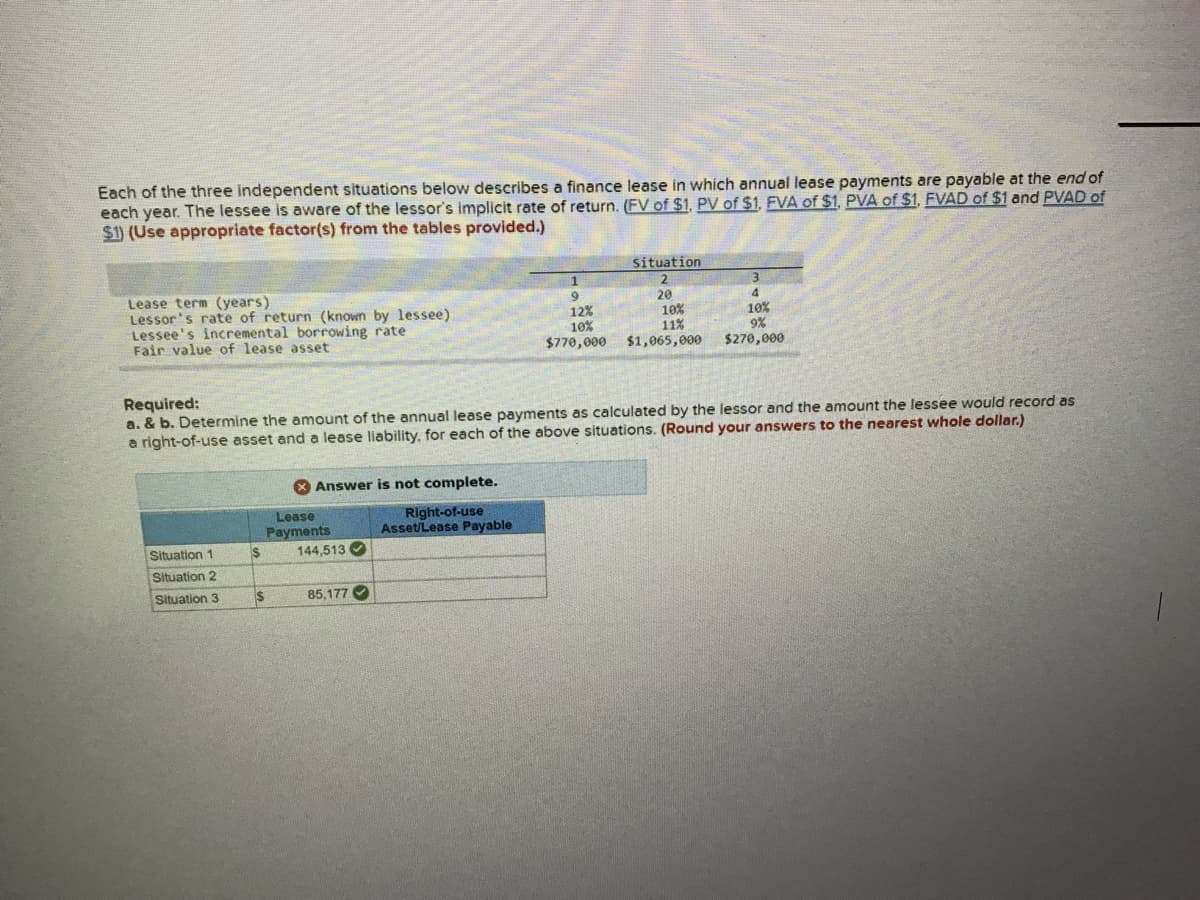

Each of the three independent situations below describes a finance lease in which annual lease payments are payable at the end of each year. The lessee is aware of the lessor's implicit rate of return. (FV of $1, PV of $1. FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Lease term (years) Lessor's rate of return (known by lessee) Lessee's incremental borrowing rate Fair value of lease asset Situation 1 Situation 2 Situation 3 Answer is not complete. Right-of-use Asset/Lease Payable Lease Payments $ Required: a. & b. Determine the amount of the annual lease payments as calculated by the lessor and the amount the lessee would record as a right-of-use asset and a lease liability, for each of the above situations. (Round your answers to the nearest whole dollar.) 144,513 1 9 12% 10% $770,000 85,177 situation 2 20 10% 11% $1,065,000 4 10% 9% $270,000

Each of the three independent situations below describes a finance lease in which annual lease payments are payable at the end of each year. The lessee is aware of the lessor's implicit rate of return. (FV of $1, PV of $1. FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Lease term (years) Lessor's rate of return (known by lessee) Lessee's incremental borrowing rate Fair value of lease asset Situation 1 Situation 2 Situation 3 Answer is not complete. Right-of-use Asset/Lease Payable Lease Payments $ Required: a. & b. Determine the amount of the annual lease payments as calculated by the lessor and the amount the lessee would record as a right-of-use asset and a lease liability, for each of the above situations. (Round your answers to the nearest whole dollar.) 144,513 1 9 12% 10% $770,000 85,177 situation 2 20 10% 11% $1,065,000 4 10% 9% $270,000

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter20: Accounting For Leases

Section: Chapter Questions

Problem 9RE: Use the information in RE20-3. Prepare the journal entries that Richie Company (the lessor) would...

Related questions

Question

Transcribed Image Text:Each of the three independent situations below describes a finance lease in which annual lease payments are payable at the end of

each year. The lessee is aware of the lessor's implicit rate of return. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of

$1) (Use appropriate factor(s) from the tables provided.)

Lease term (years)

Lessor's rate of return (known by lessee)

Lessee's incremental borrowing rate

Fair value of lease asset

Situation 1

Situation 2

Situation 3

Answer is not complete.

Right-of-use

Asset/Lease Payable

Lease

Payments

$

Required:

a. & b. Determine the amount of the annual lease payments as calculated by the lessor and the amount the lessee would record as

a right-of-use asset and a lease liability, for each of the above situations. (Round your answers to the nearest whole dollar.)

144,513

1

9

85,177

12%

10%

$770,000

Situation

2

20

10%

11%

$1,065,000

4

10%

9%

$270,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning