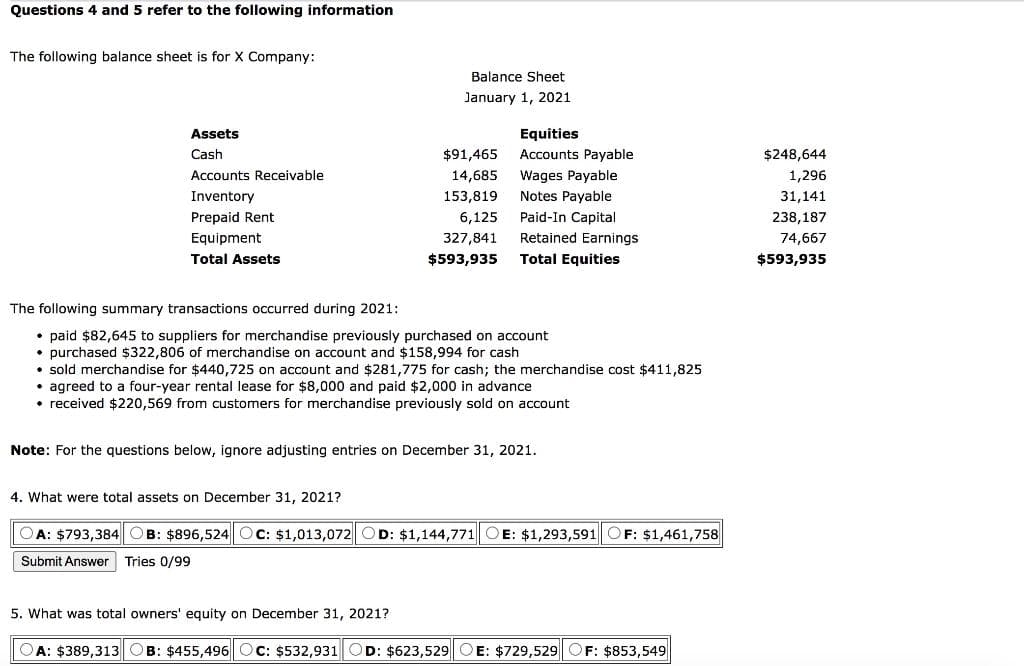

Questions 4 and 5 refer to the following information The following balance sheet is for X Company: Balance Sheet January 1, 2021 Assets Equities Cash $91,465 Accounts Payable $248,644 Wages Payable Notes Payable Paid-In Capital Retained Earnings Accounts Receivable 14,685 1,296 Inventory 153,819 31,141 Prepaid Rent 6,125 238,187 Equipment 327,841 74,667 Total Assets $593,935 Total Equities $593,935 The following summary transactions occurred during 2021: • paid $82,645 to suppliers for merchandise previously purchased on account • purchased $322,806 of merchandise on account and $158,994 for cash • sold merchandise for $440,725 on account and $281,775 for cash; the merchandise cost $411,825 • agreed to a four-year rental lease for $8,000 and paid $2,000 in advance • received $220,569 from customers for merchandise previously sold on account Note: For the questions below, ignore adjusting entries on December 31, 2021. 4. What were total assets on December 31, 2021? A: $793,384 B: $896,524 C: $1,013,072 OD: $1,144,771 E: $1,293,591 OF: $1,461,758 Submit Answer Tries 0/99 5. What was total owners' equity on December 31, 2021? OA: $389,313OB: $455,496 OC: $532,931 D: $623,529 OE: $729,529 F: $853,549

Questions 4 and 5 refer to the following information The following balance sheet is for X Company: Balance Sheet January 1, 2021 Assets Equities Cash $91,465 Accounts Payable $248,644 Wages Payable Notes Payable Paid-In Capital Retained Earnings Accounts Receivable 14,685 1,296 Inventory 153,819 31,141 Prepaid Rent 6,125 238,187 Equipment 327,841 74,667 Total Assets $593,935 Total Equities $593,935 The following summary transactions occurred during 2021: • paid $82,645 to suppliers for merchandise previously purchased on account • purchased $322,806 of merchandise on account and $158,994 for cash • sold merchandise for $440,725 on account and $281,775 for cash; the merchandise cost $411,825 • agreed to a four-year rental lease for $8,000 and paid $2,000 in advance • received $220,569 from customers for merchandise previously sold on account Note: For the questions below, ignore adjusting entries on December 31, 2021. 4. What were total assets on December 31, 2021? A: $793,384 B: $896,524 C: $1,013,072 OD: $1,144,771 E: $1,293,591 OF: $1,461,758 Submit Answer Tries 0/99 5. What was total owners' equity on December 31, 2021? OA: $389,313OB: $455,496 OC: $532,931 D: $623,529 OE: $729,529 F: $853,549

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter4: Internal Control And Cash

Section: Chapter Questions

Problem 69.3C

Related questions

Question

Transcribed Image Text:Questions 4 and 5 refer to the following information

The following balance sheet is for X Company:

Balance Sheet

January 1, 2021

Assets

Equities

Cash

$91,465

Accounts Payable

$248,644

Wages Payable

Notes Payable

Paid-In Capital

Accounts Receivable

14,685

1,296

Inventory

153,819

31,141

Prepaid Rent

6,125

238,187

Equipment

327,841

Retained Earnings

74,667

Total Assets

$593,935

Total Equities

$593,935

The following summary transactions occurred during 2021:

• paid $82,645 to suppliers for merchandise previously purchased on account

purchased $322,806 of merchandise on account and $158,994 for cash

• sold merchandise for $440,725 on account and $281,775 for cash; the merchandise cost $411,825

• agreed to a four-year rental lease for $8,000 and paid $2,000 in advance

• received $220,569 from customers for merchandise previously sold on account

Note: For the questions below, ignore adjusting entries on December 31, 2021.

4. What were total assets on December 31, 2021?

A: $793,384

B: $896,524

C: $1,013,072

O D: $1,144,771

E: $1,293,591 OF: $1,461,758

Submit Answer Tries 0/99

5. What was total owners' equity on December 31, 2021?

OA: $389,313 OB: $455,496 Oc: $532,931

D: $623,529 OE: $729,529 OF: $853,549|

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781305635937

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781305635937

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning