7.0% 6.5% 6.0% 5.5% 5.0% 4.5% 4.0% 3.5% 3.0% 2.5% LL 2.0% 1.5% 1.0% 0.5% 0.0% $0 $10 $20 $30 $40 $50 $60 $70 $80 $90 $100 $110 $120 $130 $140 $150 $160 Bank Excess Reserves ($Billion) The model of the federal funds market that we have learned is sometimes called the corridor model. This is because, in this model the equilibrium fed funds rate fluctuates between the discount rate and the interest on reserves. This gives the Fed a tool to control the fluctuations in the equilibrium fed funds rate. Let's see how. Assume that the supply of federal funds equals $70 billion. Suppose that currently the discount rate is 4.5 percent and the interest on reserves equals 1.5 percent. In this case, if demand for reserves increases by $40 billion dollars, the equilibrium fed funds rate will increase to percent, and if it decreases by $40 billion, the equilibrium fed funds rate will decrease to percent. Now suppose the Fed wants to reduce the fluctuations in the equilibrium fed funds rate. So it changes the discount rate to 3.5 percent and the interest on reserves to 2.5 percent. In that case, if demand for reserves increases by $40 billion dollars, the equilibrium fed funds rate will increase to percent, and if it decreases by $40 billion, the equilibrium fed funds rate will decrease to percent. Federal Funds Rate

7.0% 6.5% 6.0% 5.5% 5.0% 4.5% 4.0% 3.5% 3.0% 2.5% LL 2.0% 1.5% 1.0% 0.5% 0.0% $0 $10 $20 $30 $40 $50 $60 $70 $80 $90 $100 $110 $120 $130 $140 $150 $160 Bank Excess Reserves ($Billion) The model of the federal funds market that we have learned is sometimes called the corridor model. This is because, in this model the equilibrium fed funds rate fluctuates between the discount rate and the interest on reserves. This gives the Fed a tool to control the fluctuations in the equilibrium fed funds rate. Let's see how. Assume that the supply of federal funds equals $70 billion. Suppose that currently the discount rate is 4.5 percent and the interest on reserves equals 1.5 percent. In this case, if demand for reserves increases by $40 billion dollars, the equilibrium fed funds rate will increase to percent, and if it decreases by $40 billion, the equilibrium fed funds rate will decrease to percent. Now suppose the Fed wants to reduce the fluctuations in the equilibrium fed funds rate. So it changes the discount rate to 3.5 percent and the interest on reserves to 2.5 percent. In that case, if demand for reserves increases by $40 billion dollars, the equilibrium fed funds rate will increase to percent, and if it decreases by $40 billion, the equilibrium fed funds rate will decrease to percent. Federal Funds Rate

Microeconomics A Contemporary Intro

10th Edition

ISBN:9781285635101

Author:MCEACHERN

Publisher:MCEACHERN

Chapter13: Capital, Interest, Entrepreneurship, And Corporate Finance

Section: Chapter Questions

Problem 13PAE

Related questions

Question

Transcribed Image Text:7.0%

6.5%

6.0%

5.5%

5.0%

4.5%

4.0%

3.5%

3.0%

2.5%

LL 2.0%

1.5%

1.0%

0.5%

0.0%

$0 $10 $20 $30 $40 $50 $60 $70 $80 $90 $100 $110 $120 $130 $140 $150 $160

Bank Excess Reserves ($Billion)

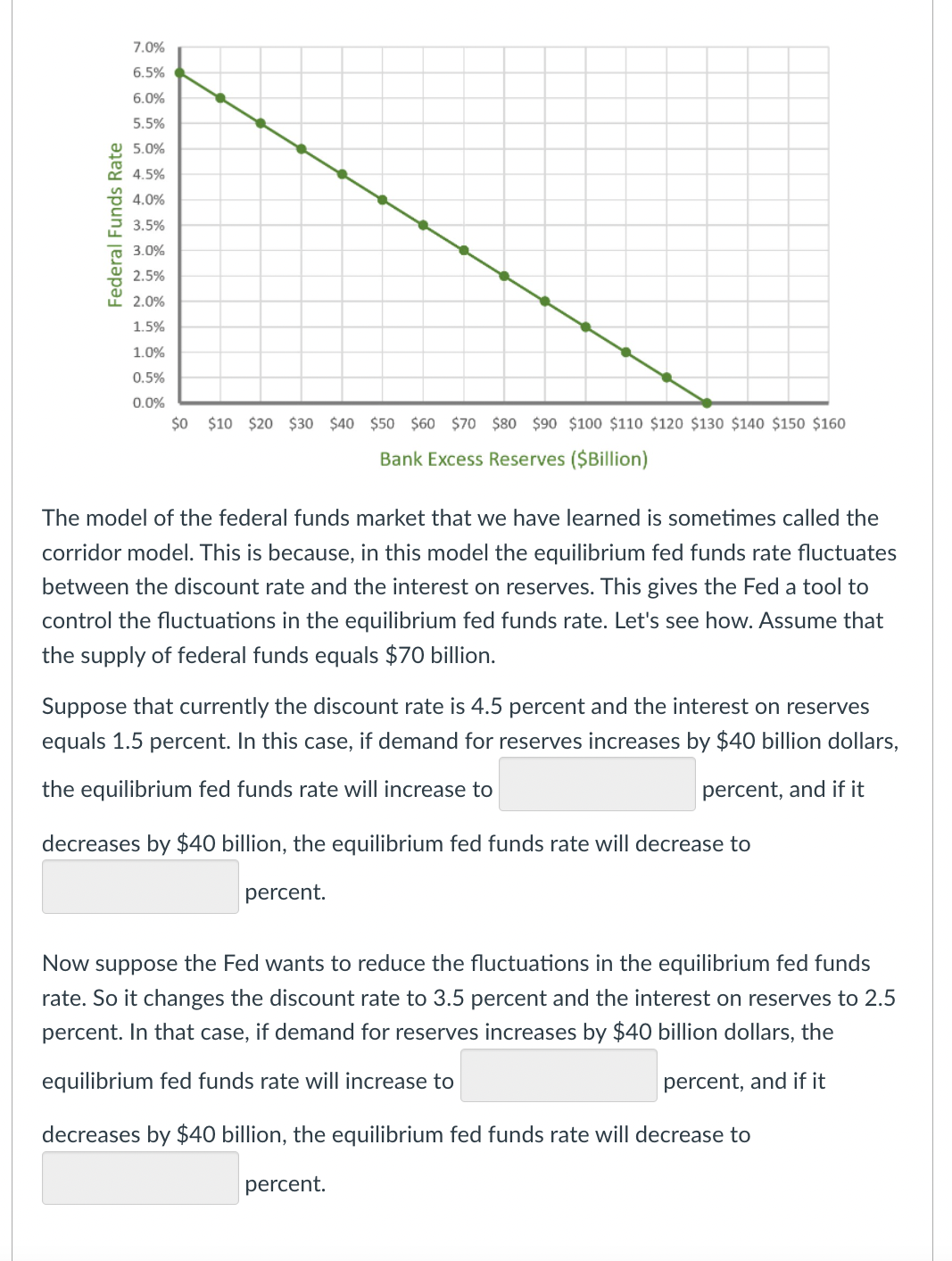

The model of the federal funds market that we have learned is sometimes called the

corridor model. This is because, in this model the equilibrium fed funds rate fluctuates

between the discount rate and the interest on reserves. This gives the Fed a tool to

control the fluctuations in the equilibrium fed funds rate. Let's see how. Assume that

the supply of federal funds equals $70 billion.

Suppose that currently the discount rate is 4.5 percent and the interest on reserves

equals 1.5 percent. In this case, if demand for reserves increases by $40 billion dollars,

the equilibrium fed funds rate will increase to

percent, and if it

decreases by $40 billion, the equilibrium fed funds rate will decrease to

percent.

Now suppose the Fed wants to reduce the fluctuations in the equilibrium fed funds

rate. So it changes the discount rate to 3.5 percent and the interest on reserves to 2.5

percent. In that case, if demand for reserves increases by $40 billion dollars, the

equilibrium fed funds rate will increase to

percent, and if it

decreases by $40 billion, the equilibrium fed funds rate will decrease to

percent.

Federal Funds Rate

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Economics 2e

Economics

ISBN:

9781947172364

Author:

Steven A. Greenlaw; David Shapiro

Publisher:

OpenStax

Principles of Economics 2e

Economics

ISBN:

9781947172364

Author:

Steven A. Greenlaw; David Shapiro

Publisher:

OpenStax