Each of the following factors affects the weighted average cost of capital (WACC) equation. Which of the following factors are outside a firm's control? Check all that apply. O Interest rates in the economy O The performance of index funds, such as the S&P 500 O The firm's dividend payout ratio

Each of the following factors affects the weighted average cost of capital (WACC) equation. Which of the following factors are outside a firm's control? Check all that apply. O Interest rates in the economy O The performance of index funds, such as the S&P 500 O The firm's dividend payout ratio

Chapter13: Capital Structure Concepts

Section: Chapter Questions

Problem 5P

Related questions

Question

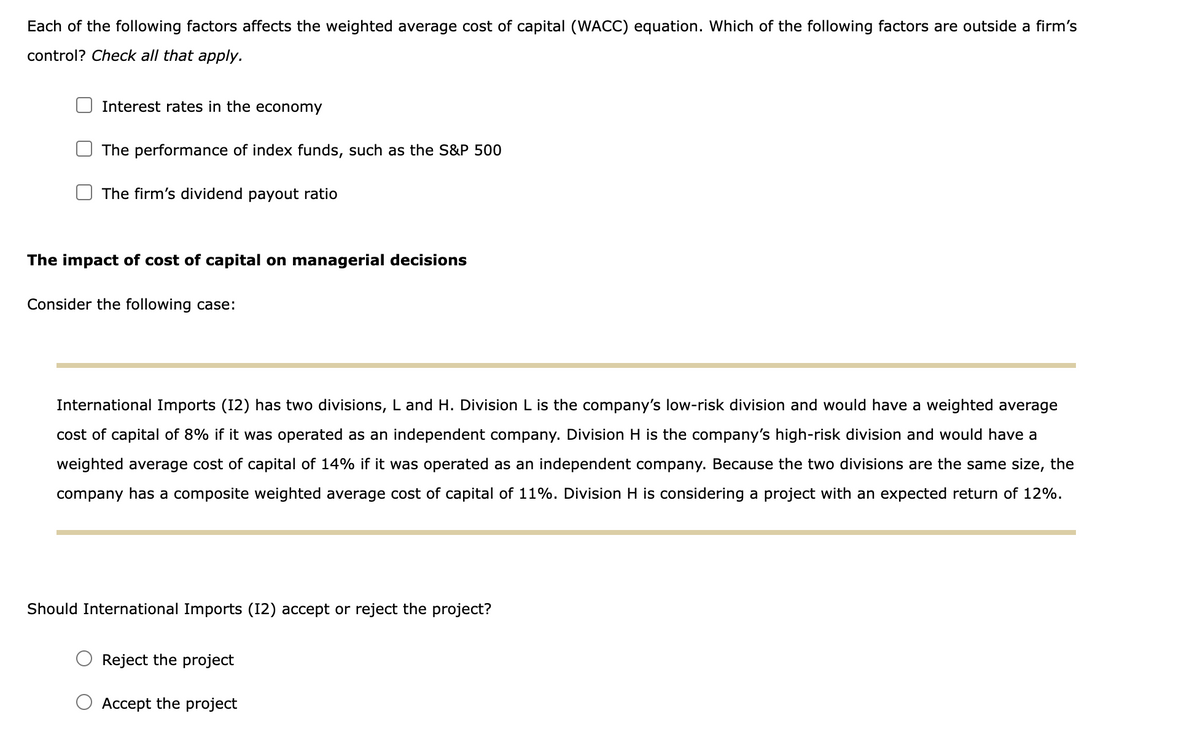

Transcribed Image Text:Each of the following factors affects the weighted average cost of capital (WACC) equation. Which of the following factors are outside a firm's

control? Check all that apply.

Interest rates in the economy

The performance of index funds, such as the S&P 500

The firm's dividend payout ratio

The impact of cost of capital on managerial decisions

Consider the following case:

International Imports (I2) has two divisions, L and H. Division L is the company's low-risk division and would have a weighted average

cost of capital of 8% if it was operated as an independent company. Division H is the company's high-risk division and would have a

weighted average cost of capital of 14% if it was operated as an independent company. Because the two divisions are the same size, the

company has a composite weighted average cost of capital of 11%. Division H is considering a project with an expected return of 12%.

Should International Imports (12) accept or reject the project?

Reject the project

Accept the project

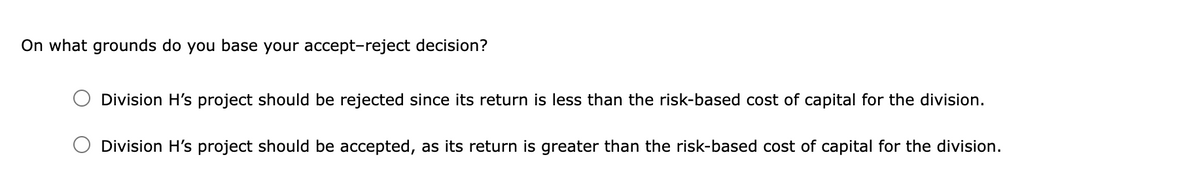

Transcribed Image Text:On what grounds do you base your accept-reject decision?

Division H's project should be rejected since its return is less than the risk-based cost of capital for the division.

Division H's project should be accepted, as its return is greater than the risk-based cost of capital for the division.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning