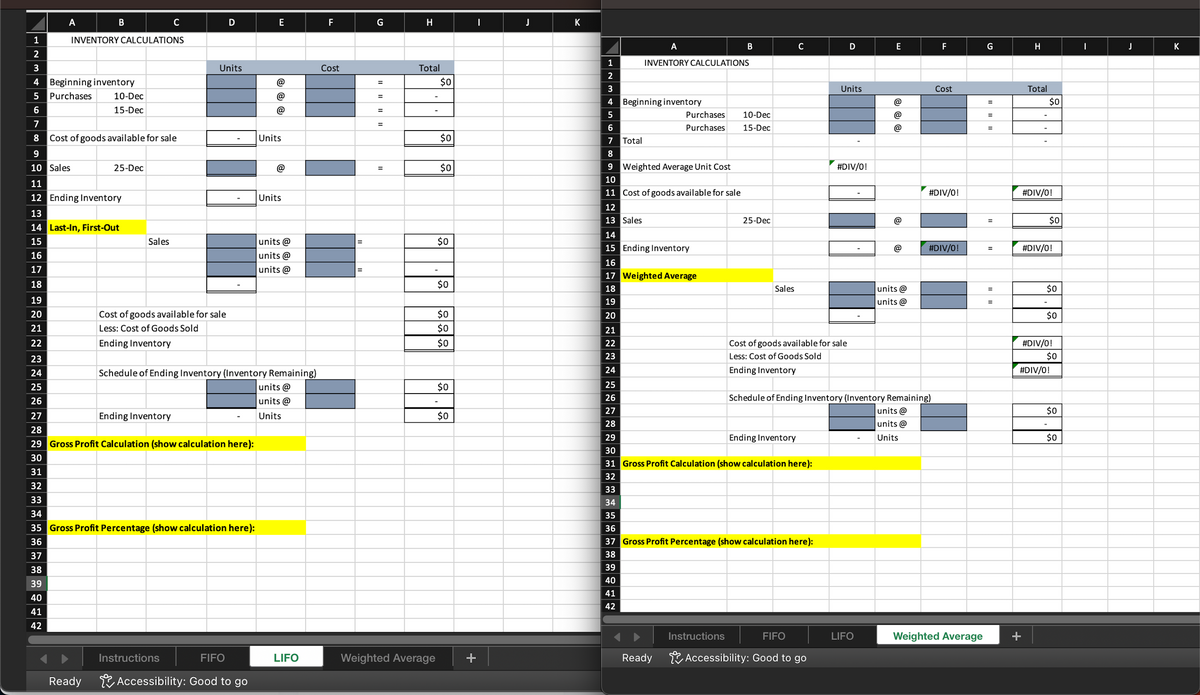

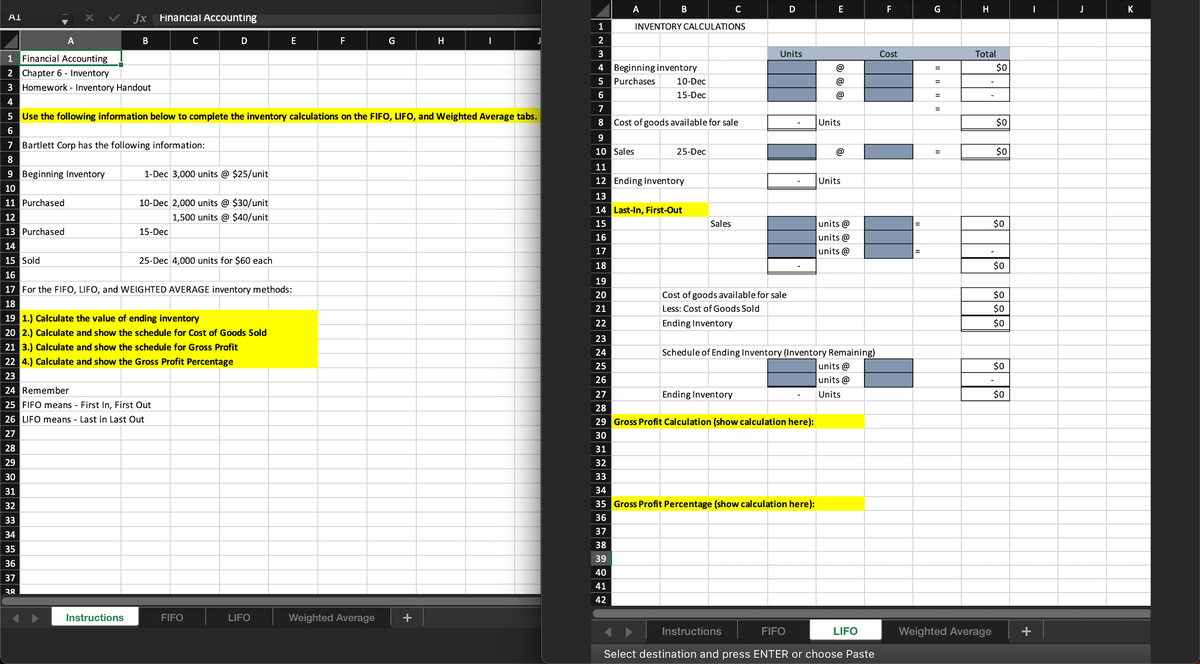

Use the following information below to complete the inventory calculations on the FIFO, LIFO, and Weighted Average tabs. Bartlett Corp has the following information: Beginning Inventory Purchased Purchased 1-Dec 3,000 units @ $25/unit 10-Dec 2,000 units @ $30/unit 1,500 units @ $40/unit Sold 15-Dec 25-Dec 4,000 units for $60 each For the FIFO, LIFO, and WEIGHTED AVERAGE inventory methods:

Use the following information below to complete the inventory calculations on the FIFO, LIFO, and Weighted Average tabs. Bartlett Corp has the following information: Beginning Inventory Purchased Purchased 1-Dec 3,000 units @ $25/unit 10-Dec 2,000 units @ $30/unit 1,500 units @ $40/unit Sold 15-Dec 25-Dec 4,000 units for $60 each For the FIFO, LIFO, and WEIGHTED AVERAGE inventory methods:

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter6: Cost Of Goods Sold And Inventory

Section: Chapter Questions

Problem 17MCQ: ( Appendix 6B) Refer to the information for Morgan Inc. above. If Morgan uses a periodic inventory...

Related questions

Topic Video

Question

Transcribed Image Text:1

2

3

4

5

6

7

8

A

19

20

21

22

9

10 Sales

23

24

25

26

B

Beginning inventory

Purchases

INVENTORY CALCULATIONS

10-Dec

15-Dec

Cost of goods available for sale

11

12 Ending Inventory

13

14 Last-In, First-Out

15

16

17

18

25-Dec

Sales

C

Cost of goods available for sale

Less: Cost of Goods Sold

Ending Inventory

Ending Inventory

D

Units

Instructions

27

28

29 Gross Profit Calculation (show calculation here):

30

31

32

33

34

35 Gross Profit Percentage (show calculation here):

36

37

38

39

40

41

42

FIFO

Ready Accessibility: Good to go

E

(a

a

@

Units

Schedule of Ending Inventory (Inventory Remaining)

units @

units @

Units

@

Units

units @

units @

units @

LIFO

F

Cost

=

=

G

||||||II

=

=

=

=

H

Total

Weighted Average

$0

$0

$0

$0

$0

$0

$0

$0

$0

$0

I

J

K

A

INVENTORY CALCULATIONS

1

2

3

4 Beginning inventory

5

6

7 Total

8

9 Weighted Average Unit Cost

10

11 Cost of goods available for sale

12

13 Sales

25

26

27

28

14

15 Ending Inventory

16

17 Weighted Average

18

19

20

21

22

23

24

Purchases

Purchases

Ready

B

Instructions

10-Dec

15-Dec

25-Dec

Sales

C

29

30

31 Gross Profit Calculation (show calculation here):

32

33

34

35

36

37 Gross Profit Percentage (show calculation here):

38

39

40

41

42

Cost of goods available for sale

Less: Cost of Goods Sold

Ending Inventory

Ending Inventory

D

Units

FIFO

Accessibility: Good to go

#DIV/0!

E

LIFO

@

@

@

@

@

Schedule of Ending Inventory (Inventory Remaining)

units @

units @

Units

units @

units @

F

Cost

#DIV/0!

#DIV/0!

Weighted Average

G

=

=

=

=

=

=

H

T

Total

$0

#DIV/0!

$0

#DIV/0!

$0

$0

#DIV/0!

$0

#DIV/0!

$0

$0

I

J

K

Transcribed Image Text:A1

A

Jx Financial Accounting

B

1 Financial Accounting

2 Chapter 6 - Inventory

3 Homework - Inventory Handout

4

Bartlett Corp has the following information:

Instructions

C

D

9 Beginning Inventory

10

11 Purchased

12

13 Purchased

14

15 Sold

16

17 For the FIFO, LIFO, and WEIGHTED AVERAGE inventory methods:

18

1-Dec 3,000 units @ $25/unit

5 Use the following information below to complete the inventory calculations on the FIFO, LIFO, and Weighted Average tabs.

6

7

8

15-Dec

10-Dec 2,000 units @ $30/unit

1,500 units @ $40/unit

25-Dec 4,000 units for $60 each

19 1.) Calculate the value of ending inventory

20 2.) Calculate and show the schedule for Cost of Goods Sold

21 3.) Calculate and show the schedule for Gross Profit

22 4.) Calculate and show the Gross Profit Percentage

23

24 Remember

25 FIFO means - First In, First Out

26 LIFO means - Last in Last Out

27

28

29

30

31

32

33

34

35

36

37

38

FIFO

E

LIFO

F

G

Weighted Average

H

1

2

A

3

4

5 Purchases

6

7

8

B

9

10 Sales

19

20

21

22

23

24

25

26

INVENTORY CALCULATIONS

Beginning inventory

10-Dec

15-Dec

Cost of goods available for sale

25-Dec

11

12 Ending Inventory

13

14 Last-In, First-Out

15

16

17

18

Sales

C

Cost of goods available for sale

Less: Cost of Goods Sold

Ending Inventory

Ending Inventory

D

Units

Instructions

27

28

29 Gross Profit Calculation (show calculation here):

30

31

32

33

34

35 Gross Profit Percentage (show calculation here):

36

37

38

39

40

41

42

E

(@

(α)

(@

Units

Schedule of Ending Inventory (Inventory Remaining)

units @

units@

Units

Units

units@

units @

units @

FIFO

Select destination and press ENTER or choose Paste

LIFO

F

Cost

=

=

G

=

=

=

=

=

H

Total

Weighted Average

$0

$0

$0

$0

$0

$0

$0

$0

$0

$0

I

J

K

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning