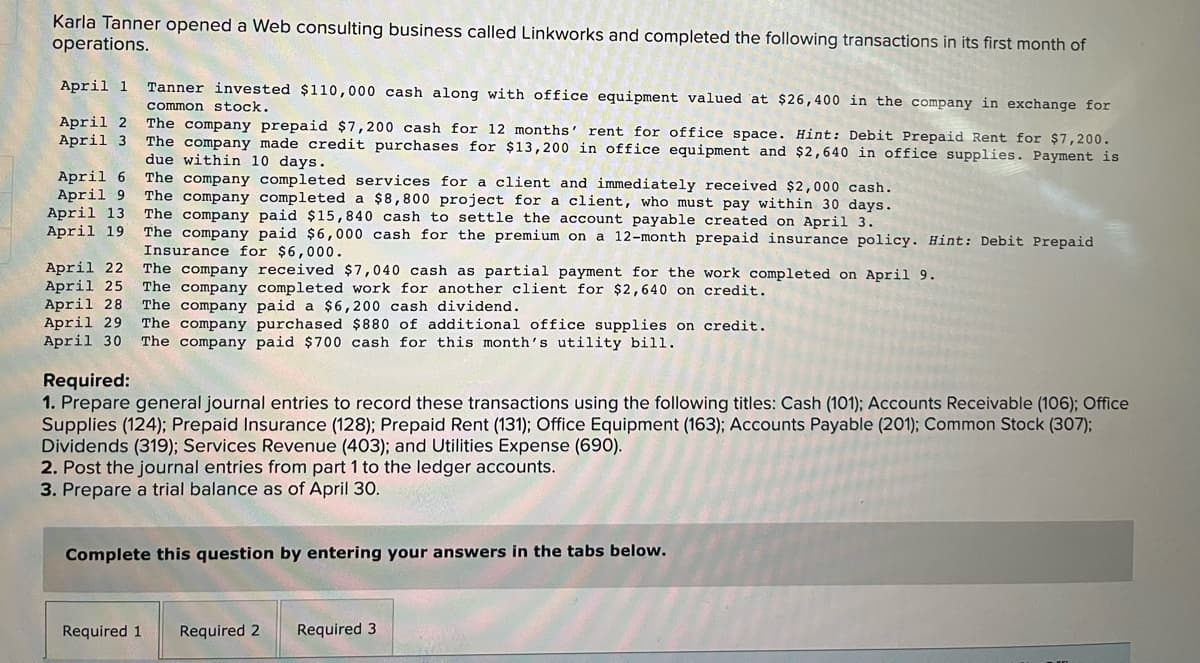

Karla Tanner opened a Web consulting business called Linkworks and completed the following transactions in its first month of operations. April 1 Tanner invested $110,000 cash along with office equipment valued at $26,400 in the company in exchange for common stock. April 2 April 3 The company prepaid $7,200 cash for 12 months' rent for office space. Hint: Debit Prepaid Rent for $7,200. The company made credit purchases for $13,200 in office equipment and $2,640 in office supplies. Payment is due within 10 days. The company completed services for a client and immediately received $2,000 cash. The company completed a $8,800 project for a client, who must pay within 30 days. The company paid $15,840 cash to settle the account payable created on April 3. The company paid $6,000 cash for the premium on a 12-month prepaid insurance policy. Hint: Debit Prepaid Insurance for $6,000. The company received $7,040 cash as partial payment for the work completed on April 9. The company completed work for another client for $2,640 on credit. The company paid a $6,200 cash dividend. The company purchased $880 of additional office supplies on credit. The company paid $700 cash for this month's utility bill. April 6 April 9 April 13 April 19 April 22 April 25 April 28 April 29 April 30 Required: 1. Prepare general journal entries to record these transactions using the following titles: Cash (101); Accounts Receivable (106); Office Supplies (124); Prepaid Insurance (128); Prepaid Rent (131); Office Equipment (163); Accounts Payable (201); Common Stock (307); Dividends (319): Services Revenue (403); and Utilities Expense (690).

Karla Tanner opened a Web consulting business called Linkworks and completed the following transactions in its first month of operations. April 1 Tanner invested $110,000 cash along with office equipment valued at $26,400 in the company in exchange for common stock. April 2 April 3 The company prepaid $7,200 cash for 12 months' rent for office space. Hint: Debit Prepaid Rent for $7,200. The company made credit purchases for $13,200 in office equipment and $2,640 in office supplies. Payment is due within 10 days. The company completed services for a client and immediately received $2,000 cash. The company completed a $8,800 project for a client, who must pay within 30 days. The company paid $15,840 cash to settle the account payable created on April 3. The company paid $6,000 cash for the premium on a 12-month prepaid insurance policy. Hint: Debit Prepaid Insurance for $6,000. The company received $7,040 cash as partial payment for the work completed on April 9. The company completed work for another client for $2,640 on credit. The company paid a $6,200 cash dividend. The company purchased $880 of additional office supplies on credit. The company paid $700 cash for this month's utility bill. April 6 April 9 April 13 April 19 April 22 April 25 April 28 April 29 April 30 Required: 1. Prepare general journal entries to record these transactions using the following titles: Cash (101); Accounts Receivable (106); Office Supplies (124); Prepaid Insurance (128); Prepaid Rent (131); Office Equipment (163); Accounts Payable (201); Common Stock (307); Dividends (319): Services Revenue (403); and Utilities Expense (690).

Chapter3: Analyzing And Recording Transactions

Section: Chapter Questions

Problem 19EB: A business has the following transactions: A. The business is started by receiving cash from an...

Related questions

Question

Question 5

Transcribed Image Text:Karla Tanner opened a Web consulting business called Linkworks and completed the following transactions in its first month of

operations.

April 1

Tanner invested $110,000 cash along with office equipment valued at $26,400 in the company in exchange for

common stock.

April 2

April 3

The company prepaid $7,200 cash for 12 months' rent for office space. Hint: Debit Prepaid Rent for $7,200.

The company made credit purchases for $13,200 in office equipment and $2,640 in office supplies. Payment is

due within 10 days.

The company completed services for a client and immediately received $2,000 cash.

The company completed a $8,800 project for a client, who must pay within 30 days.

The company paid $15,840 cash to settle the account payable created on April 3.

The company paid $6,000 cash for the premium on a 12-month prepaid insurance policy. Hint: Debit Prepaid

Insurance for $6,000.

The company received $7,040 cash as partial payment for the work completed on April 9.

The company completed work for another client for $2,640 on credit.

The company paid a $6,200 cash dividend.

The company purchased $880 of additional office supplies on credit.

The company paid $700 cash for this month's utility bill.

April 6

April 9

April 13

April 19

April 22

April 25

April 28

April 29

April 30

Required:

1. Prepare general journal entries to record these transactions using the following titles: Cash (101); Accounts Receivable (106); Office

Supplies (124); Prepaid Insurance (128); Prepaid Rent (131); Office Equipment (163); Accounts Payable (201); Common Stock (307);

Dividends (319); Services Revenue (403); and Utilities Expense (690).

2. Post the journal entries from part 1 to the ledger accounts.

3. Prepare a trial balance as of April 30.

Complete this question by entering your answers in the tabs below.

Required 1

Required 2

Required 3

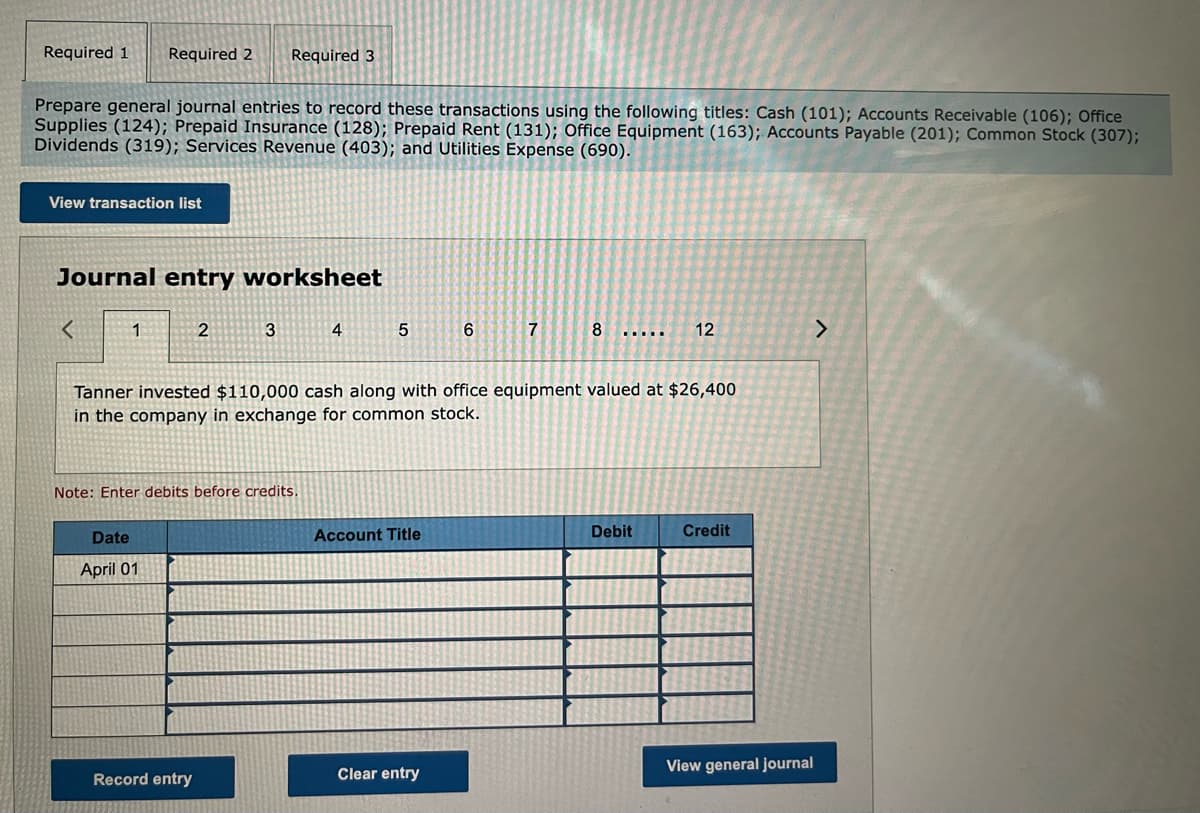

Transcribed Image Text:Required 1

Required 2

Required 3

Prepare general journal entries to record these transactions using the following titles: Cash (101); Accounts Receivable (106); Office

Supplies (124); Prepaid Insurance (128); Prepaid Rent (131); Office Equipment (163); Accounts Payable (201); Common Stock (307);

Dividends (319); Services Revenue (403); and Utilities Expense (690).

View transaction list

Journal entry worksheet

2

3

4

6

7

12

<>

Tanner invested $110,000 cash along with office equipment valued at $26,400

in the company in exchange for common stock.

Note: Enter debits before credits.

Date

Account Title

Debit

Credit

April 01

View general journal

Record entry

Clear entry

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,