Additional Information: 1. Income tax at the rate of 20% is applicable to those employees whose income is over $30,000. 2. Superannuation Deduction is 6% per annum for each employee and 6% contributed by the employer. 3. Medical insurance Deduction of $20 per month is applicable to all staff. 4. Union Fees of $100 per year for all employees. 5. Assume that the employer liabilities for each month are paid in same month. REQUIRED: 1. Prepare the payroll register. 2. Prepare the general journal entries to record the payroll for the month of May the

Additional Information: 1. Income tax at the rate of 20% is applicable to those employees whose income is over $30,000. 2. Superannuation Deduction is 6% per annum for each employee and 6% contributed by the employer. 3. Medical insurance Deduction of $20 per month is applicable to all staff. 4. Union Fees of $100 per year for all employees. 5. Assume that the employer liabilities for each month are paid in same month. REQUIRED: 1. Prepare the payroll register. 2. Prepare the general journal entries to record the payroll for the month of May the

Chapter12: Current Liabilities

Section: Chapter Questions

Problem 14EA: Toren Inc. employs one person to run its solar management company. The employees gross income for...

Related questions

Question

please help me to solve this problem

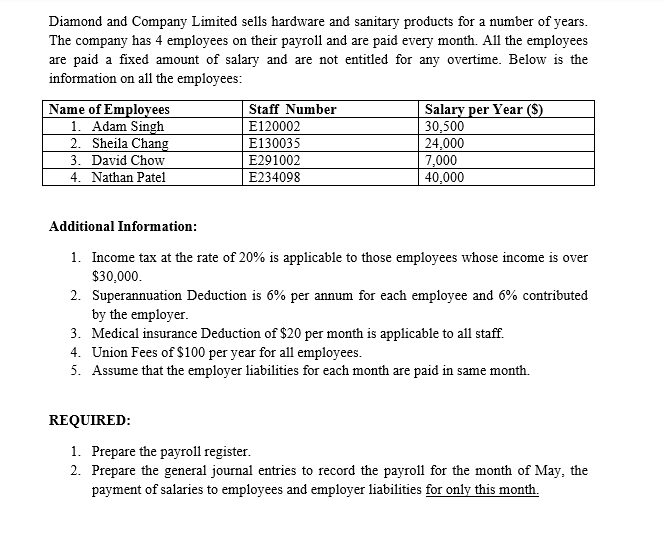

Transcribed Image Text:Diamond and Company Limited sells hardware and sanitary products for a number of years.

The company has 4 employees on their payroll and are paid every month. All the employees

are paid a fixed amount of salary and are not entitled for any overtime. Below is the

information on all the employees:

Name of Employees

1. Adam Singh

2. Sheila Chang

3. David Chow

4. Nathan Patel

Staff Number

E120002

E130035

E291002

E234098

Salary per Year ($)

30,500

REQUIRED:

24,000

7,000

40,000

Additional Information:

1. Income tax at the rate of 20% is applicable to those employees whose income is over

$30,000.

2. Superannuation Deduction is 6% per annum for each employee and 6% contributed

by the employer.

3. Medical insurance Deduction of $20 per month is applicable to all staff.

4. Union Fees of $100 per year for all employees.

5. Assume that the employer liabilities for each month are paid in same month.

1. Prepare the payroll register.

2. Prepare the general journal entries to record the payroll for the month of May, the

payment of salaries to employees and employer liabilities for only this month.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning