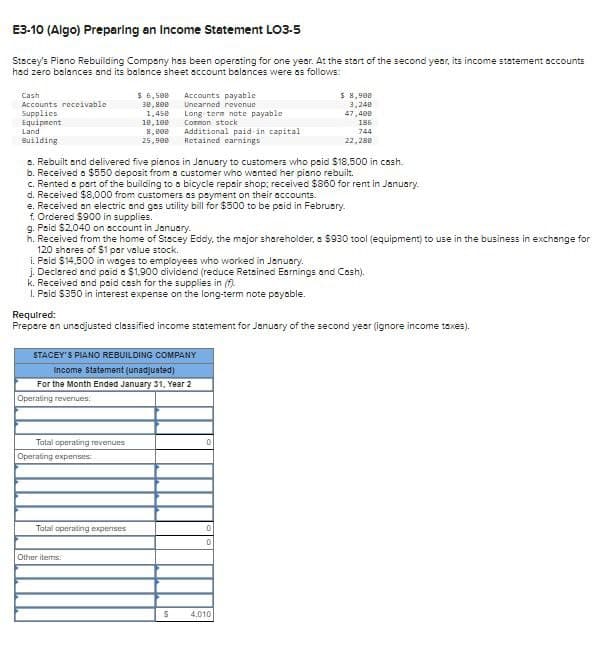

E3-10 (Algo) Preparing an Income Statement LO3-5 Stacey's Piano Rebuilding Company has been operating for one year. At the start of the second year, its income statement accounts had zero balances and its balance sheet account balances were as follows: Cash Accounts receivable Supplies Equipment Land Building $6,500 30,800 1,450 10,100 8,000 25,900 a. Rebuilt and delivered five pianos in January to customers who paid $18,500 in cash. b. Received a $550 deposit from a customer who wanted her piano rebuilt. c. Rented a part of the building to a bicycle repair shop; received $860 for rent in January. d. Received $8,000 from customers as payment on their accounts. e. Received an electric and gas utility bill for $500 to be paid in February. f. Ordered $900 in supplies. 9. Paid $2,040 on account in January. n. Received from the home of Stacey Eddy, the major shareholder, a $930 tool (equipment) to use in the business in exchange for 120 shares of $1 par value stock. Total operating revenues Accounts payable Unearned revenue Long-term note payable Cormon stock 1. Paid $14,500 in wages to employees who worked in January. j. Declared and paid a $1,900 dividend (reduce Retained Earnings and Cash). k. Received and paid cash for the supplies in (f). 1. Paid $350 in interest expense on the long-term note payable. Operating expenses Additional paid in capital Retained earnings Required: Prepare an unadjusted classified income statement for January of the second year (ignore income taxes). STACEY'S PIANO REBUILDING COMPANY Income Statement (unadjusted) For the Month Ended January 31, Year 2 Operating revenues: Total operating expenses Other items $ 8,900 3,240 47,400 186 744 22,280 S 4,010

E3-10 (Algo) Preparing an Income Statement LO3-5 Stacey's Piano Rebuilding Company has been operating for one year. At the start of the second year, its income statement accounts had zero balances and its balance sheet account balances were as follows: Cash Accounts receivable Supplies Equipment Land Building $6,500 30,800 1,450 10,100 8,000 25,900 a. Rebuilt and delivered five pianos in January to customers who paid $18,500 in cash. b. Received a $550 deposit from a customer who wanted her piano rebuilt. c. Rented a part of the building to a bicycle repair shop; received $860 for rent in January. d. Received $8,000 from customers as payment on their accounts. e. Received an electric and gas utility bill for $500 to be paid in February. f. Ordered $900 in supplies. 9. Paid $2,040 on account in January. n. Received from the home of Stacey Eddy, the major shareholder, a $930 tool (equipment) to use in the business in exchange for 120 shares of $1 par value stock. Total operating revenues Accounts payable Unearned revenue Long-term note payable Cormon stock 1. Paid $14,500 in wages to employees who worked in January. j. Declared and paid a $1,900 dividend (reduce Retained Earnings and Cash). k. Received and paid cash for the supplies in (f). 1. Paid $350 in interest expense on the long-term note payable. Operating expenses Additional paid in capital Retained earnings Required: Prepare an unadjusted classified income statement for January of the second year (ignore income taxes). STACEY'S PIANO REBUILDING COMPANY Income Statement (unadjusted) For the Month Ended January 31, Year 2 Operating revenues: Total operating expenses Other items $ 8,900 3,240 47,400 186 744 22,280 S 4,010

Survey of Accounting (Accounting I)

8th Edition

ISBN:9781305961883

Author:Carl Warren

Publisher:Carl Warren

Chapter2: Basic Accounting Systems: Cash Basis

Section: Chapter Questions

Problem 2.4.4P: Financial statements Padget Home Services began its operations on January 1, 20Y7 (see Problem 2-3)....

Related questions

Question

do not provide answer image format

Transcribed Image Text:E3-10 (Algo) Preparing an Income Statement LO3-5

Stacey's Piano Rebuilding Company has been operating for one year. At the start of the second year, its income statement accounts

had zero balances and its balance sheet account balances were as follows:

Cash

Accounts receivable

Supplies

Equipment

Land

Building

$ 6,508

30,800

1,450

10,100

8,000

25,900

Accounts payable

Unearned revenue

Long term note payable

Cormon stock

8. Rebuilt and delivered five pianos in January to customers who paid $18,500 in cash.

b. Received a $550 deposit from a customer who wanted her piano rebuilt.

Total operating revenues

Additional paid in capital

Retained earnings

c. Rented a part of the building to a bicycle repair shop; received $860 for rent in January.

d. Received $8,000 from customers as payment on their accounts.

Operating expenses

e. Received an electric and gas utility bill for $500 to be paid in February.

f. Ordered $900 in supplies.

g. Paid $2,040 on account in January.

Total operating expenses

h. Received from the home of Stacey Eddy, the major shareholder, a $930 tool (equipment) to use in the business in exchange for

120 shares of $1 par value stock.

i. Paid $14,500 in wages to employees who worked in January.

j. Declared and paid a $1,900 dividend (reduce Retained Earnings and Cash).

k. Received and paid cash for the supplies in (f).

1. Paid $350 in interest expense on the long-term note payable.

STACEY'S PIANO REBUILDING COMPANY

Income Statement (unadjusted)

For the Month Ended January 31, Year 2

Operating revenues:

Other items:

Required:

Prepare an unadjusted classified income statement for January of the second year (ignore income taxes).

$ 8,900

3,248

47,400

186

744

22,288

0

0

S 4,010

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning