east !!!

Q: Explain the main objectives of the audit of an entity’s financial statements and the importance of…

A: Standards on Auditing(SA) are principles and procedures that are required to be followed for the…

Q: Required information [The following information applies to the questions displayed below.] Listed…

A: Manufacturing Cost :— It is the cost that is incurred by company in the manufacturing of product.…

Q: How much is the cost of goods sold?

A: Direct material + Direct labour + Direct expense Prime cost + Manufacturing overhead Cost of…

Q: Putting the final touches on the paperwork for Drano Plumbing was Damon Davis. The net profit, he…

A: As per the situation of the question Assets side of the balance sheet is worth $ 400,000 and Credit…

Q: On November 1, 2022, SAN JOSE receives an order from a customer for a computer as well as 12 months…

A: Unearned sales Revenue: Unearned sales Revenue means money received from the customer in advance for…

Q: The downtown Kingston and Saint Andrew Centre were built for $400 million JAD in 2010 (Reid, 2012).…

A: Stakeholders: A party is considered to be a stakeholder in an organization if it has an interest in…

Q: During 2019, Namnama Company introduced a new product carrying a two-year warranty against defects…

A: Warranty liability is an account that a business uses to record the cost of repairs or replacements…

Q: During the year 2021, Bong Company was involved in a lawsuit. Bong was sued by an employee for…

A: Contingent Liability A contingent obligation is a responsibility that might materialize based on how…

Q: Accounting On January 1, 2022, Pronto Company acquired all of Speedy Inc.'s voting stock for…

A: C $2400000 Please fallow the answer below Sales revenue. 840,00,000 Less:COGS…

Q: On June 15, 2022, Robinson Company received a shipment of merchandise from Taytay Company with a…

A: Solution Working note- Calculation of Inventory- Stock in hand (70000*20%) 14000 Add…

Q: Shane Tamarisk began a business, on January 1 2024 with an investment of $115,000. The company had…

A: Accounting equation is the basic equation used for the preparation of the accounting statements.…

Q: Abby and Bera each owns 50 shares of stock in AB Corp, comprising all of AB Corp's outstanding…

A: Corporation liquidation results in double taxation. Further, the corporation is allowed to deduct…

Q: Green Corporation began operations in 2021. An analysis of Green’s equity investments portfolio…

A: The non trading securities are reported as separate component of shareholder's equity. The…

Q: Required information [The following information applies to the questions displayed below.] Sandra…

A: Solution Tax rate is the rate at which an individual and corporation given tax.Us use progressive…

Q: On October 1, 2020, Geri, Elma and Philip who share earnings 5:3:2, respectively, decided to…

A: As per the Above information, Profit Sharing Ratio of Geri, Elma and Philip is 5 : 3 : 2 Elma…

Q: true or false.

A: The companies act is an act that is incorporated by the parliament of the country. The prime purpose…

Q: If total assets increased by P175,000 during a specific period and liabilities decreased by P10,000…

A: Owners' equity is the amount of capital invested by the business owners in their entity. It is the…

Q: pectancy is 20.8 years from the annuity starting date. Assuming that she receives $7,000 this year,…

A: Exclusion percentage: = Purchase value of annuity / (Monthly payment × Life expectancy × 12) =…

Q: What do you focus on most when evaluating the relevance of information or audit evidence? Whether…

A:

Q: Power Company's ending inventory is understated by P7,000. The effects of this error in the current…

A: Rectification of entry :— When the error or mistakes is discovered then suddenly rectification…

Q: he following information relates to the pension plan of Brown company. Defined benefit…

A: Retirement benefit expense is one of the important expense which is reported in income statement. It…

Q: The following transactions of Jaya Mart occurred during the month of September 2021: Transactions…

A: a) Date Account Debit (RM) Credit (RM) 2021-09-01 Cash 10,000…

Q: The following data is available from the records of Spurs Merchandising Company: Cost of goods…

A: Gross profit is calculated after deducting the direct expense from the net sales. Operating…

Q: Bradley plc operates in the electronics industry. It has found that the prices being charged by its…

A: Demand-pull inflation occurs when the total demand for goods and services in the economy (i.e.…

Q: partners sharing profits 6:4,

A: The capitals introduced by Z as a new partner shall be reduced from the capital balances of X and Y…

Q: 27. Mollie operates her consultancy business as a sole trader. She is considering whether to…

A: Hi student Since there are multiple questions, we will answer only first question. If you want…

Q: b. Prepare a variable costing income statement for the three products. Enter a net loss as a…

A: Absorption Costing Absorption Costing is used to allocate fixed cost of product. It allocates…

Q: The worksheet at the end of October has P4,000 in the Trial Balance credit column for Accumulated…

A: 1. Depreciation Expenses - Depreciation Expenses are the expense incurred on the wear and tear of…

Q: The plant manager of Integrity Products Co. gathered production statistics for October as follows:…

A: According to the given question, we are required to determine the EUP conversion using the average…

Q: Integrity CORP uses job order costing. At Jan 31, only Job 101 was the only job in process with…

A: Adjusted cost of goods sold derives from the cost of goods sold after making adjustment for variance…

Q: S Corporation, a 75% owned subsidiary, of P Corporation, sells inventory items to its parent company…

A: Subsidiary revenues include any earnings, receivables, receipts, revenues, cash, profits, fees for…

Q: On July 1, 2021, Orange Company, purchased 10,000 ordinary shares of Juce Corporation at P150 per…

A: A company on which investor have significant influence is called as associate. When accounting for…

Q: Martinez Corp has issued 94,000 shares of $5 par value common stock It was authorized to sell…

A: Stockholders' equity is the amount of capital invested by the shareholders' in the business. It is…

Q: If total assets increased by P175,000 during a specific period and liabilities decreased by P10,000…

A: The basic accounting equation is that assets is the sum of liabilities and equity. In other words,…

Q: Integrity Company manufactures two products, Alpha and Beta from a joint process. One production…

A: Joint Process :— It is the process by which different products are obtained from only one common…

Q: XYZ Corporation was incorporated on January 1, 2021 with the following authorized capitalization:…

A: The contributed capital can be defined as the cash or other assets given by the shareholder to…

Q: A) Can the government tax its own agencies or instrumentalities? Explain.

A: Government agencies and instrumentalities are the extension of the government itself.…

Q: As shown below, a shop purchases and sells a certain type of product. Purchasing price : $10 per…

A: Break even point (BEP): Breakeven is the point where total expenses are equal to total revenue. at…

Q: e system was estimated to require a complete upgrade in five years to avoid obsolescenc ncurred for…

A: Allocation cost refers to the complete process of determining the expenses involve din identifying,…

Q: Net Cash Flow From Operating Activities The following are accounting items taken from Tyrone…

A: Cash flow from operating activities is a part of the cash flow statement that indicates the cash…

Q: The following is a December 31, 2024, post-closing trial balance for Almway Corporation. Debits $…

A: The balance sheet is the statement that summarizes the financial situation of a corporation as of…

Q: Where did you get the 6 million in assets turnover problem?

A: The calculated Assets turnover is wrong as per the computation. The ratio is calculated by Sales /…

Q: Blue Corp., provides a noncontributory defined-benefit pension plan for its employees. The company's…

A: Pension Asset: The assets of a pension fund are defined as those assets that were purchased with the…

Q: On November 1, 20Y9, Lexi Martin established an interior decorating business, Heritage Designs.…

A: Introduction Recording day to day transactions and maintaining records of transactions in order to…

Q: On December 31, 2021, XYZ Corporation had 200,000 Ordinary shares and 20,000 cumulative 5%…

A: Cumulative preference share dividend is deducted on accrual basis from net income for the current…

Q: 32. A consultant makes two statements about ICAEW’s regulation and supervision roles: 1 ICAEW…

A: Note: - You have posted two question, as per the Bartleby guidelines, shall answer only first one.…

Q: ypes of people: A, B, and C. Types are not ea: ves their proportion in population and their p vage…

A: Investment bank refers to the form of a bank that buys large holding of new launched shares in the…

Q: Capital balances in the WXY partnership are W, Capital P 60,000, X Capital P 50,000 and Y Capital…

A: Solution A partnership is an agreement in which two or more partners agreed to carry on business and…

Q: A statement of realization and liquidation has been prepared for the RESTLESS Corporation. The…

A: Liabilities not liquidated refer to those business obligations that remain unpaid at the time of the…

Q: Which of the following is a reserved activity for which ICAEW is a recognised professional…

A: As a global professional body for chartered accountants, ICAEW shares knowledge and insight with…

L 31

Step by step

Solved in 4 steps

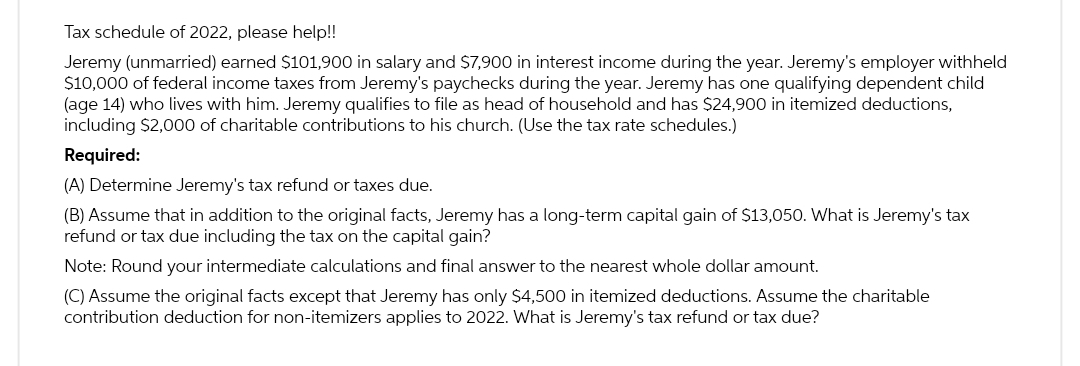

- In 2019, Lou has a salary of $53,300 from her job. She also has interest income of $1,600 and dividend income of $ 400. Lou is single and has no dependents. During the year, Lou sold silver coins held as an investment for a $7,000 loss. Calculate the following amounts for Lou: Adjusted gross income $ ____________________ Standard deduction $ ____________________ Taxable income $ ____________________During the 2019 tax year, Brian, a single taxpayer, received $ 7,400 in Social Security benefits. His adjusted gross income for the year was $14,500 (not including the Social Security benefits) and he received $ 30,000 in tax-exempt interest income and has no for-AGI deductions, Calculate the amount of the Social Security benefits that Brian must include in his gross income for 2019. SIMPIFIED TAXABLE SOCIAL SECURITY WORKSHEET (FOR MOST PEOPLE) 1. Enter the total amount of Social Security income. 2. Enter one-half of line 1 3. Enter the total of taxable income items on Form 1040 except Social Security income. 4. Enter the amount of tax-exempt interest income. 5. Add lines 2,3, and 4 6. Enter all adjustments for AGl except for student loan interest, the domestic production activities deduction, and the tuition and fees deduction. 7. Subtract line 6 from line 5 . If zero or less, stop here, none of the Social Security benefits are taxable. 8. Enter $ 25,0001 $ 32,000 if married filing jointly; 0 if married filing separately and living with spouse at any time during the year) 9. Subtract line 8 from line 7 . If zero or less, enter -0 - Note: If line 9 is zero or less, stop here; none of your benefits are faxable. Otherwise, go on to line 10 10. Enter $ 9,0001 $12,000 if married filing jointly; 0 if married filing separately and living with spouse at any time during the year) 11. Subtract line 10 from line 9. If zero or less, enter -0 -. 12. Enter the smaller of line 9 or line 10 . 13. Enter one-half of line 12 14. Enter the smaller of line 2 or line 13 . 15. Multiply line 11 by 85 (. 85 ). If line 11 is zero, enter -0 -. 16. Add lines 14 and 15 17. Multiply line 1 by 85(.85) 18. Taxable benefits. Enter the smaller of line 16 or line 17 . 1.____________ 2.____________ 3.____________ 4.____________ 5.____________ 6.____________ 7.____________ 8.____________ 9.____________ 10.____________ 11.____________ 12.____________ 13.____________ 14.____________ 15.____________ 16.____________ 17.____________ 18.____________Karen, 28 years old and a single taxpayer, has a salary of $33,000 and rental income of $33,000 for the 2019 calendar tax year. Karen is covered by a pension through her employer. What is the maximum amount that Karen may deduct for contributions to her IRA for 2019? $__________________________ If Karen is a calendar year taxpayer and files her tax return on August 15, what is the last date on which she can make her contribution to the IRA and deduct it for 2019? $__________________________

- Troy, a cash basis taxpayer, is employed by Eagle Corporation, also a cash basis taxpayer. Tray is a full-time employee of the corporation and receives a salary of 60,000 per year. He also receives a bonus equal to 10% of all collections from diems he serviced during the year. Determine the tax consequences of the following events to the corporation and to Troy: a. On December 31, 2019, Troy was visiting a customer. The customer gave Troy a 10,000 check payable to the corporation for appraisal services Troy performed during 2019. Troy did not deliver the check to the corporation until January 2020. b. The facts are the same as in part (a), except that the corporation is an accrual basis taxpayer and Troy deposited the check on December 31, but the bank did not add the deposit to the corporations account until January 2020. c. The facts are the same as in part (a), except that the customer told Troy to hold the check until January 2020 when the customer could make a bank deposit that would cover the check.Calculate the 2019 tax liability and the tax or refund due for each situation: a. Mark is single with no dependents and has a taxable income of 60,000. He has 9,200 withheld from his salary for the year. b. Harry and Linda are married and have taxable income of 60,000. Harry has 4,250 withheld from his salary. Linda makes estimated tax payments totaling 3,000. c. Aspra is single. His 20-year-old son, Calvin, lives with him throughout the year. Calvin pays for less than one-half of his support and his earned income for the year is 3,000. Aspra pays all costs of maintaining the household. His taxable income is 60,000. Aspras withholdings total 7,800. d. Randy and Raina are married. Because of marital discord, they are not living together at the end of the year, although they are not legally separated or divorced. Randys taxable income is 25,000, and Rainas is 60,000. Randy makes estimated tax payments of 3,500, and Raina has 7,500 in tax withheld from her salary.