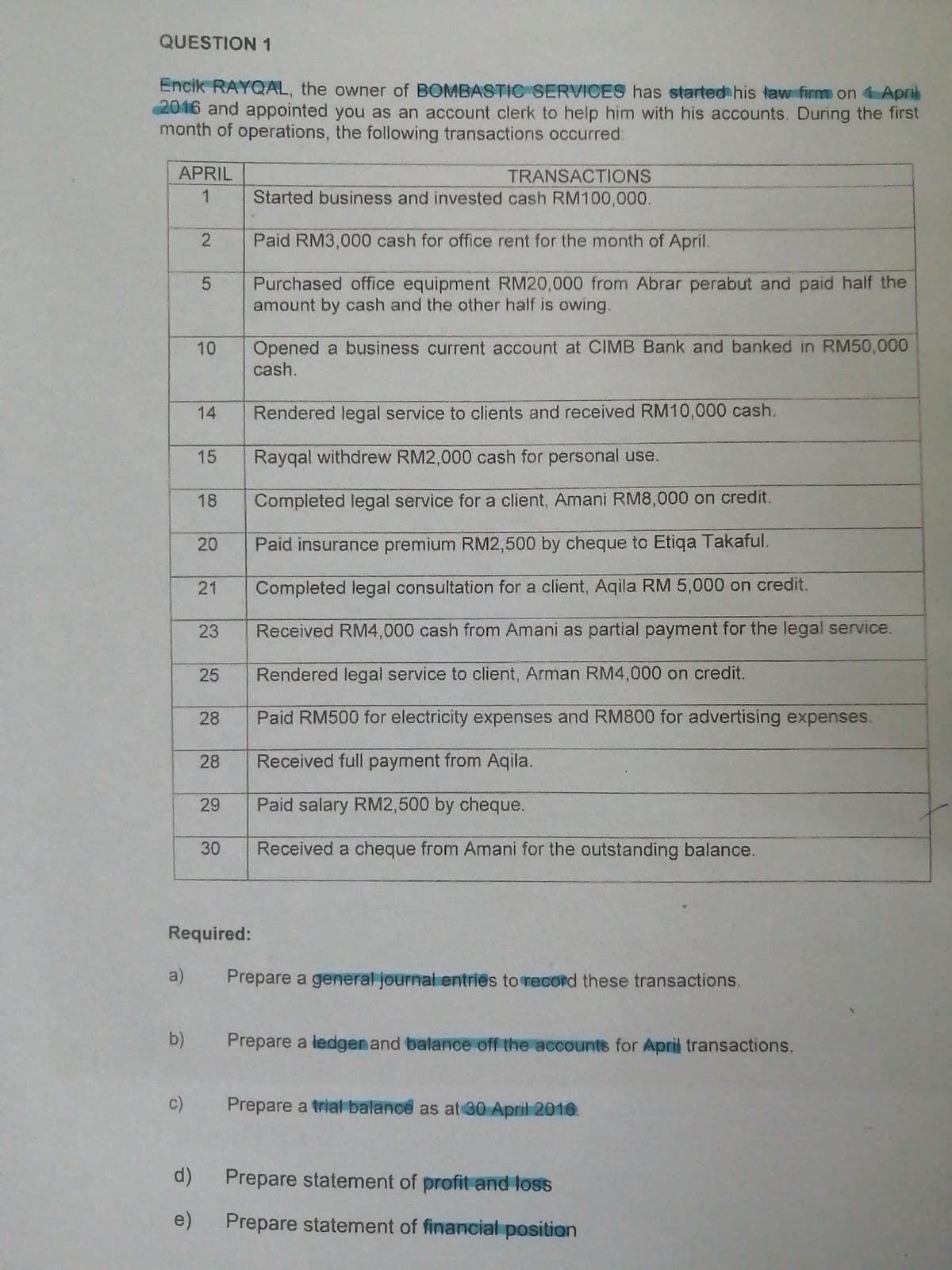

Encik RAYQAL, the owner of BOMBASTIC SERVICES has started his taw firm on April 2016 and appointed you as an account clerk to help him with his accounts. During the first month of operations, the following transactions occurred: APRIL TRANSACTIONS Started business and invested cash RM100,000. Paid RM3,000 cash for office rent for the month of April. Purchased office equipment RM20,000 from Abrar perabut and paid half the amount by cash and the other half is owing. Opened a business current account at CIMB Bank and banked in RM50,000 cash. 10 Rendered legal service to clients and received RM10,000 cash. Rayqal withdrew RM2,000 cash for personal use. 18 Completed legal service for a client, Amani RM8,000 on credit. 20 Paid insurance premium RM2,500 by cheque to Etiqa Takaful. 21 Completed legal consultation for a client, Aqila RM 5,000 on credit. 23 Received RM4,000 cash from Amani as partial payment for the legal service. 25 Rendered legal service to client, Arman RM4,000 on credit. 28 Paid RM500 for electricity expenses and RM800 for advertising expenses. 28 Received full payment from Aqila. 29 Paid salary RM2,500 by cheque. 30 Received a cheque from Amani for the outstanding balance. Required: a) Prepare a general journal entries to record these transactions. 15 14

Encik RAYQAL, the owner of BOMBASTIC SERVICES has started his taw firm on April 2016 and appointed you as an account clerk to help him with his accounts. During the first month of operations, the following transactions occurred: APRIL TRANSACTIONS Started business and invested cash RM100,000. Paid RM3,000 cash for office rent for the month of April. Purchased office equipment RM20,000 from Abrar perabut and paid half the amount by cash and the other half is owing. Opened a business current account at CIMB Bank and banked in RM50,000 cash. 10 Rendered legal service to clients and received RM10,000 cash. Rayqal withdrew RM2,000 cash for personal use. 18 Completed legal service for a client, Amani RM8,000 on credit. 20 Paid insurance premium RM2,500 by cheque to Etiqa Takaful. 21 Completed legal consultation for a client, Aqila RM 5,000 on credit. 23 Received RM4,000 cash from Amani as partial payment for the legal service. 25 Rendered legal service to client, Arman RM4,000 on credit. 28 Paid RM500 for electricity expenses and RM800 for advertising expenses. 28 Received full payment from Aqila. 29 Paid salary RM2,500 by cheque. 30 Received a cheque from Amani for the outstanding balance. Required: a) Prepare a general journal entries to record these transactions. 15 14

College Accounting (Book Only): A Career Approach

13th Edition

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:Scott, Cathy J.

Chapter1: Asset, Liability, Owner’s Equity, Revenue, And Expense Accounts

Section: Chapter Questions

Problem 3PB: P. Schwartz, Attorney at Law, opened his office on October 1. The account headings are presented...

Related questions

Topic Video

Question

100%

Transcribed Image Text:QUESTION1

Encik RAYQAL, the owner of BOMBASTIC SERVICES has started his taw firm on April

2016 and appointed you as an account clerk to help him with his accounts. During the first

month of operations, the following transactions occurred

APRIL

TRANSACTIONS

1

Started business and invested cash RM100,000

Paid RM3,000 cash for office rent for the month of April.

Purchased office equipment RM20,000 from Abrar perabut and paid half the

amount by cash and the other half is owing.

Opened a business current account at CIMB Bank and banked in RM50,000

cash.

10

14

Rendered legal service to clients and received RM10,000 cash.

15

Rayqal withdrew RM2,000 cash for personal use.

18

Completed legal service for a client, Amani RM8,000 on credit.

20

Paid insurance premium RM2,500 by cheque to Etiqa Takaful.

21

Completed legal consultation for a client, Aqila RM 5,000 on credit.

23

Received RM4,000 cash from Amani as partial payment for the legal service.

25

Rendered legal service to client, Arman RM4,000 on credit.

28

Paid RM500 for electricity expenses and RM800 for advertising expenses.

28

Received full payment from Aqila.

29

Paid salary RM2,500 by cheque.

30

Received a cheque from Amani for the outstanding balance.

Required:

a)

Prepare a general journal entries to record these transactions

b)

Prepare a ledgen and balance off the accounts for April transactions.

c)

Prepare a trial balance as at 30 April 2016.

d)

Prepare statement of profit and loss

e)

Prepare statement of financial position

2.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning