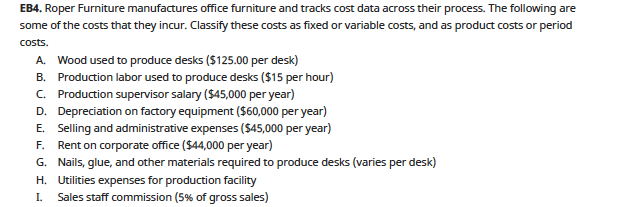

EB4. Roper Furniture manufactures office furniture and tracks cost data across their process. The following are some of the costs that they incur. Classify these costs as fixed or variable costs, and as product costs or period costs. A. Wood used to produce desks ($125.00 per desk) B. Production labor used to produce desks ($15 per hour) C. Production supervisor salary ($45,000 per year) D. Depreciation on factory equipment ($60,000 per year) E. Selling and administrative expenses ($45,000 per year) F. Rent on corporate office ($44,000 per year) G. Nails, glue, and other materials required to produce desks (varies per desk) H. Utilities expenses for production facility Sales staff commission (5% of gross sales) I.

EB4. Roper Furniture manufactures office furniture and tracks cost data across their process. The following are some of the costs that they incur. Classify these costs as fixed or variable costs, and as product costs or period costs. A. Wood used to produce desks ($125.00 per desk) B. Production labor used to produce desks ($15 per hour) C. Production supervisor salary ($45,000 per year) D. Depreciation on factory equipment ($60,000 per year) E. Selling and administrative expenses ($45,000 per year) F. Rent on corporate office ($44,000 per year) G. Nails, glue, and other materials required to produce desks (varies per desk) H. Utilities expenses for production facility Sales staff commission (5% of gross sales) I.

Chapter2: Building Blocks Of Managerial Accounting

Section: Chapter Questions

Problem 4EB: Roper Furniture manufactures office furniture and tracks cost data across their process. The...

Related questions

Question

Transcribed Image Text:EB4. Roper Furniture manufactures office furniture and tracks cost data across their process. The following are

some of the costs that they incur. Classify these costs as fixed or variable costs, and as product costs or period

costs.

A. Wood used to produce desks ($125.00 per desk)

B. Production labor used to produce desks ($15 per hour)

C. Production supervisor salary ($45,000 per year)

D. Depreciation on factory equipment ($60,000 per year)

E. Selling and administrative expenses ($45,000 per year)

F. Rent on corporate office ($44,000 per year)

G. Nails, glue, and other materials required to produce desks (varies per desk)

H. Utilities expenses for production facility

Sales staff commission (5% of gross sales)

I.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,