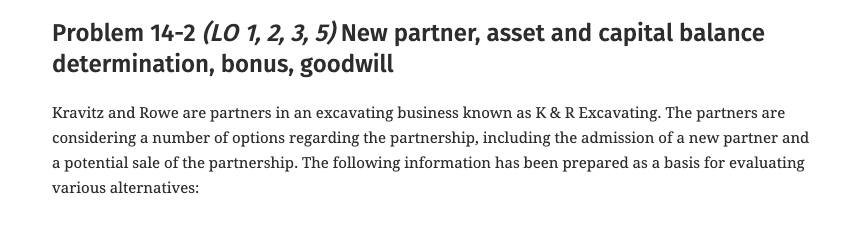

Given the stated fair values, if Rowe were to sell one-half of her interest in capital to someone outside the partnership, what would be a suggested asking price? 2. Given the stated fair values, if a third party were to convey assets to the partnership in exchange for a 40% interest in the partnership, what would the value of those assets have to be? 3. Assume a new partner was admitted to the partnership with a 40% interest in capital in exchange for a cash contribution of $60,000. What would Rowe’s capital balance be as a result of this transaction, assuming use of the bonus method?

Required

1. Given the stated fair values, if Rowe were to sell one-half of her interest in capital to someone outside the partnership, what would be a suggested asking price?

2. Given the stated fair values, if a third party were to convey assets to the partnership in exchange for a 40% interest in the partnership, what would the value of those assets have to be?

3. Assume a new partner was admitted to the partnership with a 40% interest in capital in exchange for a cash contribution of $60,000. What would Rowe’s capital balance be as a result of this transaction, assuming use of the bonus method?

4. Given the facts of (3) above, what would Rowe’s capital balance be, assuming use of the

5. Assume a new partner was admitted to the partnership with a 30% interest in capital in exchange for a contribution of $55,000 of net tangible assets. What would the new partner’s capital balance be as a result of this transaction, assuming use of the bonus method?

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images