eBook Show Me How Calculator E Print Item Entries for Issuing stock Instructions Chart of Accounts Journal Instructions X. On May 23, Stoltz Realty Inc. issued for cash 111,000 shares of no-par common stock (with a stated value of $5) at $8. On July 6, Stoltz Realty Inc. issued at par value 35,000 shares of preferred 1% stock, $10 par for cash. On September 15, Stoltz Realty Inc. issued for cash 20,000 shares of preferred 1% stock, $10 par at $11. Journalize the entries to record the May 23, July 6, and September 15 transactions. Refer to the Chart of Accounts for exact wording of account tides. eck My Work 3 more Check My Work uses remaining. Previous Nex

eBook Show Me How Calculator E Print Item Entries for Issuing stock Instructions Chart of Accounts Journal Instructions X. On May 23, Stoltz Realty Inc. issued for cash 111,000 shares of no-par common stock (with a stated value of $5) at $8. On July 6, Stoltz Realty Inc. issued at par value 35,000 shares of preferred 1% stock, $10 par for cash. On September 15, Stoltz Realty Inc. issued for cash 20,000 shares of preferred 1% stock, $10 par at $11. Journalize the entries to record the May 23, July 6, and September 15 transactions. Refer to the Chart of Accounts for exact wording of account tides. eck My Work 3 more Check My Work uses remaining. Previous Nex

College Accounting, Chapters 1-27

23rd Edition

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:HEINTZ, James A.

Chapter20: Corporations: Organization And Capital Stock

Section: Chapter Questions

Problem 5SEB: STOCKHOLDERS EQUITY SECTION After closing its books on December 31, Mel Brothers stockholders equity...

Related questions

Question

100%

Transcribed Image Text:eBook

Show Me How

Calculator

E Print Item

Entries for Issuing stock

Instructions

Chart of Accounts

Journal

Instructions

X.

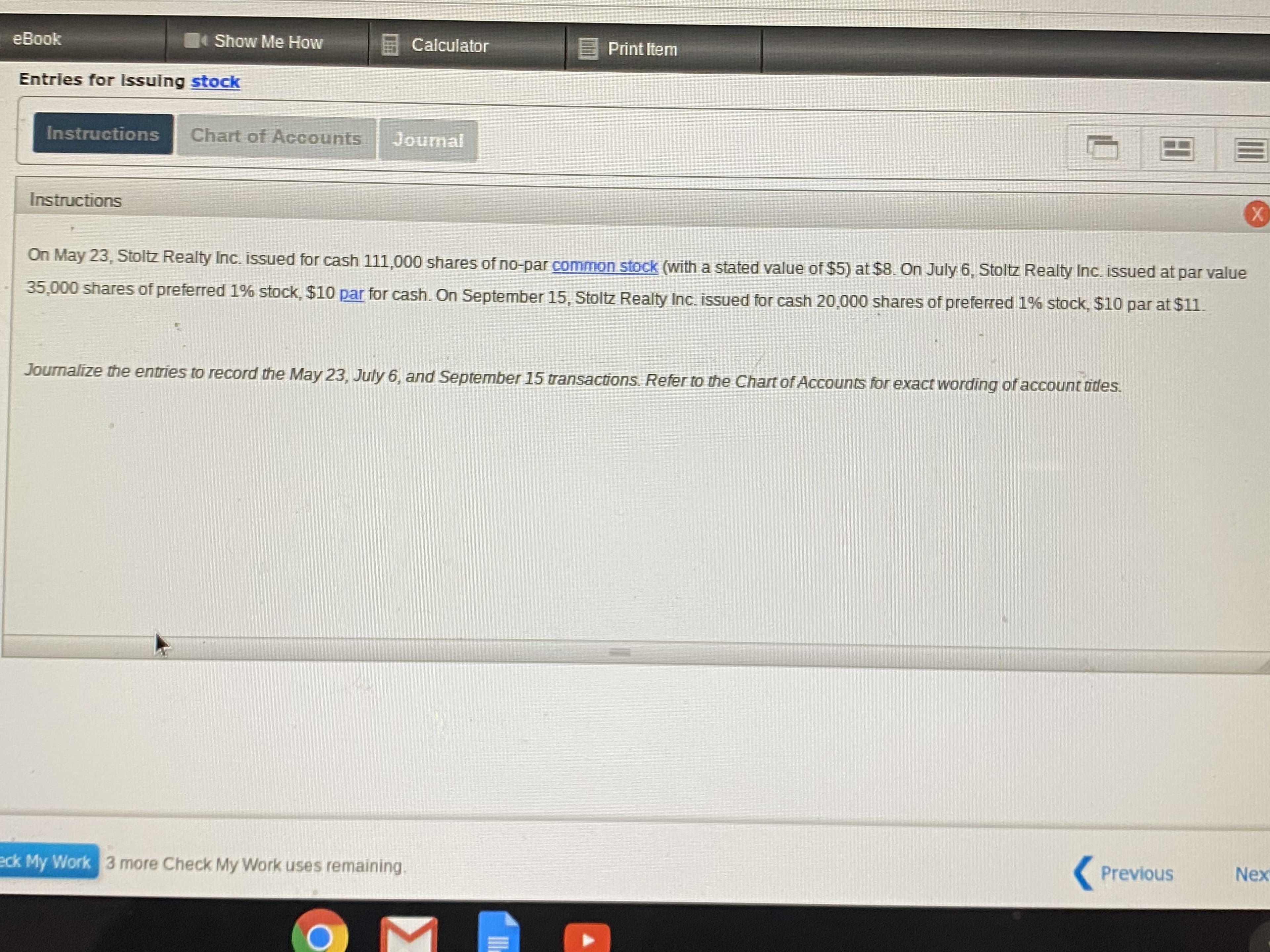

On May 23, Stoltz Realty Inc. issued for cash 111,000 shares of no-par common stock (with a stated value of $5) at $8. On July 6, Stoltz Realty Inc. issued at par value

35,000 shares

of preferred 1% stock, $10 par for cash. On September 15, Stoltz Realty Inc. issued for cash 20,000 shares of preferred 1% stock, $10 par at $11.

Journalize the entries to record the May 23, July 6, and September 15 transactions. Refer to the Chart of Accounts for exact wording of account tides.

eck My Work

3 more Check My Work uses remaining.

Previous

Nex

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Recommended textbooks for you

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning