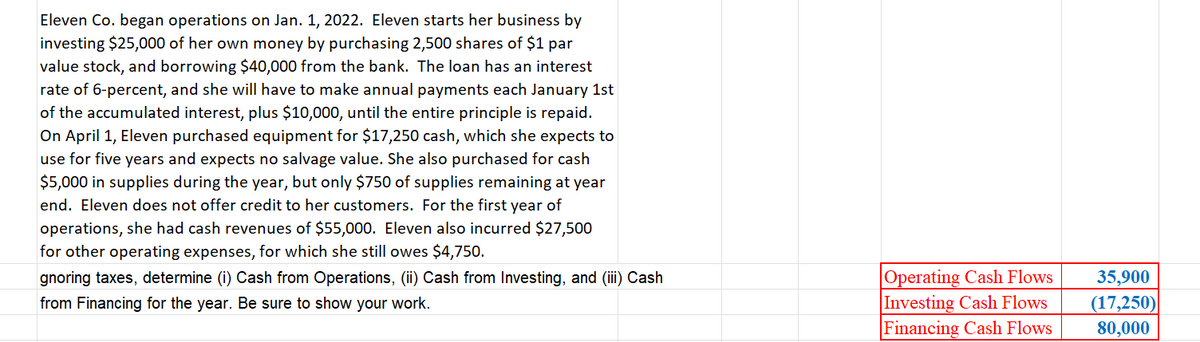

Eleven Co. began operations on Jan. 1, 2022. Eleven starts her business by investing $25,000 of her own money by purchasing 2,500 shares of $1 par value stock, and borrowing $40,000 from the bank. The loan has an interest rate of 6-percent, and she will have to make annual payments each January 1st of the accumulated interest, plus $10,000, until the entire principle is repaid. On April 1, Eleven purchased equipment for $17,250 cash, which she expects to use for five years and expects no salvage value. She also purchased for cash $5,000 in supplies during the year, but only $750 of supplies remaining at year end. Eleven does not offer credit to her customers. For the first year of operations, she had cash revenues of $55,000. Eleven also incurred $27,500 for other operating expenses, for which she still owes $4,750. Operating Cash Flows Investing Cash Flows Financing Cash Flows gnoring taxes, determine (i) Cash from Operations, (ii) Cash from Investing, and (i) Cash 35,900 from Financing for the year. Be sure to show your work. (17,250) 80.000

Eleven Co. began operations on Jan. 1, 2022. Eleven starts her business by investing $25,000 of her own money by purchasing 2,500 shares of $1 par value stock, and borrowing $40,000 from the bank. The loan has an interest rate of 6-percent, and she will have to make annual payments each January 1st of the accumulated interest, plus $10,000, until the entire principle is repaid. On April 1, Eleven purchased equipment for $17,250 cash, which she expects to use for five years and expects no salvage value. She also purchased for cash $5,000 in supplies during the year, but only $750 of supplies remaining at year end. Eleven does not offer credit to her customers. For the first year of operations, she had cash revenues of $55,000. Eleven also incurred $27,500 for other operating expenses, for which she still owes $4,750. Operating Cash Flows Investing Cash Flows Financing Cash Flows gnoring taxes, determine (i) Cash from Operations, (ii) Cash from Investing, and (i) Cash 35,900 from Financing for the year. Be sure to show your work. (17,250) 80.000

Chapter16: Accounting Periods And Methods

Section: Chapter Questions

Problem 3DQ

Related questions

Question

Transcribed Image Text:Eleven Co. began operations on Jan. 1, 2022. Eleven starts her business by

investing $25,000 of her own money by purchasing 2,500 shares of $1 par

value stock, and borrowing $40,000 from the bank. The loan has an interest

rate of 6-percent, and she will have to make annual payments each January 1st

of the accumulated interest, plus $10,000, until the entire principle is repaid.

On April 1, Eleven purchased equipment for $17,250 cash, which she expects to

use for five years and expects no salvage value. She also purchased for cash

$5,000 in supplies during the year, but only $750 of supplies remaining at year

end. Eleven does not offer credit to her customers. For the first year of

operations, she had cash revenues of $55,000. Eleven also incurred $27,500

for other operating expenses, for which she still owes $4,750.

|Operating Cash Flows

Investing Cash Flows

Financing Cash Flows

gnoring taxes, determine (i) Cash from Operations, (ii) Cash from Investing, and (ii) Cash

35,900

from Financing for the year. Be sure to show your work.

(17,250)

80,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College