ENcel ter ons P9-18. As the bookkeeper of Rose Company of Drumheller, you received the bank state- ment from TD Canada Trust indicating a balance of $5,820. The ending cheque- book balance was $6,321. Prepare the bank reconciliation for Rose Company as of July 31, 2023, and prepare journal entries as needed based on the following a. Deposits in transit, $2,875. b. Bank service charges, $24. c. Cheques outstanding No. 111, $478; No. 115, $1,147. d. TD Canada Trust collected a note for Rose, $1,770, less a $12 collection fee. e. NSF cheque, $525. f. Rose Company records cheque No. 107 as $900 to pay the month's rent. The cancelled cheque and bank statement show the actual cheque was $800. g The bank made an error by deducting a cheque for $560 issued by another business.

ENcel ter ons P9-18. As the bookkeeper of Rose Company of Drumheller, you received the bank state- ment from TD Canada Trust indicating a balance of $5,820. The ending cheque- book balance was $6,321. Prepare the bank reconciliation for Rose Company as of July 31, 2023, and prepare journal entries as needed based on the following a. Deposits in transit, $2,875. b. Bank service charges, $24. c. Cheques outstanding No. 111, $478; No. 115, $1,147. d. TD Canada Trust collected a note for Rose, $1,770, less a $12 collection fee. e. NSF cheque, $525. f. Rose Company records cheque No. 107 as $900 to pay the month's rent. The cancelled cheque and bank statement show the actual cheque was $800. g The bank made an error by deducting a cheque for $560 issued by another business.

Corporate Financial Accounting

14th Edition

ISBN:9781305653535

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter1: Introduction To Accounting And Business

Section: Chapter Questions

Problem 1.5EX: Accounting equation The total assets and total liabilities (in millions) of Dollar Tree Inc. and...

Related questions

Question

100%

Transcribed Image Text:1:59

College Accounting..

...

Jun 1

Jun 2

# 580

$2,275.00

$12,115.00

# 581

$135.00

$11,980.00

# 577

Jun 3

$1,500,00

$10,480.00

$1,137.45

$75.00

# 582

Jun 4

Jun 4

$2,456.00 $11,798.55

# 586

Jun 17

Jun 17 $2,345.25 $14,068.80

$13,944.05

#587

Jun 20

$124.75

#585

Jun 28

$745.65

$13,198.40

NSF

Jun 28

$255,45

$12,942.95

NSF charge

Service Charge Jun 30

Jun 28

$15.00

$12,927.95

$45.50

$12,882.45

Required

Prepare a bank reconciliation at June 30, 2023. Assume that any errors were

made by the bookkeeper and Cheque #585 was for office supplies.

GROUP B PROBLEMS

(Excel templates for all questions are available in Mylab Accounting)

Preparing a bank reconciliation,

including collection of a note

O (20 min)

P9-18. As the bookkeeper of Rose Company of Drumheller, you received the bank state-

ment from TD Canada Trust indicating a balance of $5,820. The ending cheque-

book balance was $6,321. Prepare the bank reconciliation for Rose Company as of

July 31, 2023, and prepare journal entries as needed based on the following:

Chok Fige

a. Deposits in transit, $2,875.

b. Bank service charges, $24.

c. Cheques outstanding: No. 111, $478; No. 115, $1,147.

Reconciled balance $7,630

d. TD Canada Trust collected a note for Rose, $1,770, less a $12 collection fee.

e. NSF cheque, $525.

f. Rose Company records cheque No. 107 as $900 to pay the month's rent. The

cancelled cheque and bank statement show the actual cheque was $800.

g The bank made an error by deducting a cheque for $560 issued by another

business.

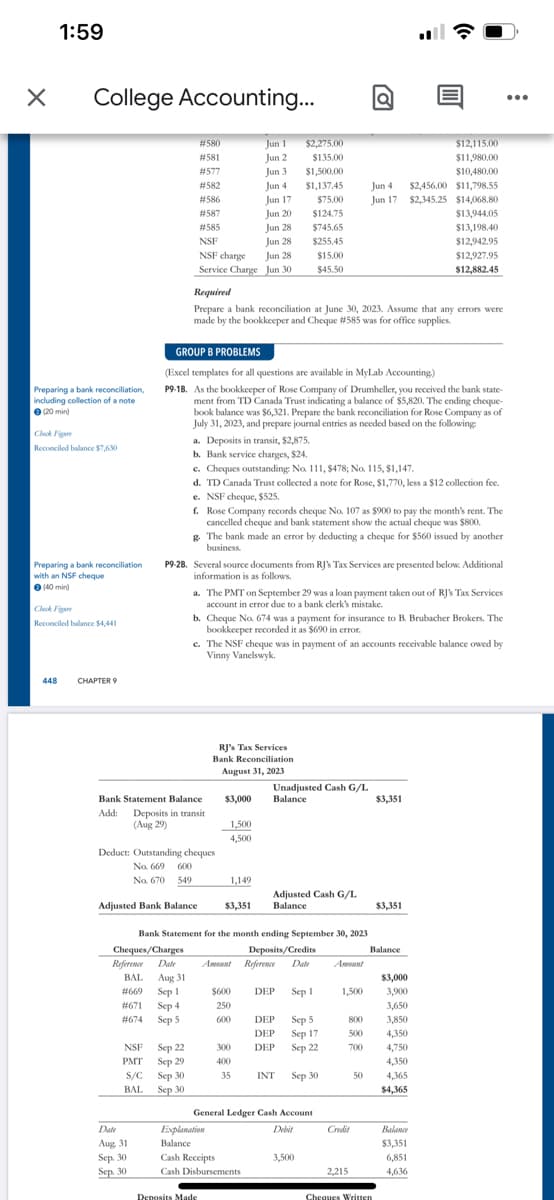

P9-28. Several source documents from RJ's Tax Services are presented belo. Additional

Preparing a bank reconciliation

with an NSF cheque

information is as follows.

O 40 min)

a. The PMT on September 29 was a loan payment taken out of RJ's Tax Services

account in error due to a bank clerk's mistake.

Chk Fige

b. Cheque No. 674 was a payment for insurance to B. Brubacher Brokers. The

bookkeeper recorded it as $690 in error.

c. The NSF cheque was in payment of an accounts receivable balance owed by

Vinny Vanelswyk.

Reconciled balance $4,441

448

CHAPTER 9

RJ's Tax Services

Bank Reconciliation

August 31, 2023

Unadjusted Cash G/L

Bank Statement Balance

$3,000

Balance

$3,351

Add:

Deposits in transit

(Aug 29)

1,500

4.500

Deduct: Outstanding cheques

No. 669 600

No. 670 549

1,149

Adjusted Cash G/L

Balance

Adjusted Bank Balance

$3,351

$3,351

Bank Statement for the month ending September 30, 2023

Cheques/Charges

Reference

Deposits/Credits

Balance

Date

Awonnt Reference

Date

Awonnt

Aug 31

Sep 1

BAL

$3,000

#669

S600

DEP

Sep 1

1,500

3,900

#671

3,650

Sep 4

Sep 5

250

#674

600

DEP

Sep 5

Sep 17

Sep 22

800

3,850

DEP

500

4,350

NSF

Sep 22

300

DEP

700

4,750

PMT

Sep 29

400

4,350

S/C

4,365

Sep 30

Sep 30

35

INT

Sep 30

50

BAL

$4,365

General Ledger Cash Account

Date

Explanation

Debit

Credit

Balance

Aug 31

Balance

$3,351

Sep. 30

Cash Receipts

3,500

6,851

Sep. 30

Cash Disbursements

2,215

4,636

Deposits Made

Cheques Written

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning