BEPS = DEPS =

Q: zed as revenue.

A: These are the accounting transactions that are having a monetary impact on the financial statement…

Q: per? per?

A: Formula to calculate proceeds from commercial paper: Proceeds = Par value*1/(1+ifor time of issue)

Q: ation purc the execu ch is the f

A: Introduction: The benefits which are provided by the employer which acts as job satisfaction to…

Q: Define T- account.

A: Transaction: It is an economic event that is recorded in the accounting system of an organisation.…

Q: Xcerpts Trom S O.

A: Receivable turnover ratio is an accounting measure used to measure how effective a company is in…

Q: Discuss and give an example of the following types of associations: (1:0,1), (1:1), (1:M), and…

A: Given: The values are (1: 0, 1), (1:1), (1: M), (M: M)

Q: iestion rXYZ r SDA.

A: Dear student , You asked two questions. As…

Q: da MT 1 have ned $L

A: Answer is given below:

Q: Indicate

A: During the course of Audit auditor use test of control and substantive procedure depending upon the…

Q: ong form of the E e information and

A: Explanation : The semi strong form of efficient market hypothesis do state that the stock prices…

Q: he APY c ompounde PY is

A: APY means Annual Percentage Yield . It tells us that if you invest some amount how much total…

Q: Count cc by ch

A: Cash Book- It is type of financial journal which contains all the cash receipt and payment…

Q: r to get mpleted

A: The right answer is Petty Corruption

Q: reipts: an from John ings

A: Jean Smith Profit and Loss A/c for the Year ended 31-03-206…

Q: Calculate the amounts for A to J

A: ** As per our guidelines, we are allowed to solve only the first question. please resubmit for…

Q: e for e

A: Interest is a concept which arises when the money borrowed by the borrower has to be [aid along with…

Q: Match the de

A: Financial informations are the informations which is measured in monetary term and these are the…

Q: Compute for the amount to be received by GHI.

A: Cash P21000 ABC Loan charge from ABC's capital Account P15000 Collection from Accounts…

Q: What is GAAP in Full

A: GAAP is a combination of set of different policy standards

Q: Define Last-In, First-Out (LIFO) method.

A: Inventory cost flow assumptions: These are the methods used by the companies to compute the cost…

Q: nare Required Compute each the follow (Ro

A: Financial ratios are classified based on financial component of the company that they measure.

Q: GAAP stands for:

A: GAAP is a standard setting body that formulates common standards for financial reporting. These…

Q: breakeven chart i

A: [Note: Since you have asked multiple questions, we will solve the first question for you. For the…

Q: Statement Date ement Instructions arges We have

A: Bank Reconciliation statement is prepared at the end of the month to reconcile the balance as per…

Q: Activity Machin Number Number Direct la

A: Plantwide Overhead rate is equal to Total Budgeted Overhead divided by Total direct labour hours.

Q: ash distributed to DEF.

A: A partnership refers to a business in which two or more people work together to form an…

Q: Define R&D according to U.S. GAAP.

A:

Q: information prepar nt for Steven and C

A: A sale and lease back agreement is a contract between two parties where one party sells an asset to…

Q: come from. Basec

A: Introduction The consumer surplus is the difference between the expected consumer expenditure and…

Q: GAAP stands for

A: Correct answer D. GENERALLY ACCEPTED ACCOUNTING PRINCIPLE

Q: is the defer E eductible tem arryforward.

A: Explanation : The proportion of deferred tax liability owing to transitory differences that will…

Q: payc

A: Formula for Dividend payout ratio: Dividend payout ratio = Distributable earnings/Net income

Q: ys vs

A: Formula to calculate Effective annual rate: Discount rate/(1 - Discount rate)*(360/(Full allowed…

Q: Which course precedes GART? GENTREP GMATH O GSELF GWORLD O O O

A: We need to find out the sequence of courses.

Q: Determine X.

A: Given : Face value of bond = 1,000 Nominal interest rate = 2X with semiannual coupons Purchase…

Q: ulate EBITDA multiple

A: We need to compute EBITDA for 2017 and 2018

Q: débit side. Even though these account balances are ncreasing what is hannonin

A: An expense is the cost of operation that a business incurs…

Q: s and its s

A: Direct labour rate variance (also called direct labour price or spending variance) is the difference…

Q: at is busd What is xrp How they

A: What is busd ? The New York State Department of Financial Services (NYDFS) has authorised Binance…

Q: riting? O date is writt date is writte date is writte

A: A journal entry is used to record day-to-day transactions of the business by debiting and crediting…

Q: be re

A: dATE Account Title dEBIT Credit January 1 prepaid expense $3,600 Cash…

Q: nent statement of XYZ CC X Y

A: As per rule, allowed to answer one question and post the remaining in the next submission.

Q: ome will be reported using FIFO as

A: Since we answer only one question, we will answer the first question. Please resubmit the questions…

Q: roblem 1- Able Compan

A:

Q: UESTION 4 ne following info

A: In Marginal Costing, variable costing is taken marginally on units sold and entire fixed cost is…

Q: A/Fi,n) A/Pi,n)

A: The correct option is : 1. (F/A,i,n) A capital recovery factor is the ratio of a constant…

Q: What ran allov an mc

A: Range is computed as maximum value of a data set less minimum value.

Q: excel

A: “Since you have asked multiple questions, we will solve the first question for you. If you want any…

Q: terest from a m required, rou

A: Working note :- Total earning of Taylor for 2019 Particulars Amount…

Q: ect Wo provide net opera

A: 1. Calculation of Net Present Value Before calculating Net Present Value, we should have accurate…

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

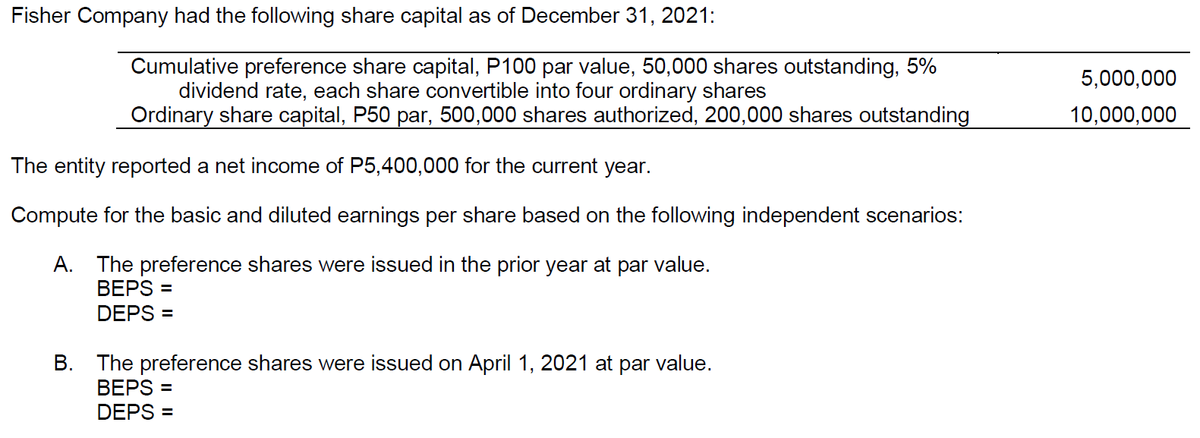

- Raun Company had the following equity items as of December 31, 2019: Preferred stock, 9% cumulative, 100 par, convertible Paid-in capital in excess of par value on preferred stock Common stock, 1 stated value Paid-in capital in excess of stated value on common stock| Retained earnings The following additional information about Raun was available for the year ended December 31, 2019: 1. There were 2 million shares of preferred stock authorized, of which 1 million were outstanding. All 1 million shares outstanding were issued on January 2, 2016, for 120 a share. The preferred stock is convertible into common stock on a 1-for-1 basis until December 31, 2025; thereafter, the preferred stock ceases to be convertible and is callable at par value by the company. No preferred stock has been converted into common stock, and there were no dividends in arrears at December 31, 2019. 2. The common stock has been issued at amounts above stated value per share since incorporation in 2002. Of the 5 million shares authorized, 3,580,000 were outstanding at January 1, 2019. The market price of the outstanding common stock has increased slowly but consistently for the last 5 years. 3. Raun has an employee share option plan where certain key employees and officers may purchase shares of common stock at 100% of the marker price at the date of the option grant. All options are exercisable in installments of one-third each year, commencing 1 year after the date of the grant, and expire if not exercised within 4 years of the grant date. On January 1, 2019, options for 70,000 shares were outstanding at prices ranging from 47 to 83 a share. Options for 20,000 shares were exercised at 47 to 79 a share during 2019. During 2019, no options expired and additional options for 15,000 shares were granted at 86 a share. The 65,000 options outstanding at December 31, 2019, were exercisable at 54 to 86 a share; of these, 30,000 were exercisable at that date at prices ranging from 54 to 79 a share. 4. Raun also has an employee share purchase plan whereby the company pays one-half and the employee pays one-half of the market price of the stock at the date of the subscription. During 2019, employees subscribed to 60,000 shares at an average price of 87 a share. All 60,000 shares were paid for and issued late in September 2019. 5. On December 31, 2019, there was a total of 355,000 shares of common stock set aside for the granting of future share options and for future purchases under the employee share purchase plan. The only changes in the shareholders equity for 2019 were those described previously, the 2019 net income, and the cash dividends paid. Required: Prepare the shareholders equity section of Rauns balance sheet at December 31, 2019. Substitute, where appropriate, Xs for unknown dollar amounts. Use good form and provide full disclosure. Write appropriate notes as they should appear in the publisher financial statements.Contributed Capital Adams Companys records provide the following information on December 31, 2019: Additional information: 1. Common stock has a 5 par value, 50,000 shares are authorized, 15,000 shares have been issued and are outstanding. 2. Preferred stock has a 100 par value, 3,000 shares are authorized, 800 shares have been issued and are outstanding. Two hundred shares have been subscribed at 120 per share. The stock pays an 8% dividend, is cumulative, and is callable at 130 per share. 3. Bonds payable mature on January 1, 2023. They carry a 12% annual interest rate, payable semiannually. Required: Prepare the Contributed Capital section of the December 31, 2019, balance sheet for Adams. Include appropriate parenthetical notes.Silva Company is authorized to issue 5,000,000 shares of $2 par value common stock. In its IPO, the company has the following transaction: Mar. 1, issued 500,000 shares of stock at $15.75 per share for cash to investors. Journalize this transaction.

- Cary Corporation has 50,000 shares of 10 par common stock authorized. The following transactions took place during 2019, the first year of the corporations existence: Sold 5,000 shares of common stock for 18 per share. Issued 5,000 shares of common stock in exchange for a patent valued at 100,000. At the end of Carys first year, total contributed capital amounted to: a. 40,000 b. 90,000 c. 100,000 d. 190,000Kent Corporation was organized on January 1, 2014. On that date, it issued 200,000 shares of 10 par value common stock at 15 per share (400,000 shares were authorized). During the period January 1, 2014, through December 31, 2019, Kent reported net income of 750,000 and paid cash dividends of 380,000. On January 5, 2019, Kent purchased 12,000 shares of its common stock at 12 per share. On December 28, 2019, 8,000 treasury shares were sold at 8 per share. Kent used the cost method of accounting for treasury shares. What is Kents total shareholders equity as of December 31, 2019? a. 3,290,000 b. 3,306,000 c. 3,338,000 d. 3,370,000Hyde Corporations capital structure at December 31, 2018, was as follows: On July 2, 2019, Hyde issued a 10% stock dividend on its common stock and paid a cash dividend of 2.00 per share on its preferred stock. Net income for the year ended December 31, 2019, was 780,000. What should be Hydes 2019 basic earnings per share? a. 7.80 b. 7.09 c. 7.68 d. 6.73

- Lyon Company shows the following condensed income statement information for the year ended December 31, 2019: Lyon declared dividends of 6,000 on preferred stock and 17,280 on common stock. At the beginning of 2019, 10,000 shares of common stock were outstanding. On May 1, 2019, the company issued 2,000 additional common shares, and on October 31, 2019, it issued a 20% stock dividend on its common stock. The preferred stock is not convertible. Required: 1. Compute the 2019 basic earnings per share. 2. Show the 2019 income statement disclosure of basic earnings per share. 3. Draft a related note to accompany the 2019 financial statements.On January 1, 2019, Kittson Company had a retained earnings balance of 218,600. It is subject to a 30% corporate income tax rate. During 2019, Kittson earned net income of 67,000, and the following events occurred: 1. Cash dividends of 3 per share on 4,000 shares of common stock were declared and paid. 2. A small stock dividend was declared and issued. The dividend consisted of 600 shares of 10 par common stock. On the date of declaration, the market price of the companys common stock was 36 per share. 3. The company recalled and retired 500 shares of 100 par preferred stock. The call price was 125 per share; the stock had originally been issued for 110 per share. 4. The company discovered that it had erroneously recorded depreciation expense of 45,000 in 2018 for both financial reporting and income tax reporting. The correct depreciation for 2018 should have been 20,000. This is considered a material error. Required: 1. Prepare journal entries to record Items 1 through 4. 2. Prepare Kittsons statement of retained earnings for the year ended December 31, 2019.Given the following year-end information, compute Greenwood Corporations basic and diluted earnings per share. Net income, 15,000 The income tax rate, 30% 4,000 shares of common stock were outstanding the entire year. shares of 10%, 50 par (and issuance price) convertible preferred stock were outstanding the entire year. Dividends of 2,500 were declared on this stock during the year. Each share of preferred stock is convertible into 5 shares of common stock.

- Anoka Company reported the following selected items in the shareholders equity section of its balance sheet on December 31, 2019, and 2020: In addition, it listed the following selected pretax items as a December 31, 2019 and 2020: The preferred shares were outstanding during all of 2019 and 2020; annual dividends were declared and paid in each year. During 2019, 2,000 common shares were sold for cash on October 4. During 2020, a 20% stock dividend was declared and issued in early May. At the end of 2019 and 2020, the common stock was selling for 25.75 and 32.20, respectively. The company is subject to a 30% income tax rate. Required: 1. Prepare the comparative 2019 and 2020 income statements (multiple-step), and the related note that would appear in Anokas 2020 annual report. 2. Next Level Compute the price/earnings ratio for 2020. How does this compare to 2019? Why is it different?Cash dividends on the 10 par value common stock of Garrett Company were as follows: The 4th-quarter cash dividend was declared on December 21, 2019, to shareholders of record on December 31, 2019. Payment of the 4th-quarter cash dividend was made on January 18, 2020. In addition, Garrett declared a 5% stock dividend on its 10 par value common stock on December 3, 2019, when there were 300,000 shares issued and outstanding and the market value of the common stock was 20 per share. The shares were issued on December 24, 2019. What was the effect on Garretts shareholders equity accounts as a result of the preceding transactions?Selected transactions completed by Equinox Products Inc. during the fiscal year ended December 31, 2016, were as follows: a. Issued 15,000 shares of 20 par common stock at 30, receiving cash. b. Issued 4, 000 shares of 80 par preferred 5% stock at 100, receiving cash. c. Issued 500,000 of 10-year, 5% bonds at 104, with interest payable semiannually. d. Declared a quarterly dividend of 0.50 per share on common stock and 1.00 per share on preferred stock. On the date of record, 100,000 shares of common stock were outstanding, no treasury shares were held, and 20,000 shares of preferred stock were outstanding. e. Paid the cash dividends declared in (d). f. Purchased 7,500 shares of Solstice Corp. at 40 per share, plus a 150 brokerage commission. The investment is classified as an available-for-sale investment. g. Purchased 8,000 shares of treasury common stock at 33 per share. h. Purchased 40,000 shares of Pinkberry Co. stock directly from the founders for 24 per share. Pinkberry has 125,000 shares issued and outstanding. Equinox Products Inc. treated the investment as an equity method investment. i. Declared a 1.00 quarterly cash dividend per share on preferred stock. On the date of record, 20,000 shares of preferred stock had been issued. j. Paid the cash dividends to the preferred stockholders. k. Received 27,500 dividend from Pinkberry Co. investment in (h). l. Purchased 90,000 of Dream Inc. 10-year, 5% bonds, directly from the issuing company, at their face amount plus accrued interest of 37 5. The bonds are classified as a held-to-maturity long -term investment. m. Sold, at 38 per share, 2,600 shares of treasury common stock purchased in (g). n. Received a dividend of 0 .60 per share from the Solstice Corp. investment in (f). o. Sold 1,000 shares of Solstice Corp. at 45, including commission. p. Recorded the payment of semiannual interest on the bonds issue d in (c) and the amortization of the premium for six months. The amortization is determined using the straight-line method . q. Accrued interest for three months on the Dream Inc. bonds purchased in (I). r. Pinkberry Co. recorded total earnings of 240 ,000. Equinox Products recorded equity earnings for its share of Pinkberry Co. net income. s. The fair value for Solstice Corp. stock was 39. 02 per share on December 31, 2016. The investment is adjusted to fair value , using a valuation allowance account. Assume Valuation Allowance for Available-for-Sale Investments h ad a beginning balance of zero. Instructions 1. Journalize the selected transactions. 2. After all of the transaction s for the year ended December 31, 201 6, had been poste d [including the transactions recorded in part (1) and all adjusting entries), the data that follows were taken from the records of Equinox Products Inc. a. Prepare a multiple-step in come statement for the year ended December 31, 201 6, concluding with earnings per share . In computing earnings per share, assume that the average number of common shares outstanding was 100,000 and preferred dividends were 100,000. ( Round earnings per share to the nearest cent.) b. Prepare a retained earnings statement for the year ended December 31, 20 6. c. Prepare a balance sheet in report form as of December 31, 2016.