ench) exclusively through television advertising. The comparative income statements and balance sheets are for the past two years.Additional InformationThe following information regarding the company’s operations in 2011 is available from the company’s accounting records:1. Early in the year the company declared and paid a $4,000 cash dividend.2. During the year marketable securities costing $15,000 were sold for $14,000 cash, resulting in a $1,000 nonoperating loss.3. The company purchased plant assets for $20,000, paying $2,000 in cash and issuing a note payable for the $18,000 balance.4. During the year the company repaid a $10,000 note payable, but incurred an additional $18,000 in long-term debt as described in 3.5. The owners invested $15,000 cash in the business as a condition of the new loans described in paragraph 4. requried: Prepare and Analyze a Statement of

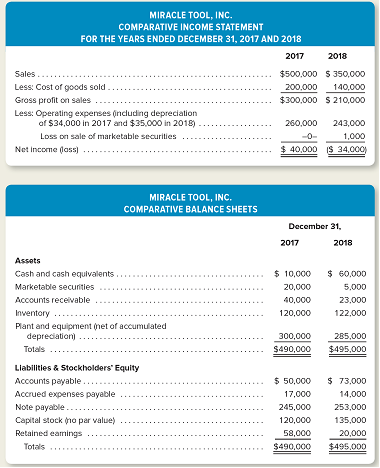

Miracle Tool, Inc., sells a single product (a combination screwdriver, pliers, hammer, and crescent

wrench) exclusively through television advertising. The comparative income statements and balance sheets are for the past two years.

Additional Information

The following information regarding the company’s operations in 2011 is available from the company’s accounting records:

1. Early in the year the company declared and paid a $4,000 cash dividend.

2. During the year marketable securities costing $15,000 were sold for $14,000 cash, resulting in a $1,000 nonoperating loss.

3. The company purchased plant assets for $20,000, paying $2,000 in cash and issuing a note payable for the $18,000 balance.

4. During the year the company repaid a $10,000 note payable, but incurred an additional $18,000 in long-term debt as described in 3.

5. The owners invested $15,000 cash in the business as a condition of the new loans described in paragraph 4.

requried: Prepare and Analyze a Statement of Cash Flows; Involves Preparation of a Worksheet. Use information provided in problem prepare Cash flow statement using indirect method.

I have attached separately income statement and balance sheet for your help!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 4 images