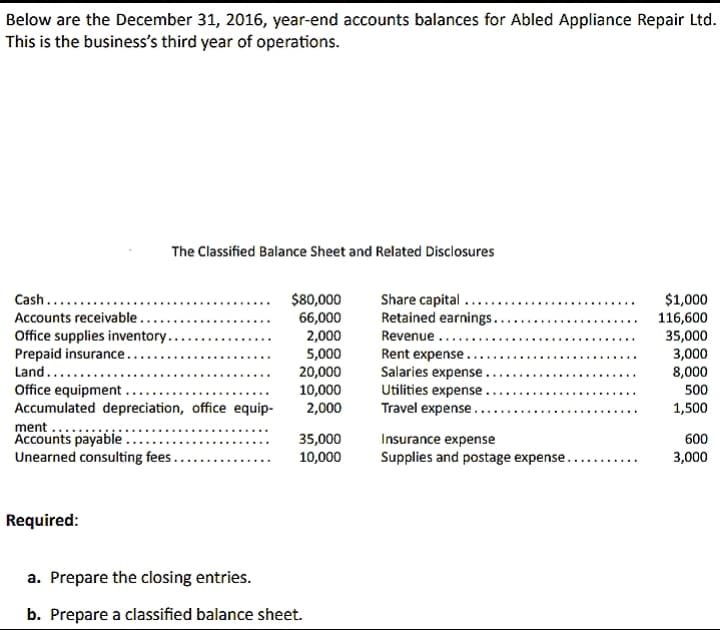

Below are the December 31, 2016, year-end accounts balances for Abled Appliance Repair Ltd This is the business's third year of operations. The Classified Balance Sheet and Related Disclosures Cash.... Accounts receivable... Share capital .... Retained earnings.. $80,000 66,000 2,000 5,000 20,000 10,000 2,000 $1,000 Office supplies inventory. Prepaid insurance.... Land..... 116,600 35,000 3,000 8,000 Revenue... Rent expense.. Salaries expense . Utilities expense Travel expense.. Office equipment . Accumulated depreciation, office equip- 500 1,500 ment ..... Accounts payable Unearned consulting fees. 35,000 10,000 Insurance expense 600 Supplies and postage expense... 3,000 ...... Required: a. Prepare the closing entries. b. Prepare a classified balance sheet.

Below are the December 31, 2016, year-end accounts balances for Abled Appliance Repair Ltd This is the business's third year of operations. The Classified Balance Sheet and Related Disclosures Cash.... Accounts receivable... Share capital .... Retained earnings.. $80,000 66,000 2,000 5,000 20,000 10,000 2,000 $1,000 Office supplies inventory. Prepaid insurance.... Land..... 116,600 35,000 3,000 8,000 Revenue... Rent expense.. Salaries expense . Utilities expense Travel expense.. Office equipment . Accumulated depreciation, office equip- 500 1,500 ment ..... Accounts payable Unearned consulting fees. 35,000 10,000 Insurance expense 600 Supplies and postage expense... 3,000 ...... Required: a. Prepare the closing entries. b. Prepare a classified balance sheet.

Financial Accounting

14th Edition

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Carl Warren, Jim Reeve, Jonathan Duchac

Chapter6: Accounting For Merchandising Businesses

Section: Chapter Questions

Problem 6PB: Selected accounts and related amounts for Kanpur Co. for the fiscal year ended June 30, 2016, are...

Related questions

Question

Transcribed Image Text:Below are the December 31, 2016, year-end accounts balances for Abled Appliance Repair Ltd.

This is the business's third year of operations.

The Classified Balance Sheet and Related Disclosures

Share capital .....

Retained earnings.

Revenue ...

$80,000

66,000

2,000

5,000

20,000

10,000

2,000

$1,000

116,600

35,000

3,000

8,000

Cash......

Accounts receivable..

Office supplies inventory..

Prepaid insurance...

Land......

Rent expense.

Salaries expense.

Utilities expense

Travel expense.

Office equipment.

Accumulated depreciation, office equip-

ment ...

Accounts payable

Unearned consulting fees.

500

1,500

35,000

10,000

Insurance expense

600

Supplies and postage expense..

3,000

Required:

a. Prepare the closing entries.

b. Prepare a classified balance sheet.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning