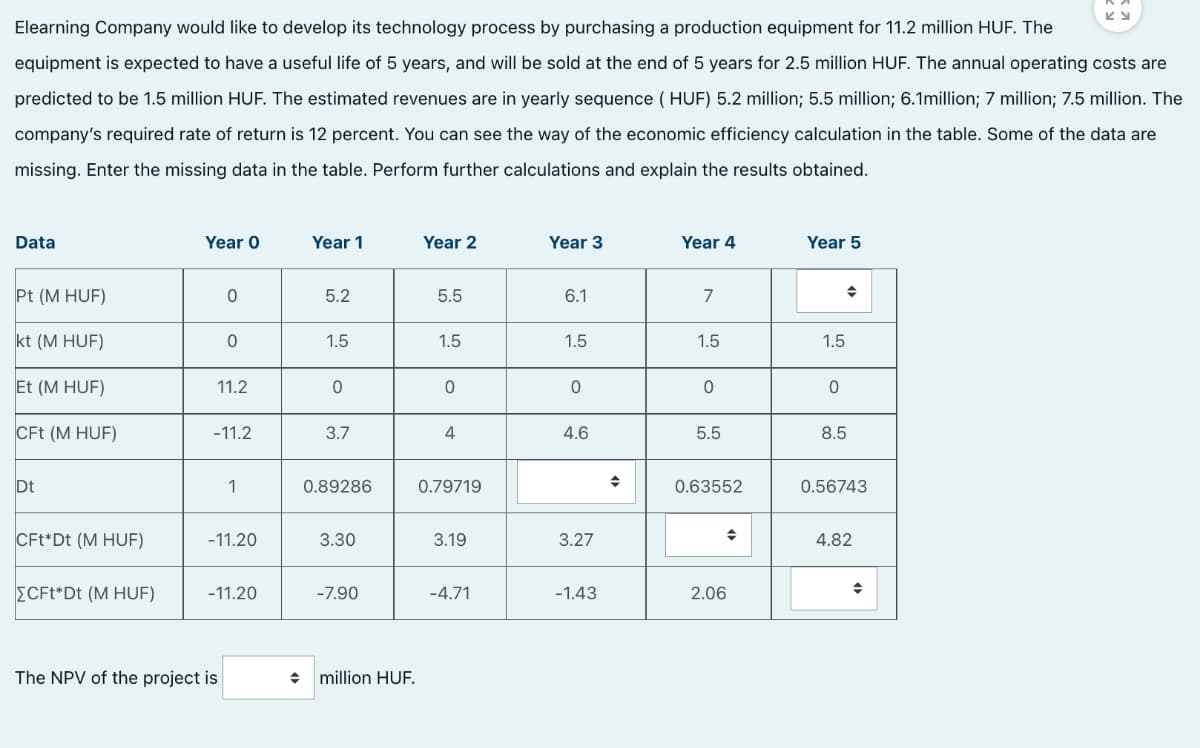

Elearning Company would like to develop its technology process by purchasing a production equipment for 11.2 million HUF. The equipment is expected to have a useful life of 5 years, and will be sold at the end of 5 years for 2.5 million HUF. The annual operating costs are predicted to be 1.5 million HUF. The estimated revenues are in yearly sequence ( HUF) 5.2 million; 5.5 million; 6.1million; 7 million; 7.5 million. The company's required rate of return is 12 percent. You can see the way of the economic efficiency calculation in the table. Some of the data are missing. Enter the missing data in the table. Perform further calculations and explain the results obtained.

Elearning Company would like to develop its technology process by purchasing a production equipment for 11.2 million HUF. The equipment is expected to have a useful life of 5 years, and will be sold at the end of 5 years for 2.5 million HUF. The annual operating costs are predicted to be 1.5 million HUF. The estimated revenues are in yearly sequence ( HUF) 5.2 million; 5.5 million; 6.1million; 7 million; 7.5 million. The company's required rate of return is 12 percent. You can see the way of the economic efficiency calculation in the table. Some of the data are missing. Enter the missing data in the table. Perform further calculations and explain the results obtained.

Chapter10: Capital Budgeting: Decision Criteria And Real Option

Section: Chapter Questions

Problem 14P

Related questions

Question

Transcribed Image Text:Elearning Company would like to develop its technology process by purchasing a production equipment for 11.2 million HUF. The

equipment is expected to have a useful life of 5 years, and will be sold at the end of 5 years for 2.5 million HUF. The annual operating costs are

predicted to be 1.5 million HUF. The estimated revenues are in yearly sequence ( HUF) 5.2 million; 5.5 million; 6.1million; 7 million; 7.5 million. The

company's required rate of return is 12 percent. You can see the way of the economic efficiency calculation in the table. Some of the data are

missing. Enter the missing data in the table. Perform further calculations and explain the results obtained.

Data

Year O

Year 1

Year 2

Year 3

Year 4

Year 5

Pt (M HUF)

5.2

5.5

6.1

7

kt (M HUF)

1.5

1.5

1.5

1.5

1.5

Et (M HUF)

11.2

CFt (M HUF)

-11.2

3.7

4

4.6

5.5

8.5

Dt

1

0.89286

0.79719

0.63552

0.56743

CFt*Dt (M HUF)

-11.20

3.30

3.19

3.27

4.82

ECF**Dt (M HUF)

-11.20

-7.90

-4.71

-1.43

2.06

The NPV of the project is

million HUF.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning