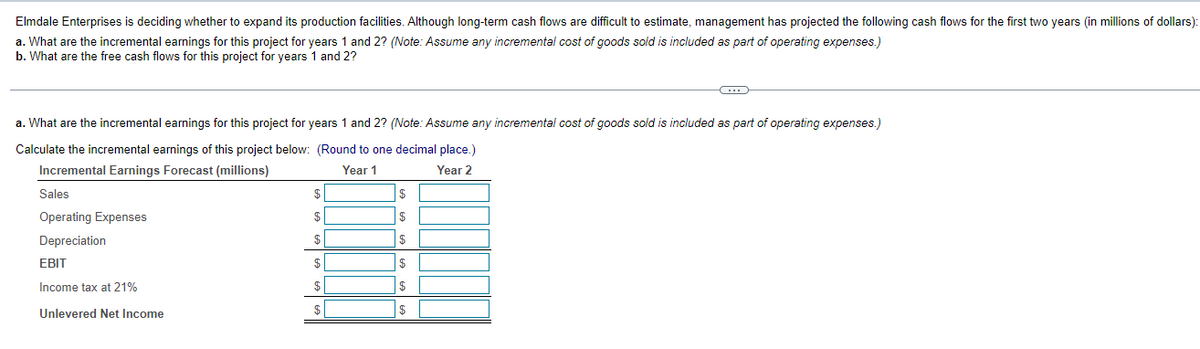

Elmdale Enterprises is deciding whether to expand its production facilities. Although long-term cash flows are difficult to estimate, management has projected the following cash flows for the first two years (in millions of dollars): a. What are the incremental earnings for this project for years 1 and 2? (Note: Assume any incremental cost of goods sold is included as part of operating expenses.) b. What are the free cash flows for this project for years 1 and 2? G a. What are the incremental earnings for this project for years 1 and 2? (Note: Assume any incremental cost of goods sold is included as part of operating expenses.)

Elmdale Enterprises is deciding whether to expand its production facilities. Although long-term cash flows are difficult to estimate, management has projected the following cash flows for the first two years (in millions of dollars): a. What are the incremental earnings for this project for years 1 and 2? (Note: Assume any incremental cost of goods sold is included as part of operating expenses.) b. What are the free cash flows for this project for years 1 and 2? G a. What are the incremental earnings for this project for years 1 and 2? (Note: Assume any incremental cost of goods sold is included as part of operating expenses.)

Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Eugene F. Brigham, Phillip R. Daves

Chapter12: Capital Budgeting: Decision Criteria

Section: Chapter Questions

Problem 21P: Your division is considering two investment projects, each of which requires an up-front expenditure...

Related questions

Question

|

|

Year 1

|

Year 2

|

||

|

Revenues

|

123.3

|

|

166.9

|

|

|

Operating Expenses (other than

|

44.6

|

|

67.2

|

|

|

Depreciation

|

28.9

|

|

43.4

|

|

|

Increase in Net Working Capital

|

2.9

|

|

8.8

|

|

|

Capital Expenditures

|

26.4

|

|

43.4

|

|

|

Marginal Corporate Tax Rate

|

21

|

%

|

21

|

%

|

Transcribed Image Text:Elmdale Enterprises is deciding whether to expand its production facilities. Although long-term cash flows are difficult to estimate, management has projected the following cash flows for the first two years (in millions of dollars):

a. What are the incremental earnings for this project for years 1 and 2? (Note: Assume any incremental cost of goods sold is included as part of operating expenses.)

b. What are the free cash flows for this project for years 1 and 2?

a. What are the incremental earnings for this project for years 1 and 2? (Note: Assume any incremental cost of goods sold

Calculate the incremental earnings of this project below:

Incremental Earnings Forecast (millions)

Sales

Operating Expenses

Depreciation

EBIT

Income tax at 21%

Unlevered Net Income

(Round to one decimal place.)

Year 1

Year 2

$

$

$

$

$

$

$

$

$

$

$

$

-C

included as part of operating expenses.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub