Early in 2020, Kingbird Equipment Company sold 600 Rollomatics at $5,400 each. During 2020, Kingbird spent $21,000 servicing the 2-year assurance warranties that accompany the Rollomatic. All sales transactions are on a cash basis. (a) Your Answer Correct Answer (Used) Your answer is partially correct. Prepare 2020 entries for Kingbird. Assume that Kingbird estimates the total cost of servicing the warranties in the second year will be $31,000. (If no entry is required, select "No Entry" for the account titles and enter O for the amounts. Credit account titles are

Early in 2020, Kingbird Equipment Company sold 600 Rollomatics at $5,400 each. During 2020, Kingbird spent $21,000 servicing the 2-year assurance warranties that accompany the Rollomatic. All sales transactions are on a cash basis. (a) Your Answer Correct Answer (Used) Your answer is partially correct. Prepare 2020 entries for Kingbird. Assume that Kingbird estimates the total cost of servicing the warranties in the second year will be $31,000. (If no entry is required, select "No Entry" for the account titles and enter O for the amounts. Credit account titles are

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter8: Current And Contingent Liabilities

Section: Chapter Questions

Problem 31CE

Related questions

Question

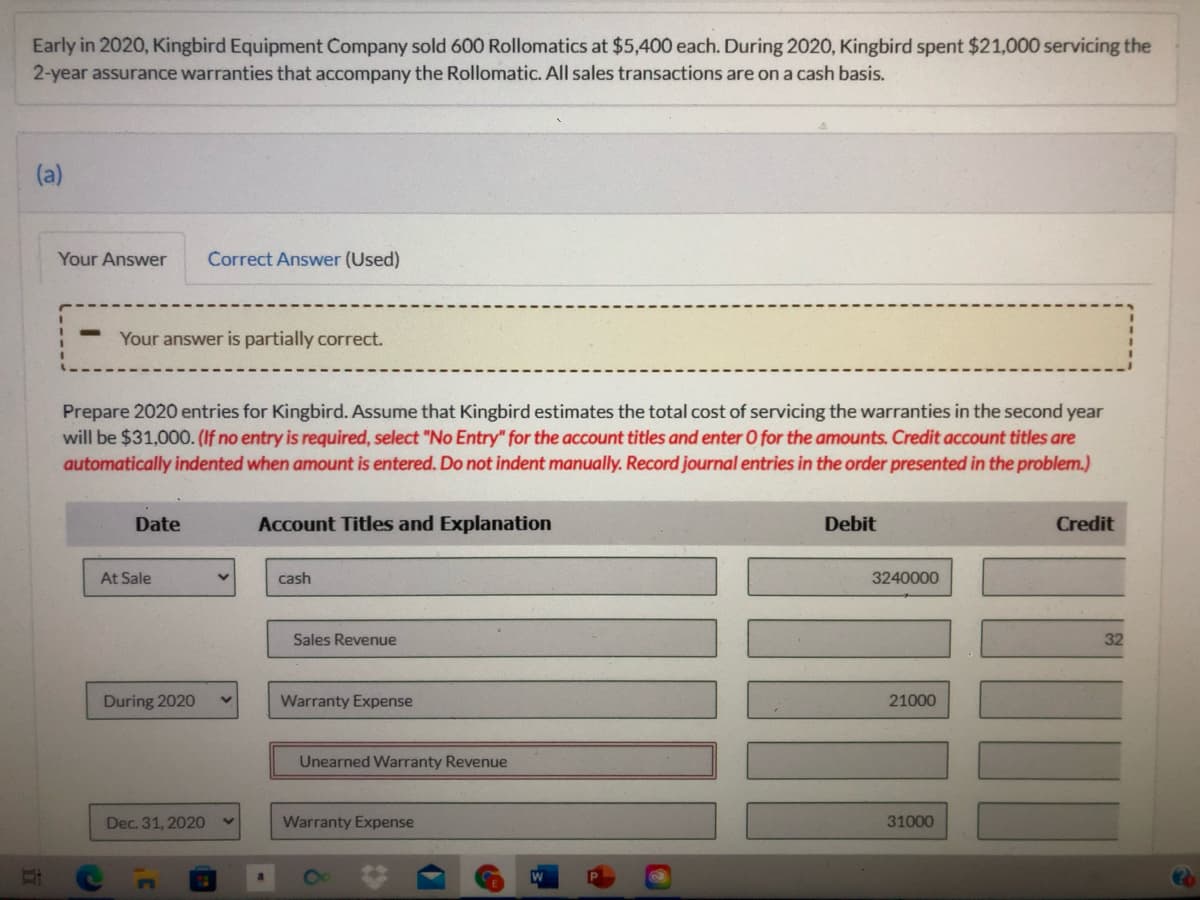

Transcribed Image Text:Early in 2020, Kingbird Equipment Company sold 600 Rollomatics at $5,400 each. During 2020, Kingbird spent $21,000 servicing the

2-year assurance warranties that accompany the Rollomatic. All sales transactions are on a cash basis.

(a)

Your Answer

Correct Answer (Used)

Your answer is partially correct.

Prepare 2020 entries for Kingbird. Assume that Kingbird estimates the total cost of servicing the warranties in the second year

will be $31,000. (If no entry is required, select "No Entry" for the account titles and enter O for the amounts. Credit account titles are

automatically indented when amount is entered. Do not indent manually. Record journal entries in the order presented in the problem.)

Date

Account Titles and Explanation

Debit

Credit

At Sale

cash

3240000

Sales Revenue

32

During 2020

Warranty Expense

21000

Unearned Warranty Revenue

Dec. 31, 2020

Warranty Expense

31000

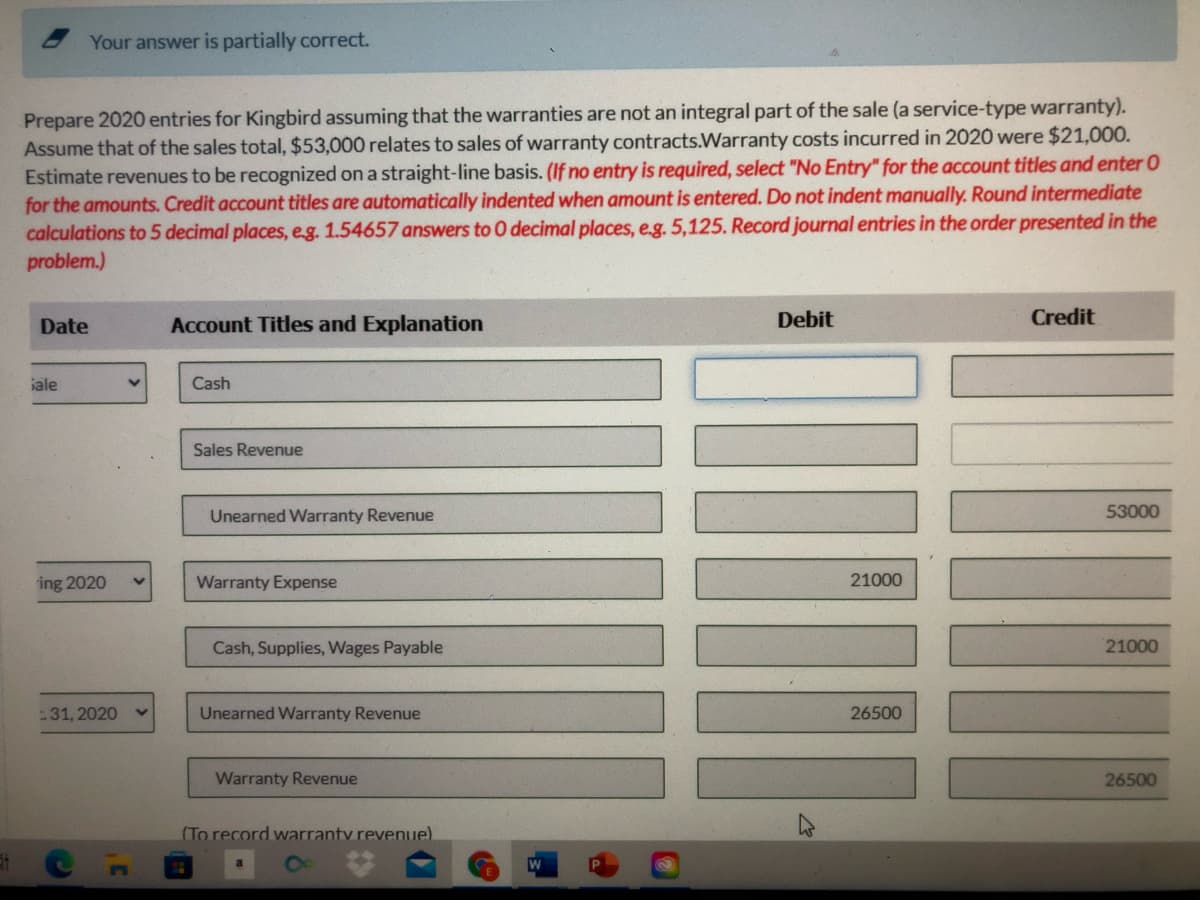

Transcribed Image Text:Your answer is partially correct.

Prepare 2020 entries for Kingbird assuming that the warranties are not an integral part of the sale (a service-type warranty).

Assume that of the sales total, $53,000 relates to sales of warranty contracts.Warranty costs incurred in 2020 were $21,000.

Estimate revenues to be recognized on a straight-line basis. (If no entry is required, select "No Entry" for the account titles and enter 0

for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually. Round intermediate

calculations to 5 decimal places, eg. 1.54657 answers to 0 decimal places, e.g. 5,125. Record journal entries in the order presented in the

problem.)

Date

Account Titles and Explanation

Debit

Credit

iale

Cash

Sales Revenue

Unearned Warranty Revenue

53000

ing 2020

Warranty Expense

21000

Cash, Supplies, Wages Payable

21000

31, 2020

Unearned Warranty Revenue

26500

Warranty Revenue

26500

(To record warranty revenue)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College