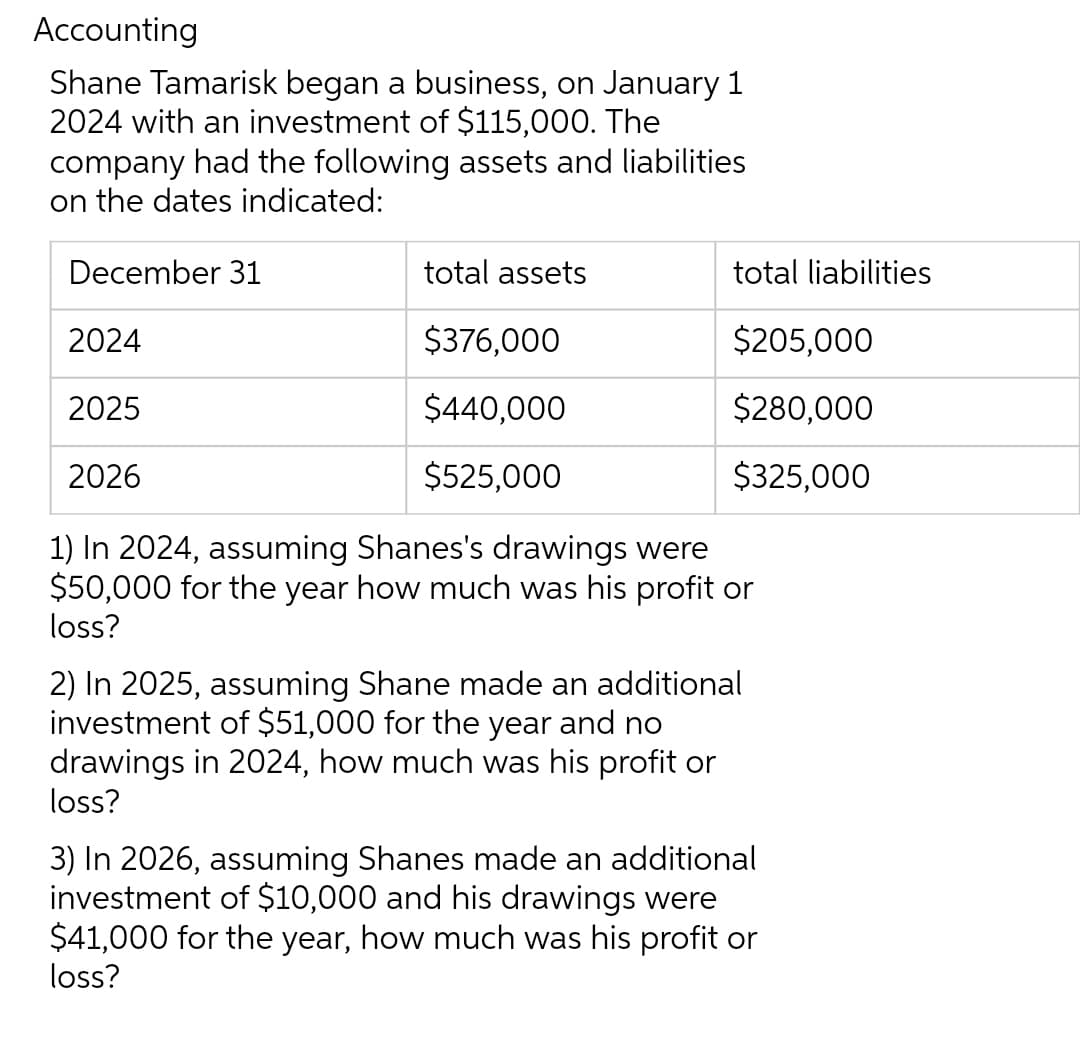

Shane Tamarisk began a business, on January 1 2024 with an investment of $115,000. The company had the following assets and liabilities on the dates indicated: December 31 total assets $376,000 $440,000 $525,000 total liabilities $205,000 $280,000 $325,000 2024 2025 2026 1) In 2024, assuming Shanes's drawings were $50,000 for the year how much was his profit or loss? 2) In 2025, assuming Shane made an additional investment of $51,000 for the year and no drawings in 2024, how much was his profit or loss? 3) In 2026, assuming Shanes made an additional investment of $10,000 and his drawings were $41,000 for the year, how much was his profit or loss?

Shane Tamarisk began a business, on January 1 2024 with an investment of $115,000. The company had the following assets and liabilities on the dates indicated: December 31 total assets $376,000 $440,000 $525,000 total liabilities $205,000 $280,000 $325,000 2024 2025 2026 1) In 2024, assuming Shanes's drawings were $50,000 for the year how much was his profit or loss? 2) In 2025, assuming Shane made an additional investment of $51,000 for the year and no drawings in 2024, how much was his profit or loss? 3) In 2026, assuming Shanes made an additional investment of $10,000 and his drawings were $41,000 for the year, how much was his profit or loss?

College Accounting (Book Only): A Career Approach

13th Edition

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:Scott, Cathy J.

Chapter5: Closing Entries And The Post-closing Trial Balance

Section: Chapter Questions

Problem 10E: Prepare a statement of owners equity for The Lindal Clinic for the year ended December 31. P....

Related questions

Topic Video

Question

Transcribed Image Text:Accounting

Shane Tamarisk began a business, on January 1

2024 with an investment of $115,000. The

company had the following assets and liabilities

on the dates indicated:

December 31

total assets

$376,000

$440,000

$525,000

total liabilities

$205,000

$280,000

$325,000

2024

2025

2026

1) In 2024, assuming Shanes's drawings were

$50,000 for the year how much was his profit or

loss?

2) In 2025, assuming Shane made an additional

investment of $51,000 for the year and no

drawings in 2024, how much was his profit or

loss?

3) In 2026, assuming Shanes made an additional

investment of $10,000 and his drawings were

$41,000 for the year, how much was his profit or

loss?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning