Edition

ISBN:9780357391266

Author:Nellen

Publisher:Nellen

Chapter8: Property Transactions: Capital Gains And Losses, Section 1231 And Recapture Provisions

Section: Chapter Questions

Problem 4BCRQ

Related questions

Question

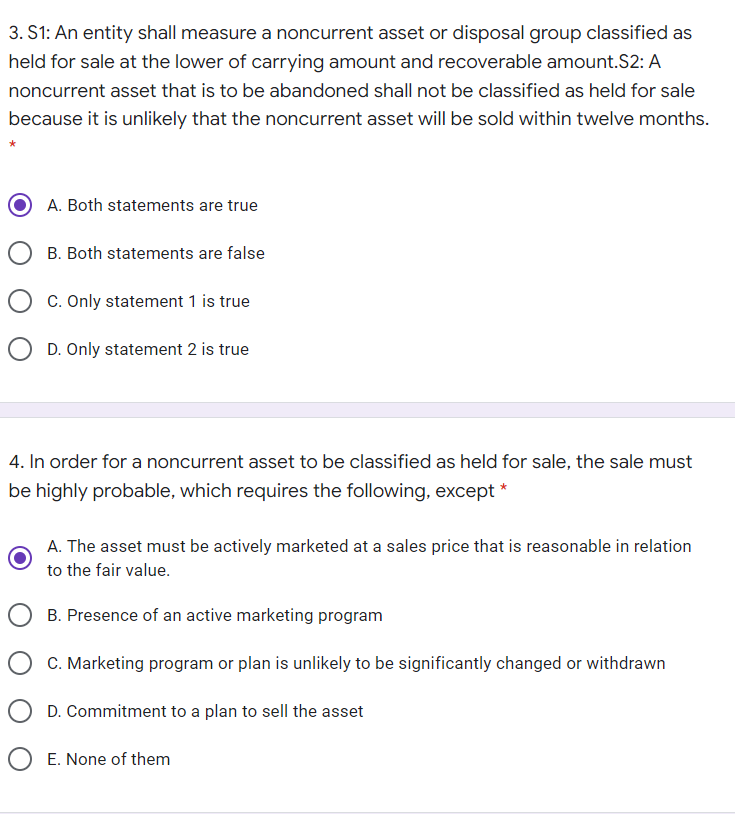

Transcribed Image Text:3. S1: An entity shall measure a noncurrent asset or disposal group classified as

held for sale at the lower of carrying amount and recoverable amount.S2: A

noncurrent asset that is to be abandoned shall not be classified as held for sale

because it is unlikely that the noncurrent asset will be sold within twelve months.

A. Both statements are true

B. Both statements are false

C. Only statement 1 is true

D. Only statement 2 is true

4. In order for a noncurrent asset to be classified as held for sale, the sale must

be highly probable, which requires the following, except *

A. The asset must be actively marketed at a sales price that is reasonable in relation

to the fair value.

B. Presence of an active marketing program

C. Marketing program or plan is unlikely to be significantly changed or withdrawn

D. Commitment to a plan to sell the asset

O E. None of them

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you