ecifi -cum mpa m to mna

Auditing: A Risk Based-Approach (MindTap Course List)

11th Edition

ISBN:9781337619455

Author:Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Chapter12: Auditing Long-lived Assets And Merger And Acquisition Activity

Section: Chapter Questions

Problem 20RQSC

Related questions

Question

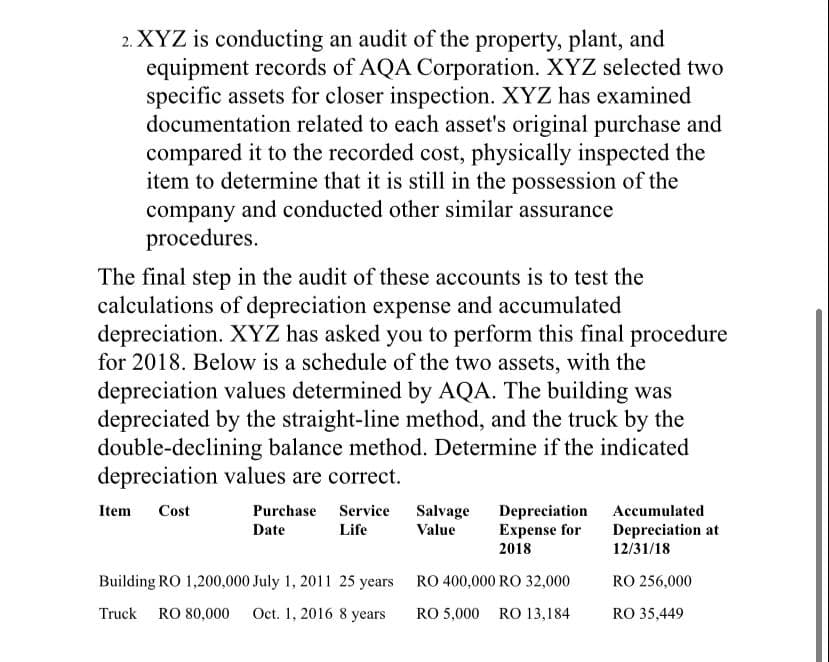

Transcribed Image Text:2. XYZ is conducting an audit of the property, plant, and

equipment records of AQA Corporation. XYZ selected two

specific assets for closer inspection. XYZ has examined

documentation related to each asset's original purchase and

compared it to the recorded cost, physically inspected the

item to determine that it is still in the possession of the

company and conducted other similar assurance

procedures.

The final step in the audit of these accounts is to test the

calculations of depreciation expense and accumulated

depreciation. XYZ has asked you to perform this final procedure

for 2018. Below is a schedule of the two assets, with the

depreciation values determined by AQA. The building was

depreciated by the straight-line method, and the truck by the

double-declining balance method. Determine if the indicated

depreciation values are correct.

Item

Cost

Purchase Service

Salvage

Value

Depreciation

Expense for

Accumulated

Date

Life

Depreciation at

2018

12/31/18

Building RO 1,200,000 July 1, 2011 25 years RO 400,000 RO 32,000

RO 256,000

Truck RO 80,000 Oct. 1, 2016 8 years

RO 5,000 RO 13,184

RO 35,449

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning

Auditing: A Risk Based-Approach to Conducting a Q…

Accounting

ISBN:

9781305080577

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

South-Western College Pub

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning

Auditing: A Risk Based-Approach to Conducting a Q…

Accounting

ISBN:

9781305080577

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

South-Western College Pub