Employee Details Employee Name: Miguel Cabrera Employee ID: 12345 Hire Date: 11 0ctober 2021 Bank Account number 12345678 Department: Sales Llob Title: Sales Manager Payments Taxable Income Basic Salary Commission Over time pay Gross Taxable Income Deductions SSS Contribution Pag-ibig Contribution PhảlHealth Contribution P1125 PhilHealth deduction SSS Deduction P44,000 37,500 10,000 P91,500 100 770 Total P1,995 Pag-ibig deduction Non-Taxable Income BIR Withholding Tax Computation Gross Taxable Income P91,500 1.995 P89,505 17,684.73 Rice Allowance Laundry Allowance Clothing Allowance Transportation Allowance 2,000 250 50 Less: Total Deductions Taxable Income Tax Due Net pay Tax due 2.000 P4,750 Total Non-Taxable Income Miguel Cabrera's Particulars of Salary NET PAY Taxable Income P09,50S Non-Taxable Income Less: Tax Due 4,750 17,684.73 sSS Deduction Pag-ibig deduction PhIHealth deduction Tax due Net pay Net pay P76,570.27

Employee Details Employee Name: Miguel Cabrera Employee ID: 12345 Hire Date: 11 0ctober 2021 Bank Account number 12345678 Department: Sales Llob Title: Sales Manager Payments Taxable Income Basic Salary Commission Over time pay Gross Taxable Income Deductions SSS Contribution Pag-ibig Contribution PhảlHealth Contribution P1125 PhilHealth deduction SSS Deduction P44,000 37,500 10,000 P91,500 100 770 Total P1,995 Pag-ibig deduction Non-Taxable Income BIR Withholding Tax Computation Gross Taxable Income P91,500 1.995 P89,505 17,684.73 Rice Allowance Laundry Allowance Clothing Allowance Transportation Allowance 2,000 250 50 Less: Total Deductions Taxable Income Tax Due Net pay Tax due 2.000 P4,750 Total Non-Taxable Income Miguel Cabrera's Particulars of Salary NET PAY Taxable Income P09,50S Non-Taxable Income Less: Tax Due 4,750 17,684.73 sSS Deduction Pag-ibig deduction PhIHealth deduction Tax due Net pay Net pay P76,570.27

SWFT Essntl Tax Individ/Bus Entities 2020

23rd Edition

ISBN:9780357391266

Author:Nellen

Publisher:Nellen

Chapter3: Taxes On The Financial Statements

Section: Chapter Questions

Problem 3BD

Related questions

Question

Transcribed Image Text:How much is his total deductions? *

How much is his gross pay? *

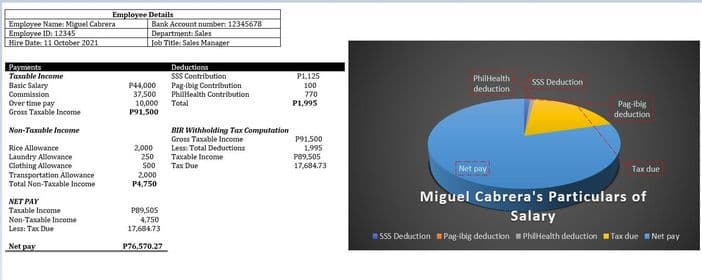

Transcribed Image Text:Employee Details

Employee Name: Miguel Cabrera

Employee ID: 12345

Hire Date: 11 October 2021

Bank Account numben 12345678

Department Sales

Tob Title: Sales Manager

Payments

Taxable Income

Basic Salary

Commission

Over time pay

Gross Taxable Income

Deductions

SSS Contribution

Pag-ibig Contribution

PL125

100

770

P1,995

PhilHealth

deduction

SSS Deduction

P44,000

37,500

10,000

P91,500

PhalHealth Contribution

Total

Pag-ibig

deduction

Non-Taxable Income

BIR Withholding Tax Computation

Gross Taxable Income

Less: Total Deductions

Taxable Income

Tax Due

P91,500

1,995

P89,505

17,684.73

Rice Allowance

Laundry Allowance

Clothing Allowance

Transportation Allowance

Total Non-Taxable Income

2,000

250

50

2.000

P4,750

Net pay

Tаx due

NET PAY

Taxable Income

Miguel Cabrera's Particulars of

Salary

Non-Taxable Income

Less: Tax Due

P09,50S

4,750

17,684.73

SSS Deduction Pag-ibig deduction PhiHealth deduction Tax due Net pay

Net pay

P76,570.27

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage