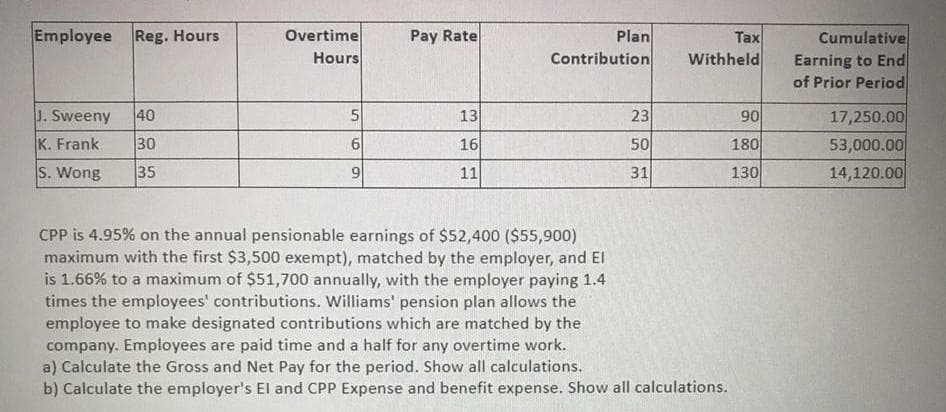

Employee Reg. Hours Overtime Hours Pay Rate Plan Contribution Таx Withheld Cumulative Earning to End of Prior Period J. Sweeny 40 13 23 90 17,250.00 53,000.00 14,120.00 K. Frank 30 16 50 180 S. Wong 35 11 31 130 CPP is 4.95% on the annual pensionable earnings of $52,400 ($55,900) maximum with the first $3,500 exempt), matched by the employer, and El is 1.66% to a maximum of $51,700 annually, with the employer paying 1.4 times the employees' contributions. Williams' pension plan allows the employee to make designated contributions which are matched by the company. Employees are paid time and a half for any overtime work. a) Calculate the Gross and Net Pay for the period. Show all calculations.

Employee Reg. Hours Overtime Hours Pay Rate Plan Contribution Таx Withheld Cumulative Earning to End of Prior Period J. Sweeny 40 13 23 90 17,250.00 53,000.00 14,120.00 K. Frank 30 16 50 180 S. Wong 35 11 31 130 CPP is 4.95% on the annual pensionable earnings of $52,400 ($55,900) maximum with the first $3,500 exempt), matched by the employer, and El is 1.66% to a maximum of $51,700 annually, with the employer paying 1.4 times the employees' contributions. Williams' pension plan allows the employee to make designated contributions which are matched by the company. Employees are paid time and a half for any overtime work. a) Calculate the Gross and Net Pay for the period. Show all calculations.

Chapter12: Current Liabilities

Section: Chapter Questions

Problem 16EA: An employee and employer cost-share pension plan contributions and health insurance premium...

Related questions

Question

Transcribed Image Text:Employee Reg. Hours

Overtime

Hours

Pay Rate

Plan

Contribution

Tax

Withheld

Cumulative

Earning to End

of Prior Period

J. Sweeny

40

90

17,250.00

53,000.00

13

23

K. Frank

30

16

50

180

S. Wong

35

9.

11

31

130

14,120.00

CPP is 4.95% on the annual pensionable earnings of $52,400 ($55,900)

maximum with the first $3,500 exempt), matched by the employer, and El

is 1.66% to a maximum of $51,700 annually, with the employer paying 1.4

times the employees' contributions. Williams' pension plan allows the

employee to make designated contributions which are matched by the

company. Employees are paid time and a half for any overtime work.

a) Calculate the Gross and Net Pay for the period. Show all calculations.

b) Calculate the employer's El and CPP Expense and benefit expense. Show all calculations.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning