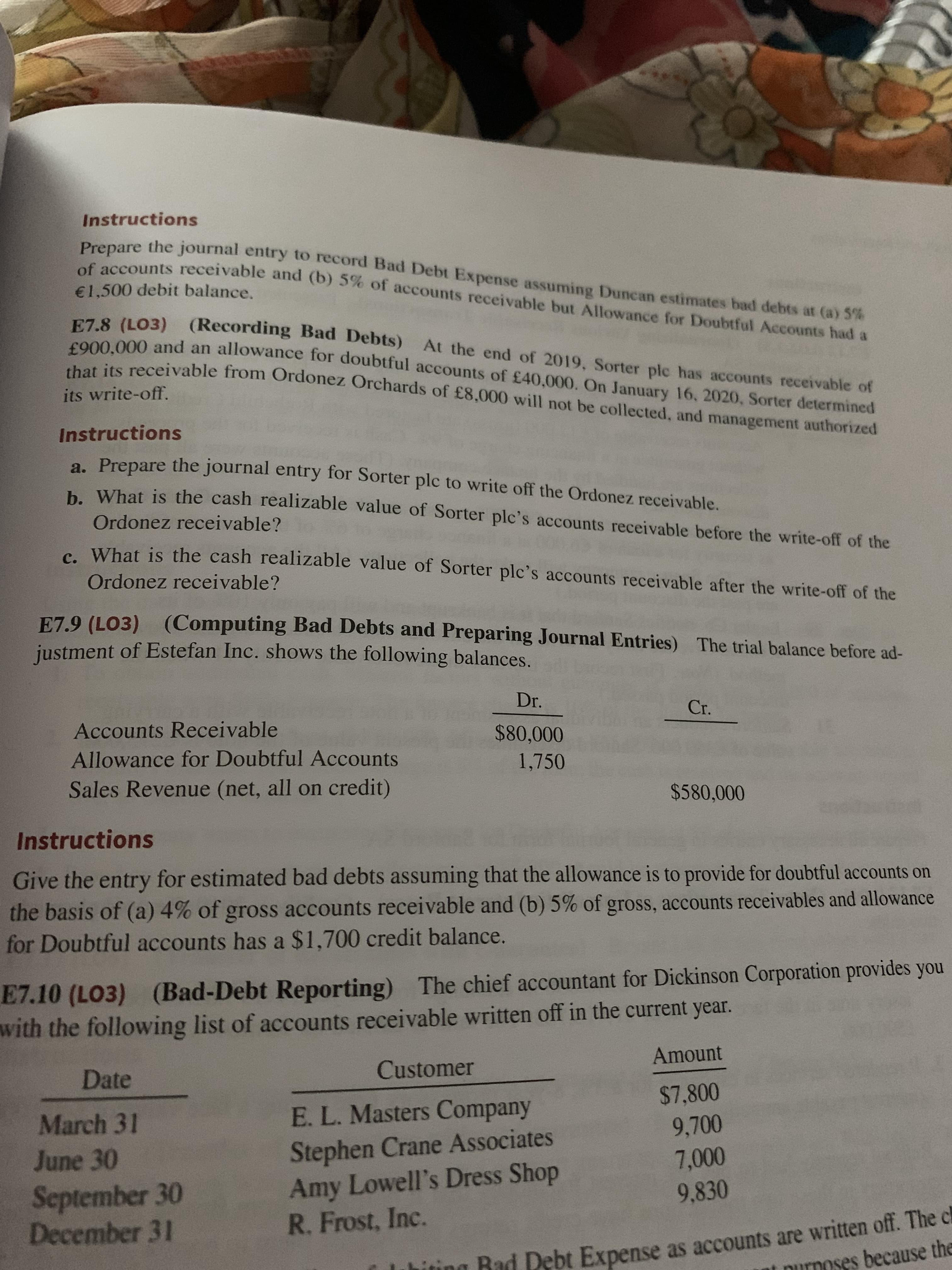

E7.9 (LO3) (Computing Bad Debts and Preparing Journal Entries) The trial balance before ad- justment of Estefan Inc. shows the following balances. Dr. Cr. Accounts Receivable $80,000 Allowance for Doubtful Accounts 1,750 Sales Revenue (net, all on credit) $580,000 Instructions Give the entry for estimated bad debts assuming that the allowance is to provide for doubtful accounts on the basis of (a) 4% of gross accounts receivable and (b) 5% of gross, accounts receivables and allowance for Doubtful accounts has a $1,700 credit balance.

Master Budget

A master budget can be defined as an estimation of the revenue earned or expenses incurred over a specified period of time in the future and it is generally prepared on a periodic basis which can be either monthly, quarterly, half-yearly, or annually. It helps a business, an organization, or even an individual to manage the money effectively. A budget also helps in monitoring the performance of the people in the organization and helps in better decision-making.

Sales Budget and Selling

A budget is a financial plan designed by an undertaking for a definite period in future which acts as a major contributor towards enhancing the financial success of the business undertaking. The budget generally takes into account both current and future income and expenses.

Hi,

Please help with 7.9.

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images