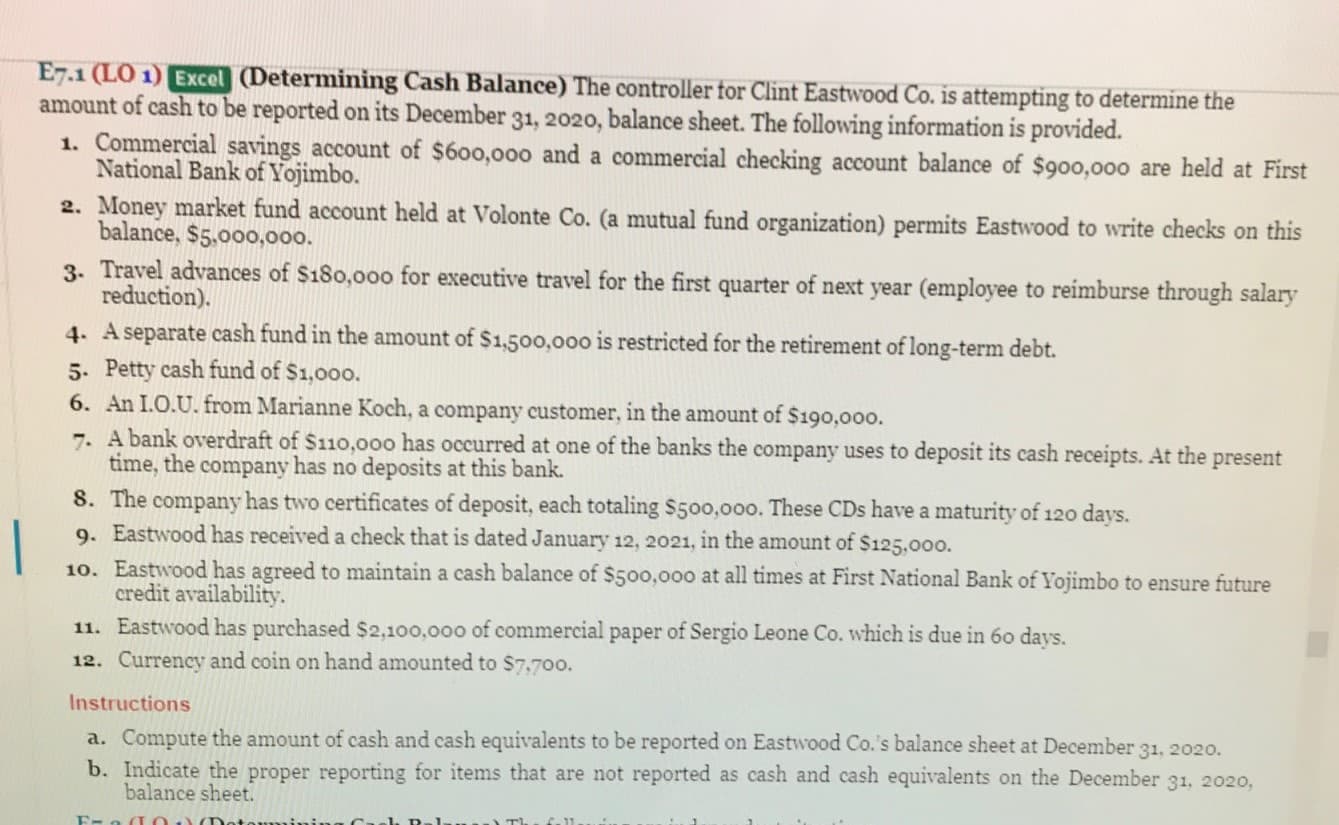

E7.1 (LO 1) Excel (Determining Cash Balance) The controller for Clint Eastwood Co. is attempting to determine the amount of cash to be reported on its December 31, 20o20, balance sheet. The following information is provided. 1. Commercial savings account of $600,000 and a commercial checking account balance of $900,000 are held at First National Bank of Yojimbo. 2. Money market fund account held at Volonte Co. (a mutual fund organization) permits Eastwood to write checks on this balance, $5.000,000. 3. Travel advances of $180,00oo for executive travel for the first quarter of next year (employee to reimburse through salary reduction). 4. A separate cash fund in the amount of $1,500,000 is restricted for the retirement of long-term debt. 5. Petty cash fund of $1,000. 6. An I.O.U. from Marianne Koch, a company customer, in the amount of $190,000. 7. A bank overdraft of $110,000 has occurred at one of the banks the company uses to deposit its cash receipts. At the present time, the company has no deposits at this bank. 8. The company has two certificates of deposit, each totaling $500,000o. These CDs have a maturity of 120 days. 9. Eastwood has received a check that is dated January 12, 2021, in the amount of $125,000. 10. Eastwood has agreed to maintain a cash balance of $500,000 at all times at First National Bank of Yojimbo to ensure future credit availability. 11. Eastwood has purchased $2,100,000 of commercial paper of Sergio Leone Co. which is due in 60 days. 12. Currency and coin on hand amounted to $7.700. Instructions a. Compute the amount of cash and cash equivalents to be reported on Eastwood Co.'s balance sheet at December 31, 2020. b. Indicate the proper reporting for items that are not reported as cash and cash equivalents on the December 31, 2020, balance sheet.

E7.1 (LO 1) Excel (Determining Cash Balance) The controller for Clint Eastwood Co. is attempting to determine the amount of cash to be reported on its December 31, 20o20, balance sheet. The following information is provided. 1. Commercial savings account of $600,000 and a commercial checking account balance of $900,000 are held at First National Bank of Yojimbo. 2. Money market fund account held at Volonte Co. (a mutual fund organization) permits Eastwood to write checks on this balance, $5.000,000. 3. Travel advances of $180,00oo for executive travel for the first quarter of next year (employee to reimburse through salary reduction). 4. A separate cash fund in the amount of $1,500,000 is restricted for the retirement of long-term debt. 5. Petty cash fund of $1,000. 6. An I.O.U. from Marianne Koch, a company customer, in the amount of $190,000. 7. A bank overdraft of $110,000 has occurred at one of the banks the company uses to deposit its cash receipts. At the present time, the company has no deposits at this bank. 8. The company has two certificates of deposit, each totaling $500,000o. These CDs have a maturity of 120 days. 9. Eastwood has received a check that is dated January 12, 2021, in the amount of $125,000. 10. Eastwood has agreed to maintain a cash balance of $500,000 at all times at First National Bank of Yojimbo to ensure future credit availability. 11. Eastwood has purchased $2,100,000 of commercial paper of Sergio Leone Co. which is due in 60 days. 12. Currency and coin on hand amounted to $7.700. Instructions a. Compute the amount of cash and cash equivalents to be reported on Eastwood Co.'s balance sheet at December 31, 2020. b. Indicate the proper reporting for items that are not reported as cash and cash equivalents on the December 31, 2020, balance sheet.

Financial Accounting

14th Edition

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Carl Warren, Jim Reeve, Jonathan Duchac

Chapter8: Sarbanes-oxley, Internal Control, And Cash

Section: Chapter Questions

Problem 18E

Related questions

Question

Buenos días

haber si me pueden ayudar. pregunta puedo enviar dos ejercicios juntos.

Transcribed Image Text:E7.1 (LO 1) Excel (Determining Cash Balance) The controller for Clint Eastwood Co. is attempting to determine the

amount of cash to be reported on its December 31, 20o20, balance sheet. The following information is provided.

1. Commercial savings account of $600,000 and a commercial checking account balance of $900,000 are held at First

National Bank of Yojimbo.

2. Money market fund account held at Volonte Co. (a mutual fund organization) permits Eastwood to write checks on this

balance, $5.000,000.

3. Travel advances of $180,00oo for executive travel for the first quarter of next year (employee to reimburse through salary

reduction).

4. A separate cash fund in the amount of $1,500,000 is restricted for the retirement of long-term debt.

5. Petty cash fund of $1,000.

6. An I.O.U. from Marianne Koch, a company customer, in the amount of $190,000.

7. A bank overdraft of $110,000 has occurred at one of the banks the company uses to deposit its cash receipts. At the present

time, the company has no deposits at this bank.

8. The company has two certificates of deposit, each totaling $500,000o. These CDs have a maturity of 120 days.

9. Eastwood has received a check that is dated January 12, 2021, in the amount of $125,000.

10. Eastwood has agreed to maintain a cash balance of $500,000 at all times at First National Bank of Yojimbo to ensure future

credit availability.

11. Eastwood has purchased $2,100,000 of commercial paper of Sergio Leone Co. which is due in 60 days.

12. Currency and coin on hand amounted to $7.700.

Instructions

a. Compute the amount of cash and cash equivalents to be reported on Eastwood Co.'s balance sheet at December 31, 2020.

b. Indicate the proper reporting for items that are not reported as cash and cash equivalents on the December 31, 2020,

balance sheet.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning