each. At the end of their first year of trading, after paying tax and dividends, the balan Delebi Ltd was formed with an authorised share capital of 500 I March 20.1 the company issued 300 000 ordinary shares at an issue price of 100 ordinary shares. the Retained income account was R200 000. On 1 March 20.2, the company decided to issue the unissued shares to the public ata issue price of 220 cents each. The application closed on 30 April 20.2 and all the sha were allotted. A receipt was issued for the monies received. Required: 1.16.1 The relevant entry in the Cash Receipts Journal on 30 April 20.2. 1.16.2 The posting to the General Ledger. 1.16.3 The effect on the Balance Sheet of the company on 30 April 20.2 (and Notes to Balance Sheet).

each. At the end of their first year of trading, after paying tax and dividends, the balan Delebi Ltd was formed with an authorised share capital of 500 I March 20.1 the company issued 300 000 ordinary shares at an issue price of 100 ordinary shares. the Retained income account was R200 000. On 1 March 20.2, the company decided to issue the unissued shares to the public ata issue price of 220 cents each. The application closed on 30 April 20.2 and all the sha were allotted. A receipt was issued for the monies received. Required: 1.16.1 The relevant entry in the Cash Receipts Journal on 30 April 20.2. 1.16.2 The posting to the General Ledger. 1.16.3 The effect on the Balance Sheet of the company on 30 April 20.2 (and Notes to Balance Sheet).

Chapter14: Property Transactions: Capital Gains And Losses, § 1231, And Recapture Provisions

Section: Chapter Questions

Problem 43P

Related questions

Question

Transcribed Image Text:find your answer to be R2.72. If you do not agree, check with your Teacher). Will

original shareholders be happy with this? Will the new shareholders be happy with

how much will each shareholder receive for each share owned by him? (You shoua

The Shareholders Equity Will be Tmade

Shares at issue price

R4 400 000

Retained income

Cwele

March 20.6 the

ach. At the end of their fir

he Retained income accou

R500 000

The average issue price of the shares is:

R4 400 000+ 1 800 000 shares = 244.44 cents

an 1 March 20.7, the com

ssue price of 490 cents e:

Required:

1.17.1 The relevant ent

1.17.2 The posting to th

1.17.3 The effect on th

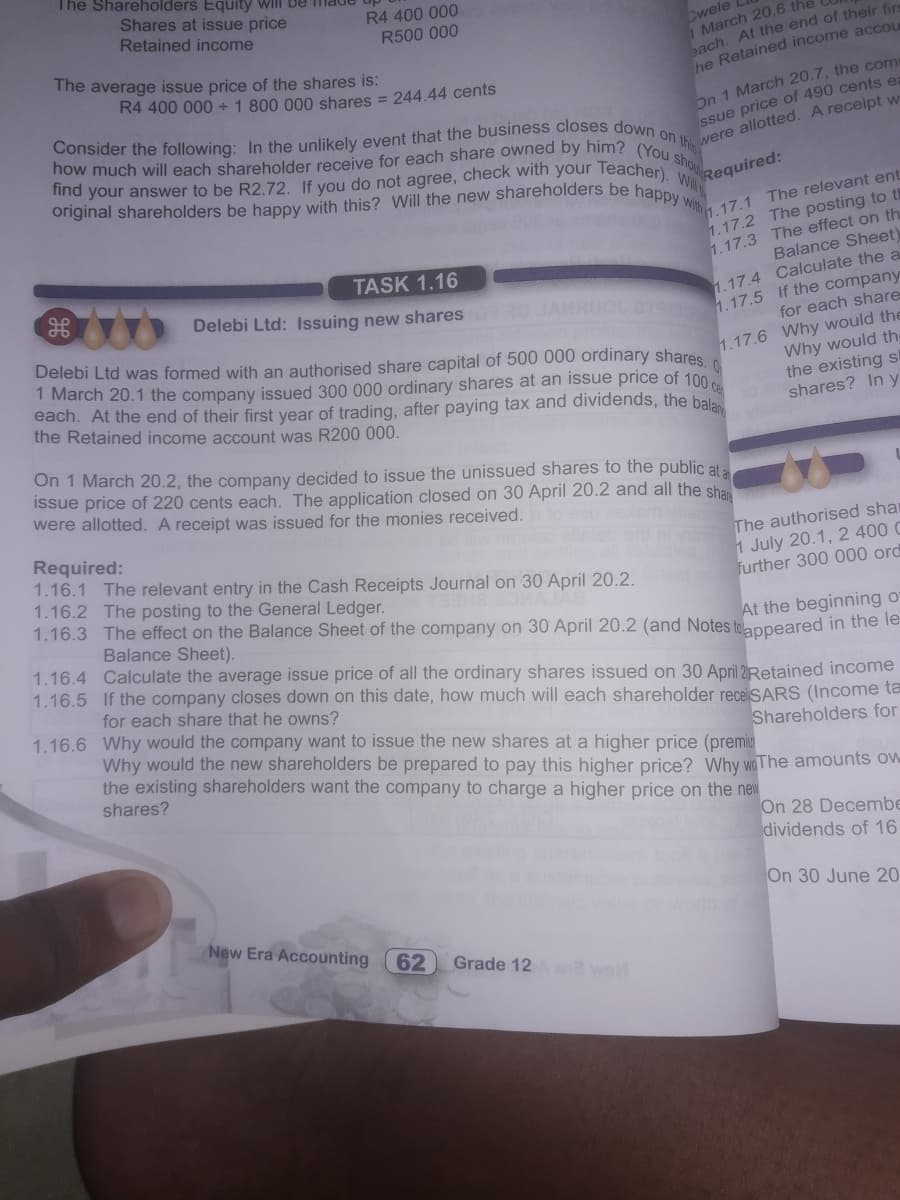

TASK 1.16

Balance Sheet

1.17.4 Calculate the a

for each share

Delebi Ltd was formed with an authorised share capital of 500 000 ordinary shares

1 March 20.1 the company issued 300 000 ordinary shares at an issue price of 100

each. At the end of their first year of trading, after paying tax and dividends, the bala

the Retained income account was R200 000.

1.17.6 Why would the

Why would the

the existing s

shares? In y

On 1 March 20.2, the company decided to issue the unissued shares to the public ata

Issue price of 220 cents each. The application closed on 30 April 20.2 and all the sha

were allotted. A receipt was issued for the monies received.

Required:

1.16.1 The relevant entry in the Cash Receipts Journal on 30 April 20.2.

1.16.2 The posting to the General Ledger.

1.16.3 The effect on the Balance Sheet of the company on 30 April 20.2 (and Notes tolappeared in the le-

The authorised shar

1 July 20.1, 2 400 C

further 300 000 ord

At the beginning o

1.16.4 Calculate the average issue price of all the ordinary shares issued on 30 April 2Retained income

Balance Sheet).

1.16.5 If the company closes down on this date, how much will each shareholder receiSARS (Income ta

for each share that he owns?

1.16.6 Why would the company want to issue the new shares at a higher price (premiu

Why would the new shareholders be prepared to pay this higher price? Why waThe amounts ow

the existing shareholders want the company to charge a higher price on the new

shares?

Shareholders for

On 28 Decembe

dividends of 16

On 30 June 20

New Era Accounting

62

Grade 12 wel

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning