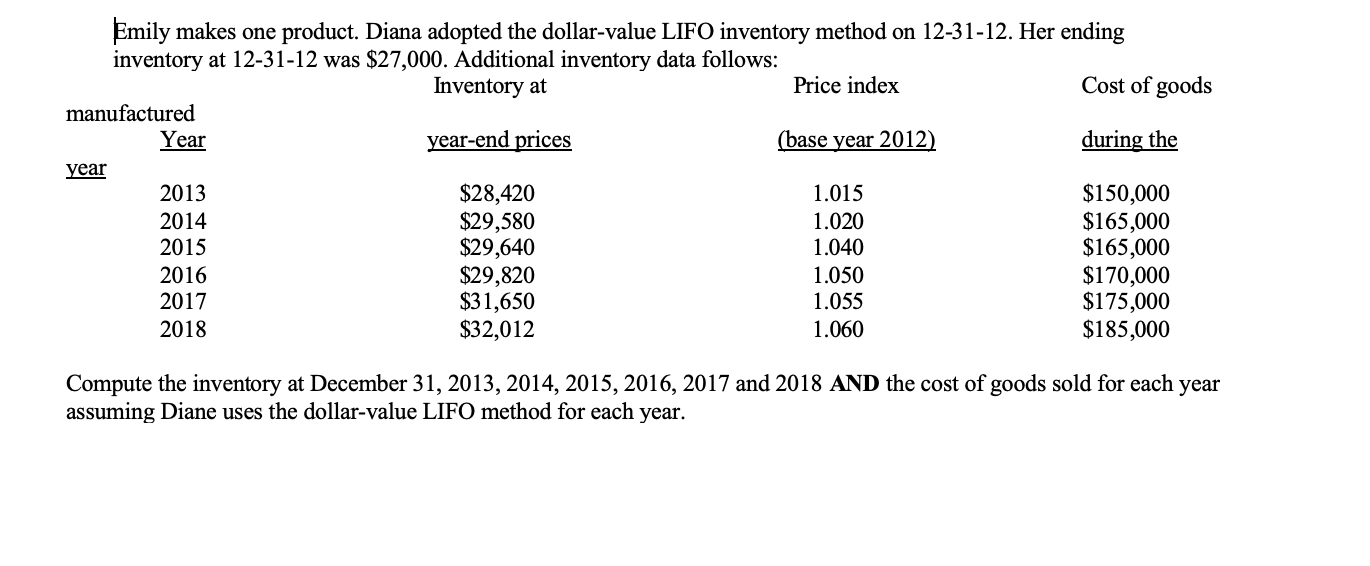

Emily makes one product. Diana adopted the dollar-value LIFO inventory method on 12-31-12. Her ending inventory at 12-31-12 was $27,000. Additional inventory data follows: Cost of goods Price index Inventory at manufactured year-end prices during the (base year 2012) Year year $150,000 $165,000 $165,000 $170,000 $175,000 $185,000 2013 $28,420 $29,580 $29,640 $29,820 $31,650 $32,012 1.015 1.020 1.040 2014 2015 2016 1.050 1.055 2017 2018 1.060 Compute the inventory at December 31, 2013, 2014, 2015, 2016, 2017 and 2018 AND the cost of goods sold for each year assuming Diane uses the dollar-value LIFO method for each year.

Emily makes one product. Diana adopted the dollar-value LIFO inventory method on 12-31-12. Her ending inventory at 12-31-12 was $27,000. Additional inventory data follows: Cost of goods Price index Inventory at manufactured year-end prices during the (base year 2012) Year year $150,000 $165,000 $165,000 $170,000 $175,000 $185,000 2013 $28,420 $29,580 $29,640 $29,820 $31,650 $32,012 1.015 1.020 1.040 2014 2015 2016 1.050 1.055 2017 2018 1.060 Compute the inventory at December 31, 2013, 2014, 2015, 2016, 2017 and 2018 AND the cost of goods sold for each year assuming Diane uses the dollar-value LIFO method for each year.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter7: Inventories: Cost Measurement And Flow Assumptions

Section: Chapter Questions

Problem 12P: Dollar-Value LIFO Kwestel Company adopted the dollar-value LIFO method for inventory valuation at...

Related questions

Question

Transcribed Image Text:Emily makes one product. Diana adopted the dollar-value LIFO inventory method on 12-31-12. Her ending

inventory at 12-31-12 was $27,000. Additional inventory data follows:

Cost of goods

Price index

Inventory at

manufactured

year-end prices

during the

(base year 2012)

Year

year

$150,000

$165,000

$165,000

$170,000

$175,000

$185,000

2013

$28,420

$29,580

$29,640

$29,820

$31,650

$32,012

1.015

1.020

1.040

2014

2015

2016

1.050

1.055

2017

2018

1.060

Compute the inventory at December 31, 2013, 2014, 2015, 2016, 2017 and 2018 AND the cost of goods sold for each year

assuming Diane uses the dollar-value LIFO method for each year.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 5 steps with 4 images

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning