edit sales, counts receivable, Dec. 31, 2018 counts receivable, Dec. 31, 2019 er of days' sales in receivables ratio, 2018 come, Dec. 31, 2018 $540,000 $620,000 $120,000 $180,000 103 days $250,000 $145,000 $175,000 110 days $350,000 al Information: pany A: Bad debt estimation percentage using the income statement method is 6%, and od is 10%. The $230,000 in Other Expenses includes all company expenses except Bad pany B: Bad debt estimation percentage using the income statement method is 6.5%, and od is 8%. The $140,000 in Other Expenses includes all company expenses except Bad D

edit sales, counts receivable, Dec. 31, 2018 counts receivable, Dec. 31, 2019 er of days' sales in receivables ratio, 2018 come, Dec. 31, 2018 $540,000 $620,000 $120,000 $180,000 103 days $250,000 $145,000 $175,000 110 days $350,000 al Information: pany A: Bad debt estimation percentage using the income statement method is 6%, and od is 10%. The $230,000 in Other Expenses includes all company expenses except Bad pany B: Bad debt estimation percentage using the income statement method is 6.5%, and od is 8%. The $140,000 in Other Expenses includes all company expenses except Bad D

Chapter9: Accounting For Receivables

Section: Chapter Questions

Problem 13EB: Fortune Accounting reports $1,455,000 in credit sales for 2018 and $1,678,430 in 2019. It has an...

Related questions

Question

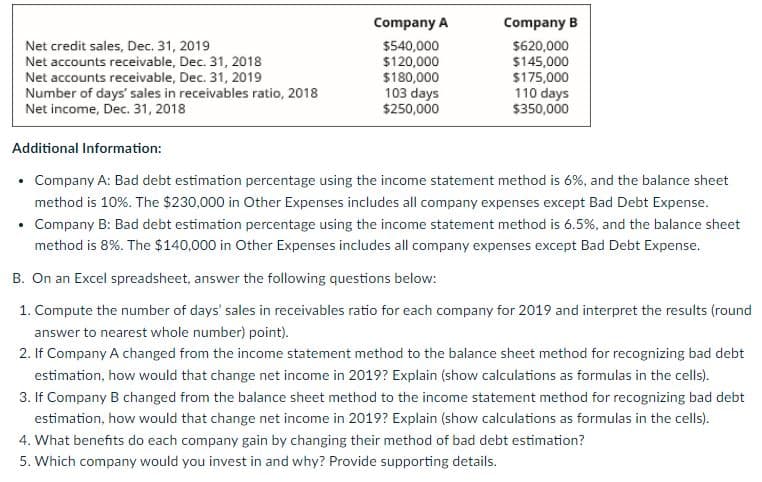

Transcribed Image Text:Company A

Company B

Net credit sales, Dec. 31, 2019

Net accounts receivable, Dec. 31, 2018

Net accounts receivable, Dec. 31, 2019

Number of days' sales in receivables ratio, 2018

Net income, Dec. 31, 2018

$540,000

$120,000

$180,000

103 days

$250,000

$620,000

$145,000

$175,000

110 days

$350,000

Additional Information:

• Company A: Bad debt estimation percentage using the income statement method is 6%, and the balance sheet

method is 10%. The $230,000 in Other Expenses includes all company expenses except Bad Debt Expense.

• Company B: Bad debt estimation percentage using the income statement method is 6.5%, and the balance sheet

method is 8%. The $140,000 in Other Expenses includes all company expenses except Bad Debt Expense.

B. On an Excel spreadsheet, answer the following questions below:

1. Compute the number of days' sales in receivables ratio for each company for 2019 and interpret the results (round

answer to nearest whole number) point).

2. If Company A changed from the income statement method to the balance sheet method for recognizing bad debt

estimation, how would that change net income in 2019? Explain (show calculations as formulas in the cells).

3. If Company B changed from the balance sheet method to the income statement method for recognizing bad debt

estimation, how would that change net income in 2019? Explain (show calculations as formulas in the cells).

4. What benefits do each company gain by changing their method of bad debt estimation?

5. Which company would you invest in and why? Provide supporting details.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 5 steps with 5 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub