Effect of Proposals on Divisional Performance < A condensed income statement for the Jet Ski Division of Amazing Rides Inc. for the year ended December 31, 20Y2, is as follows: Sales Cost of goods sold Gross profit Operating expenses Operating income Invested assets $3,220,000 (2,536,200) $ 683,800 (394,000) $ 289,800 $2,300,000 Assume that the Jet Ski Division received no charges from service departments. The president of Amazing Rides has indicated that the division's rate of return on a $2,300,000 investment must be increased to at least 15.3% by the end of the next year if operations are to continue. The division manager is considering the following three proposals: Proposal 1: Transfer equipment with a book value of $460,000 to other divisions at no gain or loss and lease similar equipment. The annual lease payments would exceed the amount of depreciation expense on the old equipment by $82,800. This increase in expense would be included as part of the cost of goods sold. Sales would remain unchanged. Proposal 2: Purchase new and more efficient machining equipment and thereby reduce the cost of goods sold by $303,600. Sales would remain unchanged, and the old equipment, which has no remaining book value, would be scrapped at no gain or loss. The new equipment would increase invested assets by an additional $1,150,000 for the year. Proposal 3: Reduce invested assets by discontinuing the tandem jet ski line. This action would eliminate sales of $488,800, cost of goods sold of $326,600, ? 0_F_20 DG5... ndlin_Re ne ion for 3350.pdf Naut ti a BOOK value of $400,000 to other divisions at no gam of 1935 and Tease Smmar equipment. The annual lease payments would exceed the amount of depreciation expense on the old equipment by $82,800. This increase in expense would be included as part of the cost of goods sold. Sales would remain unchanged. Proposal 2: Purchase new and more efficient machining equipment and thereby reduce the cost of goods sold by $303,600. Sales would remain unchanged, and the old equipment, which has no remaining book value, would be scrapped at no gain or loss. The new equipment would increase invested assets by an additional $1,150,000 for the year. Proposal 3: Reduce invested assets by discontinuing the tandem jet ski line. This action would eliminate sales of $488,800, cost of goods sold of $326,600, and operating expenses of $143,800. Assets of $1,164,500 would be transferred to other divisions at no gain or loss. Required: 1. Using the DuPont formula for return on investment, determine the profit margin, investment turnover, and return on investment for the Jet Ski Division for the past year. For investment turnover and ROI, round to one decimal place. < Profit margin Investment turnover ROI Feedback Check My Work Jet Ski Division % % ne 1. Operating income divided by sales equals profit margin. Sales divided by invested assets equals investment turnover. Multiply these two nerrentanac for the rate of rehim ion

Effect of Proposals on Divisional Performance < A condensed income statement for the Jet Ski Division of Amazing Rides Inc. for the year ended December 31, 20Y2, is as follows: Sales Cost of goods sold Gross profit Operating expenses Operating income Invested assets $3,220,000 (2,536,200) $ 683,800 (394,000) $ 289,800 $2,300,000 Assume that the Jet Ski Division received no charges from service departments. The president of Amazing Rides has indicated that the division's rate of return on a $2,300,000 investment must be increased to at least 15.3% by the end of the next year if operations are to continue. The division manager is considering the following three proposals: Proposal 1: Transfer equipment with a book value of $460,000 to other divisions at no gain or loss and lease similar equipment. The annual lease payments would exceed the amount of depreciation expense on the old equipment by $82,800. This increase in expense would be included as part of the cost of goods sold. Sales would remain unchanged. Proposal 2: Purchase new and more efficient machining equipment and thereby reduce the cost of goods sold by $303,600. Sales would remain unchanged, and the old equipment, which has no remaining book value, would be scrapped at no gain or loss. The new equipment would increase invested assets by an additional $1,150,000 for the year. Proposal 3: Reduce invested assets by discontinuing the tandem jet ski line. This action would eliminate sales of $488,800, cost of goods sold of $326,600, ? 0_F_20 DG5... ndlin_Re ne ion for 3350.pdf Naut ti a BOOK value of $400,000 to other divisions at no gam of 1935 and Tease Smmar equipment. The annual lease payments would exceed the amount of depreciation expense on the old equipment by $82,800. This increase in expense would be included as part of the cost of goods sold. Sales would remain unchanged. Proposal 2: Purchase new and more efficient machining equipment and thereby reduce the cost of goods sold by $303,600. Sales would remain unchanged, and the old equipment, which has no remaining book value, would be scrapped at no gain or loss. The new equipment would increase invested assets by an additional $1,150,000 for the year. Proposal 3: Reduce invested assets by discontinuing the tandem jet ski line. This action would eliminate sales of $488,800, cost of goods sold of $326,600, and operating expenses of $143,800. Assets of $1,164,500 would be transferred to other divisions at no gain or loss. Required: 1. Using the DuPont formula for return on investment, determine the profit margin, investment turnover, and return on investment for the Jet Ski Division for the past year. For investment turnover and ROI, round to one decimal place. < Profit margin Investment turnover ROI Feedback Check My Work Jet Ski Division % % ne 1. Operating income divided by sales equals profit margin. Sales divided by invested assets equals investment turnover. Multiply these two nerrentanac for the rate of rehim ion

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter14: The Balanced Scorecard And Corporate Social Responsibility

Section: Chapter Questions

Problem 1DQ: How does a strategic performance measurement system improve upon an ordinary performance measurement...

Related questions

Question

4

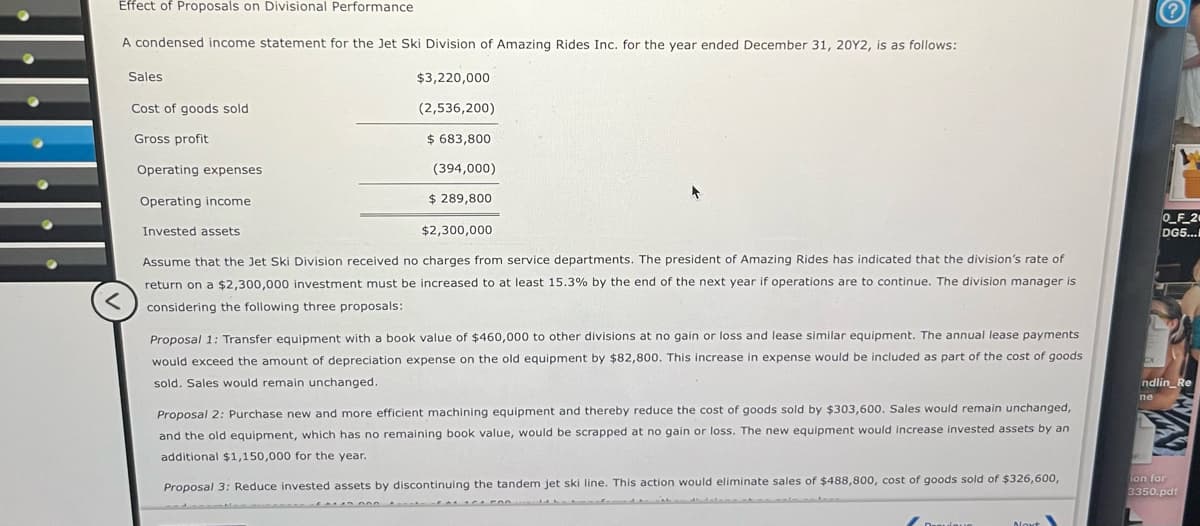

Transcribed Image Text:Effect of Proposals on Divisional Performance

<

A condensed income statement for the Jet Ski Division of Amazing Rides Inc. for the year ended December 31, 20Y2, is as follows:

Sales

Cost of goods sold

Gross profit

Operating expenses

Operating income

Invested assets

$3,220,000

(2,536,200)

$ 683,800

(394,000)

$ 289,800

$2,300,000

Assume that the Jet Ski Division received no charges from service departments. The president of Amazing Rides has indicated that the division's rate of

return on a $2,300,000 investment must be increased to at least 15.3% by the end of the next year if operations are to continue. The division manager is

considering the following three proposals:

Proposal 1: Transfer equipment with a book value of $460,000 to other divisions at no gain or loss and lease similar equipment. The annual lease payments

would exceed the amount of depreciation expense on the old equipment by $82,800. This increase in expense would be included as part of the cost of goods

sold. Sales would remain unchanged.

Proposal 2: Purchase new and more efficient machining equipment and thereby reduce the cost of goods sold by $303,600. Sales would remain unchanged,

and the old equipment, which has no remaining book value, would be scrapped at no gain or loss. The new equipment would increase invested assets by an

additional $1,150,000 for the year.

Proposal 3: Reduce invested assets by discontinuing the tandem jet ski line. This action would eliminate sales of $488,800, cost of goods sold of $326,600,

?

0_F_20

DG5...

ndlin_Re

ne

ion for

3350.pdf

Naut

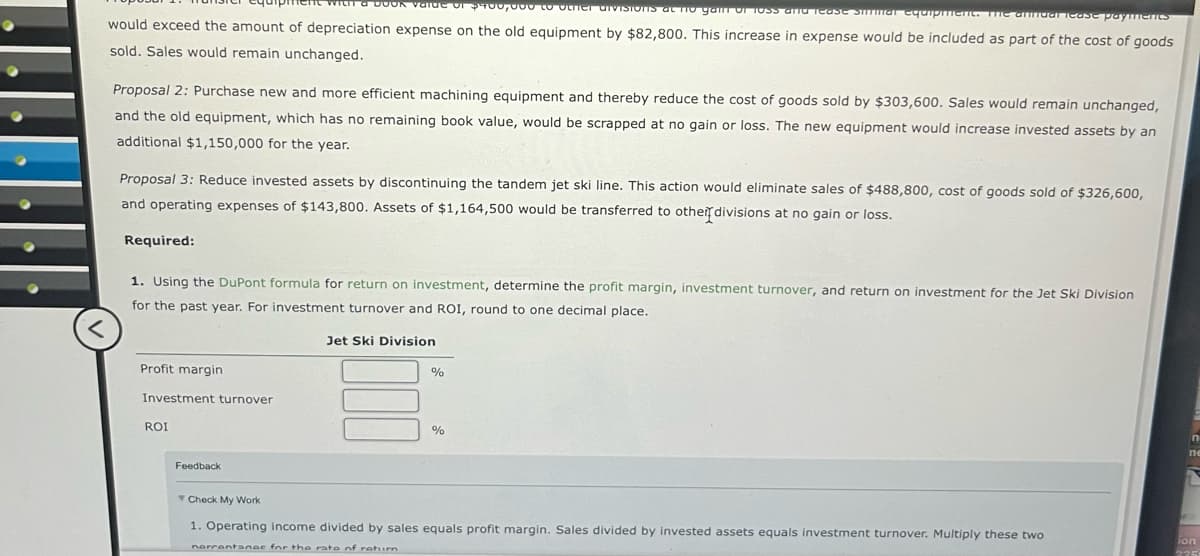

Transcribed Image Text:ti a BOOK value of $400,000 to other divisions at no gam of 1935 and Tease Smmar equipment. The annual lease payments

would exceed the amount of depreciation expense on the old equipment by $82,800. This increase in expense would be included as part of the cost of goods

sold. Sales would remain unchanged.

Proposal 2: Purchase new and more efficient machining equipment and thereby reduce the cost of goods sold by $303,600. Sales would remain unchanged,

and the old equipment, which has no remaining book value, would be scrapped at no gain or loss. The new equipment would increase invested assets by an

additional $1,150,000 for the year.

Proposal 3: Reduce invested assets by discontinuing the tandem jet ski line. This action would eliminate sales of $488,800, cost of goods sold of $326,600,

and operating expenses of $143,800. Assets of $1,164,500 would be transferred to other divisions at no gain or loss.

Required:

1. Using the DuPont formula for return on investment, determine the profit margin, investment turnover, and return on investment for the Jet Ski Division

for the past year. For investment turnover and ROI, round to one decimal place.

<

Profit margin

Investment turnover

ROI

Feedback

Check My Work

Jet Ski Division

%

%

ne

1. Operating income divided by sales equals profit margin. Sales divided by invested assets equals investment turnover. Multiply these two

nerrentanac for the rate of rehim

ion

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College