Financial Management: Theory & Practice

16th Edition

ISBN:9781337909730

Author:Brigham

Publisher:Brigham

Chapter3: Analysis Of Financial Statements

Section: Chapter Questions

Problem 3MC: Calculate the projected inventory turnover, days sales outstanding (DSO), fixed assets turnover, and...

Related questions

Question

refer to the photo below. Please provide a complete and correct solution.

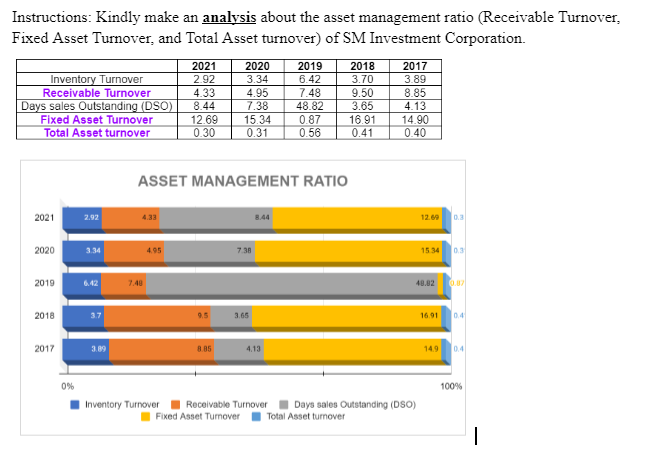

Transcribed Image Text:Instructions: Kindly make an analysis about the asset management ratio (Receivable Turnover,

Fixed Asset Turnover, and Total Asset turnover) of SM Investment Corporation.

Inventory Turnover

Receivable Turnover

Days sales Outstanding (DSO)

Fixed Asset Turnover

Total Asset turnover

2021

2020

2019

2018

2017

0%

2.92

3.34

6.42

3.89

4.33

7.48

4.95

2021

2.92

4.33

8.44

Inventory Turnover

12.69

0.30

ASSET MANAGEMENT RATIO

9.5

2020

2019

3.34

6.42

4.95

7.48

7.38 48.82

8.85

15.34

0.31

7.38

3.65

8.44

4.13

0.87

0.56

Receivable Turnover

Fixed Asset Turnover

2018

3.70

Total Asset turnover

9.50

3.65

16.91

0.41

2017

3.89

8.85

4.13

14.90

0.40

Days sales Outstanding (DSO)

12.69 0.3

15.34 0.3

48.82 0.87

16.91 0.4

14.9 0.4

100%

|

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,