E10-1 (Multiple Choice) Identify the best answer for each of the following: 1. Which of the following statements about accounting principles used in Enterprise Funds is false? a. Management may choose whether or not to apply recent FASB standards if they do not conflict with GASB standards. b. An Enterprise Fund's statement of cash flows is prepared in the same format as a state- ment of cash flows for a private-sector entity. c. Governmental entities may choose to prepare either a statement of net assets or a bal- ance sheet for an Enterprise Fund. d. Enterprise Funds may adopt budgets on a basis of accounting contrary to GAAP. e. GAAP does not require Enterprise Funds to legally adopt budgets. 2. Which of the following activities would be least likely to ho

E10-1 (Multiple Choice) Identify the best answer for each of the following: 1. Which of the following statements about accounting principles used in Enterprise Funds is false? a. Management may choose whether or not to apply recent FASB standards if they do not conflict with GASB standards. b. An Enterprise Fund's statement of cash flows is prepared in the same format as a state- ment of cash flows for a private-sector entity. c. Governmental entities may choose to prepare either a statement of net assets or a bal- ance sheet for an Enterprise Fund. d. Enterprise Funds may adopt budgets on a basis of accounting contrary to GAAP. e. GAAP does not require Enterprise Funds to legally adopt budgets. 2. Which of the following activities would be least likely to ho

Chapter1: Financial Statements And Business Decisions

Section: Chapter Questions

Problem 1Q

Related questions

Question

Exercise E10-1

1-10, please.

Thank you.

![E10-1 (Multiple Choice) Identify the best answer for each of the following:

1. Which of the following statements about accounting principles used in Enterprise Funds is

false?

a. Management may choose whether or not to apply recent FASB standards if they do not

conflict with GASB standards.

b. An Enterprise Fund's statement of cash flows is prepared in the same format as a state-

ment of cash flows for a private-sector entity.

c. Governmental entities may choose to prepare either a statement of net assets or a bal-

ance sheet for an Enterprise Fund.

d. Enterprise Funds may adopt budgets on a basis of accounting contrary to GAAP.

e. GAAP does not require Enterprise Funds to legally adopt budgets.

2. Which of the following activities would be least likely to be operated as and accounted for

in an Enterprise Fund?

a. Town planning department.

ab. Sports stadium.ions]

c. Parking garage.

Jootong no

d. Mass transit authority. grants.

3. The city of Philaburg arranged for a 10-year, $40 million loan to finance construction of a

toll bridge over the Tradewater River. If the toll bridge is accounted for as an Enterprise

Fund activity and a certain portion of the tolls collected is required to be set aside for main-

taining the bridge, these resources should be accounted for in

a. a Debt Service Fund.

b. the General Fund.

c. the Toll Bridge Enterprise Fund.

d. a Capital Projects Fund. Sang

e. None of the above.000,32 Rev

4. The fund equity of an Enterprise Fund could include any of the following except

a. invested in capital assets, net of related debt.

b. fund balance.

c. restricted net assets. rant

d. unrestricted net assets.

e. All of the above are possible classifications of equity in an Enterprise Fund.

5. The city of Silerville operates a water authority that sells water to city residents. Each new

customer is required to pay a $75 deposit at the time of hookup. The deposit cannot be

spent, but is returned with interest if the customer maintains a satisfactory payment record

for two years. The city should record these deposits

a. in a Private-Purpose Trust Fund.

b. as restricted cash and a liability payable from restricted assets in the Water Fund.

c. as unrestricted cash and a long-term liability in the Water Fund.

d. as unrestricted cash and a liability payable from restricted assets in the General Fund.

e. None of the above.

6. All Enterprise Fund transfers are reported in an Enterprise Fund's operating statement as

a. nonoperating revenues.

b. other financing sources.

c. special items.

d. None of the above.](/v2/_next/image?url=https%3A%2F%2Fcontent.bartleby.com%2Fqna-images%2Fquestion%2F1a111f43-cec5-4fed-922d-e4f02ee1a84c%2F51d09f4a-457c-46ea-ad5f-36c765470715%2Fnu5mi9p_processed.jpeg&w=3840&q=75)

Transcribed Image Text:E10-1 (Multiple Choice) Identify the best answer for each of the following:

1. Which of the following statements about accounting principles used in Enterprise Funds is

false?

a. Management may choose whether or not to apply recent FASB standards if they do not

conflict with GASB standards.

b. An Enterprise Fund's statement of cash flows is prepared in the same format as a state-

ment of cash flows for a private-sector entity.

c. Governmental entities may choose to prepare either a statement of net assets or a bal-

ance sheet for an Enterprise Fund.

d. Enterprise Funds may adopt budgets on a basis of accounting contrary to GAAP.

e. GAAP does not require Enterprise Funds to legally adopt budgets.

2. Which of the following activities would be least likely to be operated as and accounted for

in an Enterprise Fund?

a. Town planning department.

ab. Sports stadium.ions]

c. Parking garage.

Jootong no

d. Mass transit authority. grants.

3. The city of Philaburg arranged for a 10-year, $40 million loan to finance construction of a

toll bridge over the Tradewater River. If the toll bridge is accounted for as an Enterprise

Fund activity and a certain portion of the tolls collected is required to be set aside for main-

taining the bridge, these resources should be accounted for in

a. a Debt Service Fund.

b. the General Fund.

c. the Toll Bridge Enterprise Fund.

d. a Capital Projects Fund. Sang

e. None of the above.000,32 Rev

4. The fund equity of an Enterprise Fund could include any of the following except

a. invested in capital assets, net of related debt.

b. fund balance.

c. restricted net assets. rant

d. unrestricted net assets.

e. All of the above are possible classifications of equity in an Enterprise Fund.

5. The city of Silerville operates a water authority that sells water to city residents. Each new

customer is required to pay a $75 deposit at the time of hookup. The deposit cannot be

spent, but is returned with interest if the customer maintains a satisfactory payment record

for two years. The city should record these deposits

a. in a Private-Purpose Trust Fund.

b. as restricted cash and a liability payable from restricted assets in the Water Fund.

c. as unrestricted cash and a long-term liability in the Water Fund.

d. as unrestricted cash and a liability payable from restricted assets in the General Fund.

e. None of the above.

6. All Enterprise Fund transfers are reported in an Enterprise Fund's operating statement as

a. nonoperating revenues.

b. other financing sources.

c. special items.

d. None of the above.

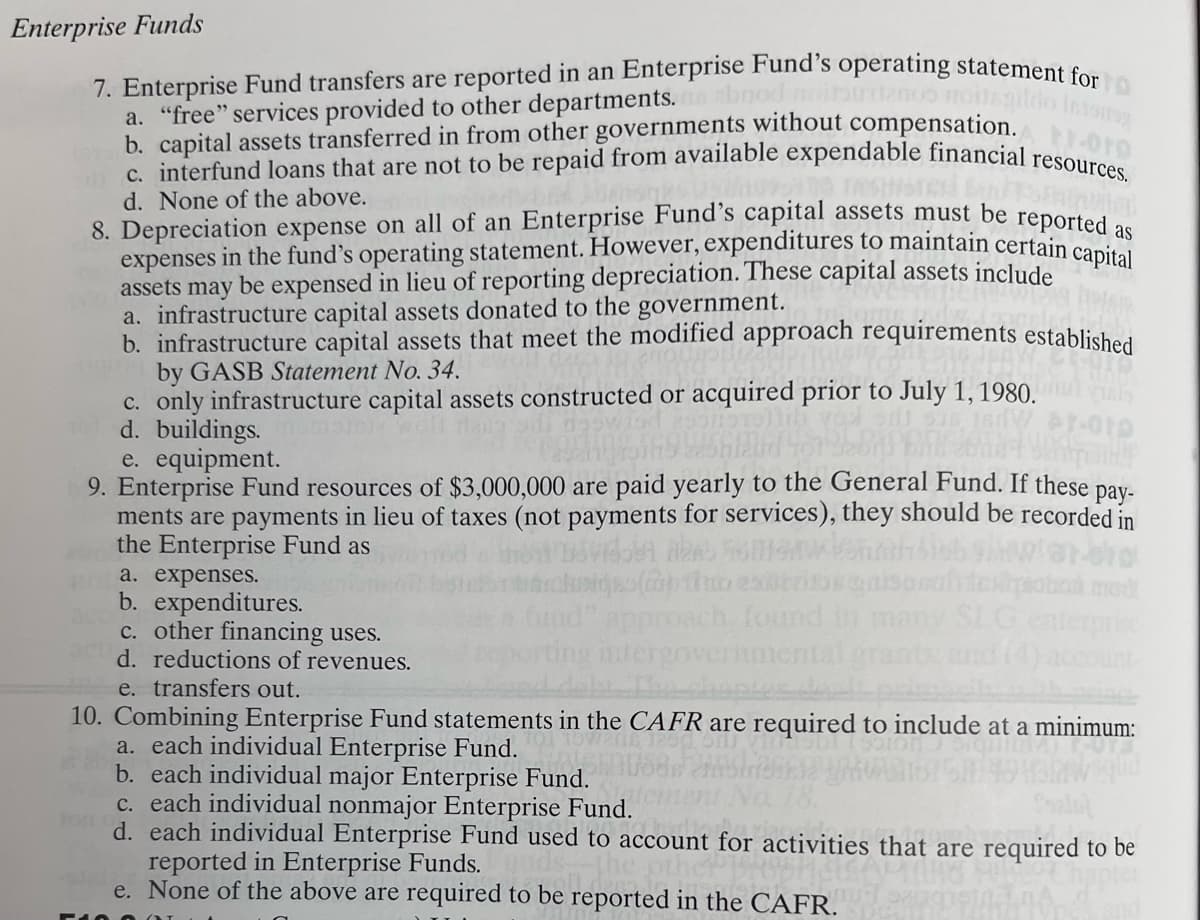

Transcribed Image Text:Enterprise Funds

7. Enterprise Fund transfers are reported in an Enterprise Fund's operating statement for

a. "free" services provided to other departments.

b. capital assets transferred in from other governments without compensation. 1.010

tc. interfund loans that are not to be repaid from available expendable financial resources.

d. None of the above.

8. Depreciation expense on all of an Enterprise Fund's capital assets must be reported as

expenses in the fund's operating statement. However, expenditures to maintain certain capital

assets may be expensed in lieu of reporting depreciation. These capital assets include

a. infrastructure capital assets donated to the government.

b. infrastructure capital assets that meet the modified approach requirements established

by GASB Statement No. 34.

c. only infrastructure capital assets constructed or acquired prior to July 1, 1980.

d. buildings.

e. equipment.

010

Bermainf

9. Enterprise Fund resources of $3,000,000 are paid yearly to the General Fund. If these pay-

ments are payments in lieu of taxes (not payments for services), they should be recorded in

the Enterprise Fund as

a. expenses.

b. expenditures.

c. other financing uses.

d. reductions of revenues.

e. transfers out.

sigo(ab tho

approach found

alergovern

10. Combining Enterprise Fund statements in the CAFR are required to include at a minimum:

a. each individual Enterprise Fund.

b. each individual major Enterprise Fund.

c. each individual nonmajor Enterprise Fund.

d. each individual Enterprise Fund used to account for activities that are required to be

reported in Enterprise Funds.

vities t

e. None of the above are required to be reported in the CAFR.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis…

Accounting

ISBN:

9780134475585

Author:

Srikant M. Datar, Madhav V. Rajan

Publisher:

PEARSON

Intermediate Accounting

Accounting

ISBN:

9781259722660

Author:

J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:

McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:

9781259726705

Author:

John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:

McGraw-Hill Education