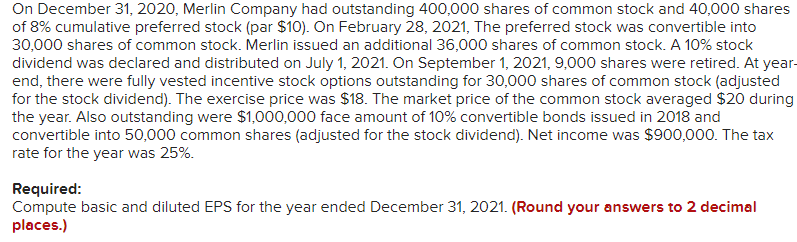

On December 31, 2020, Merlin Company had outstanding 400,000 shares of common stock and 40,000 shares of 8% cumulative preferred stock (par $10). On February 28, 2021, The preferred stock was convertible into 30,000 shares of common stock. Merlin issued an additional 36,000 shares of common stock. A 10% stock dividend was declared and distributed on July 1, 2021. On September 1, 2021, 9,000 shares were retired. At yea end, there were fully vested incentive stock options outstanding for 30,000 shares of common stock (adjusted for the stock dividend). The exercise price was $18. The market price of the common stock averaged $20 durin the year. Also outstanding were $1,000,000 face amount of 10% convertible bonds issued in 2018 and convertible into 50,000 common shares (adjusted for the stock dividend). Net income was $900,000. The tax rate for the year was 25%. Required: Compute basic and diluted EPS for the year ended December 31, 2021. (Round your answers to 2 decimal places.)

On December 31, 2020, Merlin Company had outstanding 400,000 shares of common stock and 40,000 shares of 8% cumulative preferred stock (par $10). On February 28, 2021, The preferred stock was convertible into 30,000 shares of common stock. Merlin issued an additional 36,000 shares of common stock. A 10% stock dividend was declared and distributed on July 1, 2021. On September 1, 2021, 9,000 shares were retired. At yea end, there were fully vested incentive stock options outstanding for 30,000 shares of common stock (adjusted for the stock dividend). The exercise price was $18. The market price of the common stock averaged $20 durin the year. Also outstanding were $1,000,000 face amount of 10% convertible bonds issued in 2018 and convertible into 50,000 common shares (adjusted for the stock dividend). Net income was $900,000. The tax rate for the year was 25%. Required: Compute basic and diluted EPS for the year ended December 31, 2021. (Round your answers to 2 decimal places.)

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter16: Retained Earnings And Earnings Per Share

Section: Chapter Questions

Problem 10MC

Related questions

Question

Transcribed Image Text:On December 31, 2020, Merlin Company had outstanding 400,000 shares of common stock and 40,000 shares

of 8% cumulative preferred stock (par $10). On February 28, 2021, The preferred stock was convertible into

30,000 shares of common stock. Merlin issued an additional 36,000 shares of common stock. A 10% stock

dividend was declared and distributed on July 1, 2021. On September 1, 2021, 9,000 shares were retired. At year-

end, there were fully vested incentive stock options outstanding for 30,000 shares of common stock (adjusted

for the stock dividend). The exercise price was $18. The market price of the common stock averaged $20 during

the year. Also outstanding were $1,000,000 face amount of 10% convertible bonds issued in 2018 and

convertible into 50,000 common shares (adjusted for the stock dividend). Net income was $900,000. The tax

rate for the year was 25%.

Required:

Compute basic and diluted EPS for the year ended December 31, 2021. (Round your answers to 2 decimal

places.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College