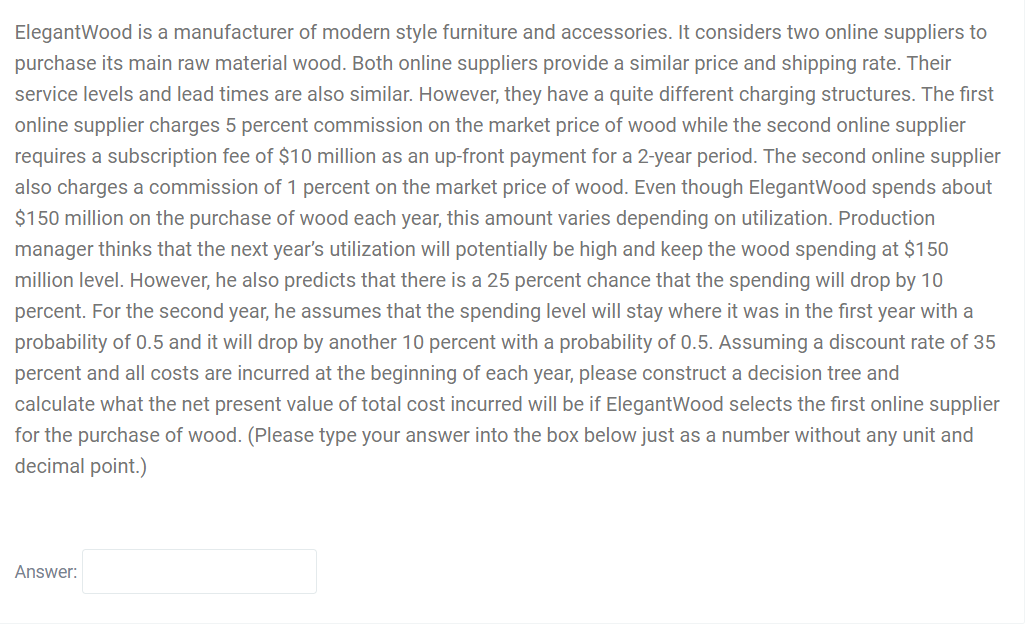

ElegantWood is a manufacturer of modern style furniture and accessories. It considers two online suppliers to purchase its main raw material wood. Both online suppliers provide a similar price and shipping rate. Their service levels and lead times are also similar. However, they have a quite different charging structures. The first online supplier charges 5 percent commission on the market price of wood while the second online supplier requires a subscription fee of $10 million as an up-front payment for a 2-year period. The second online supplie also charges a commission of 1 percent on the market price of wood. Even though ElegantWood spends about $150 million on the purchase of wood each year, this amount varies depending on utilization. Production manager thinks that the next year's utilization will potentially be high and keep the wood spending at $150 million level. However, he also predicts that there is a 25 percent chance that the spending will drop by 10 percent. For the second year, he assumes that the spending level will stay where it was in the first year with a

ElegantWood is a manufacturer of modern style furniture and accessories. It considers two online suppliers to purchase its main raw material wood. Both online suppliers provide a similar price and shipping rate. Their service levels and lead times are also similar. However, they have a quite different charging structures. The first online supplier charges 5 percent commission on the market price of wood while the second online supplier requires a subscription fee of $10 million as an up-front payment for a 2-year period. The second online supplie also charges a commission of 1 percent on the market price of wood. Even though ElegantWood spends about $150 million on the purchase of wood each year, this amount varies depending on utilization. Production manager thinks that the next year's utilization will potentially be high and keep the wood spending at $150 million level. However, he also predicts that there is a 25 percent chance that the spending will drop by 10 percent. For the second year, he assumes that the spending level will stay where it was in the first year with a

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter18: Pricing And Profitability Analysis

Section: Chapter Questions

Problem 14E: Many different businesses employ markup on cost to arrive at a price. For each of the following...

Related questions

Question

Transcribed Image Text:ElegantWood is a manufacturer of modern style furniture and accessories. It considers two online suppliers to

purchase its main raw material wood. Both online suppliers provide a similar price and shipping rate. Their

service levels and lead times are also similar. However, they have a quite different charging structures. The first

online supplier charges 5 percent commission on the market price of wood while the second online supplier

requires a subscription fee of $10 million as an up-front payment for a 2-year period. The second online supplier

also charges a commission of 1 percent on the market price of wood. Even though ElegantWood spends about

$150 million on the purchase of wood each year, this amount varies depending on utilization. Production

manager thinks that the next year's utilization will potentially be high and keep the wood spending at $150

million level. However, he also predicts that there is a 25 percent chance that the spending will drop by 10

percent. For the second year, he assumes that the spending level will stay where it was in the first year with a

probability of 0.5 and it will drop by another 10 percent with a probability of 0.5. Assuming a discount rate of 35

percent and all costs are incurred at the beginning of each year, please construct a decision tree and

calculate what the net present value of total cost incurred will be if ElegantWood selects the first online supplier

for the purchase of wood. (Please type your answer into the box below just as a number without any unit and

decimal point.)

Answer:

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning