E7-12 On January 1, 2017, Haley Company had a balance of $360,000 of goodwill on its bal- ance sheet that resulted from the purchase of a small business in a prior year. The goodwill had an indefinite life. During 2017, the company had the following additional transactions. Jan. 2 Purchased a patent (5-year life) $280,000. Acquired a 9-year franchise; expiration date July 1, 2026, $540,000. Research and development costs $185,000. bloa July 1 Sept. 1 Instructions (a) Prepare a tabular summary to record the January 1 balance in the Goodwill account as well as the 2017 transactions related to intangibles. All costs incurred were for cash. (b) Record any necessary amortization as of December 31, 2017. the intangible asset account balances should be on December 31, 2017. nting policy to amortize imated

E7-12 On January 1, 2017, Haley Company had a balance of $360,000 of goodwill on its bal- ance sheet that resulted from the purchase of a small business in a prior year. The goodwill had an indefinite life. During 2017, the company had the following additional transactions. Jan. 2 Purchased a patent (5-year life) $280,000. Acquired a 9-year franchise; expiration date July 1, 2026, $540,000. Research and development costs $185,000. bloa July 1 Sept. 1 Instructions (a) Prepare a tabular summary to record the January 1 balance in the Goodwill account as well as the 2017 transactions related to intangibles. All costs incurred were for cash. (b) Record any necessary amortization as of December 31, 2017. the intangible asset account balances should be on December 31, 2017. nting policy to amortize imated

Chapter12: Current Liabilities

Section: Chapter Questions

Problem 1PB: Consider the following situations and determine (1) which type of liability should be recognized...

Related questions

Question

Transcribed Image Text:Illounting treatmnent in each of the above situations is in

UI' assumption, if any, has been violated and what the appropriate accounting treat

lerally accepted accounting principles. Explain what accounting prin-

ment should be.

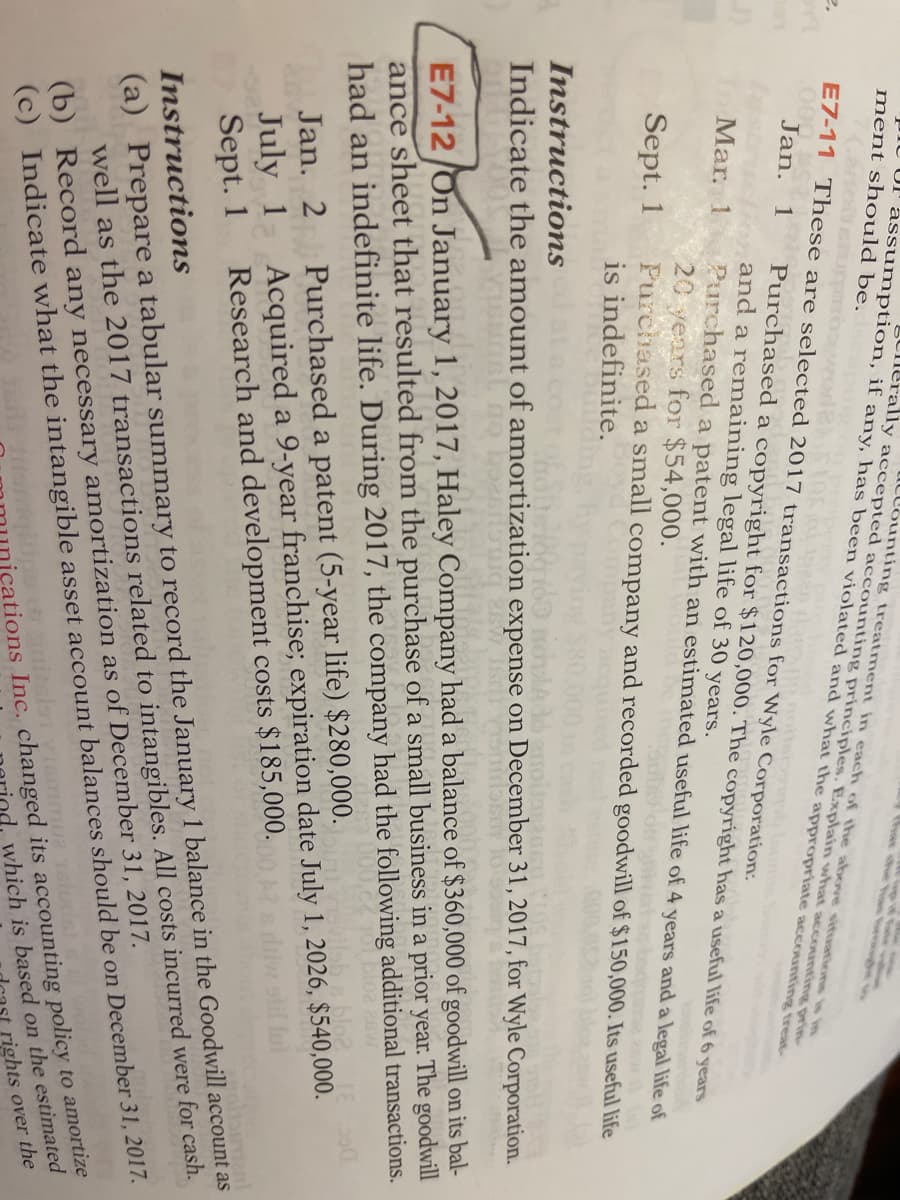

E7-11 These are selected 2017 transactions for Wyle Corporation:

.000

Jan.

1

Purchased a copyright for $120,000. The copyright has a useful life of 6 years

and a remaining legal life of 30 years.

Purchased a patent with an estimated useful life of 4 years and a legal life of

20 years for $54,000.

Purchased a small company and recorded goodwill of $150,000. Its useful life

is indefinite.

Mar. 1

Sept. 1

Instructions

Indicate the amount of amortization expense on December 31, 2017, for Wyle Corporation.

E7-12 /On January 1, 2017, Haley Company had a balance of $360,000 of goodwill on its bal-

ance sheet that resulted from the purchase of a small business in a prior year. The goodwill

had an indefinite life. During 2017, the company had the following additional transactions.

Purchased a patent (5-year life) $280,000.

Acquired a 9-year franchise; expiration date July 1, 2026, $540,000.

Research and development costs $185,000.

Jan. 2

July 1

Sept. 1

(a) Prepare a tabular summary to record the January 1 balance in the Goodwill account as

well as the 2017 transactions related to intangibles. All costs incurred were for cash.

Instructions

(c) Indicate what the intangible asset account balances should be on December 31, 2017.

rights over the

içations Inc. changed its accounting policy to amortize

nd, which is based on the estimated

(b) Record any necessary amortization as of December 31, 2017.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning