ears, with a predicted 0.8 billion RMB/year revenue and operation fee 0.45 billion RMB plus erprise income tax. If to adopt the straight-line depreciation method, the weighted mean ca 0%. According to the corresponding equations mentioned above, the project can get its inve (, EVA and accumulative economic value added (MVA) (Table 1). = 1: NPV and EVA investment decision analysis of agricultural water project (unit: 10 thousand RMB) Time (year) 4 5 I investment ation income 100000 80000 80000 80000 80000 800 15000 AR000 A5000 A5000 A50

ears, with a predicted 0.8 billion RMB/year revenue and operation fee 0.45 billion RMB plus erprise income tax. If to adopt the straight-line depreciation method, the weighted mean ca 0%. According to the corresponding equations mentioned above, the project can get its inve (, EVA and accumulative economic value added (MVA) (Table 1). = 1: NPV and EVA investment decision analysis of agricultural water project (unit: 10 thousand RMB) Time (year) 4 5 I investment ation income 100000 80000 80000 80000 80000 800 15000 AR000 A5000 A5000 A50

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter19: Capital Investment

Section: Chapter Questions

Problem 13E: Buena Vision Clinic is considering an investment that requires an outlay of 600,000 and promises a...

Related questions

Question

Why straight-line

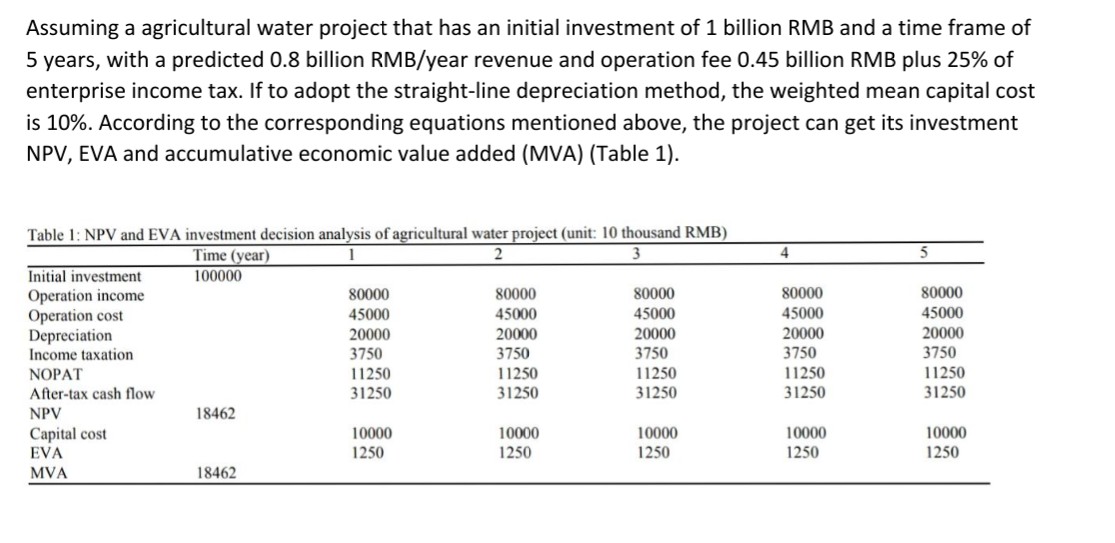

Transcribed Image Text:Assuming a agricultural water project that has an initial investment of 1 billion RMB and a time frame of

5 years, with a predicted 0.8 billion RMB/year revenue and operation fee 0.45 billion RMB plus 25% of

enterprise income tax. If to adopt the straight-line depreciation method, the weighted mean capital cost

is 10%. According to the corresponding equations mentioned above, the project can get its investment

NPV, EVA and accumulative economic value added (MVA) (Table 1).

Table 1: NPV and EVA investment decision analysis of agricultural water project (unit: 10 thousand RMB)

Time (year)

4

5

Initial investment

100000

80000

Operation income

Operation cost

Depreciation

Income taxation

80000

80000

80000

80000

45000

20000

3750

45000

45000

45000

45000

20000

3750

20000

20000

20000

3750

3750

11250

3750

11250

31250

11250

31250

NOPAT

11250

11250

After-tax cash flow

31250

31250

31250

NPV

18462

Capital cost

EVA

10000

1250

10000

1250

10000

10000

10000

1250

1250

1250

MVA

18462

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College