Elton Weiss and Reyna Herrera-Weiss are married and report the following income items: Elton's salary Reyna's Schedule C net profit The income tax deduction for Reyna's SE tax was $3,532. Elton contributed the maximum to a Section 401(k) plan, and Reyna contributed the maximum to a SEP plan. Both spouses contributed $2,750 to their IRAS. $ 254,000 50,000 Required: Compute their AGI. Note: Round your intermediate calculations to the nearest whole dollar amount. AGI Answer is complete but not entirely correct. $ 304,000

Elton Weiss and Reyna Herrera-Weiss are married and report the following income items: Elton's salary Reyna's Schedule C net profit The income tax deduction for Reyna's SE tax was $3,532. Elton contributed the maximum to a Section 401(k) plan, and Reyna contributed the maximum to a SEP plan. Both spouses contributed $2,750 to their IRAS. $ 254,000 50,000 Required: Compute their AGI. Note: Round your intermediate calculations to the nearest whole dollar amount. AGI Answer is complete but not entirely correct. $ 304,000

Chapter1: Federal Income Taxation—an Overview

Section: Chapter Questions

Problem 64P: Leroy and Amanda are married and have three dependent children. During the current year, they have...

Related questions

Question

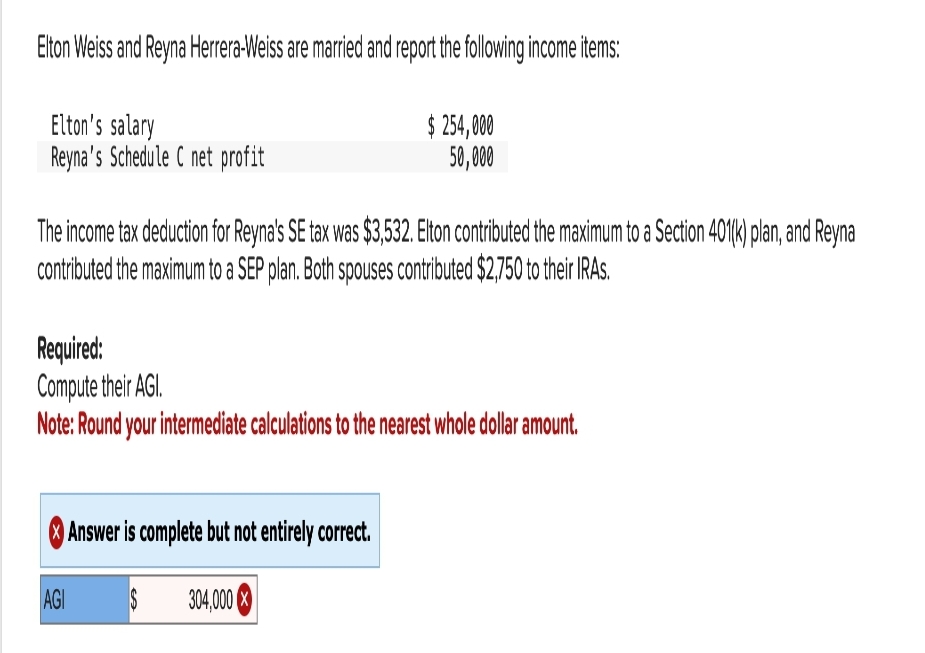

Transcribed Image Text:Elton Weiss and Reyna Herrera-Weiss are married and report the following income items:

Elton's salary

Reyna's Schedule C net profit

The income tax deduction for Reyna's SE tax was $3,532. Elton contributed the maximum to a Section 401(k) plan, and Reyna

contributed the maximum to a SEP plan. Both spouses contributed $2,750 to their IRAS.

$ 254,000

50,000

Required:

Compute their AGI.

Note: Round your intermediate calculations to the nearest whole dollar amount.

AGI

Answer is complete but not entirely correct.

$ 304,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you