End of Year 1 2 Investment 3 4 5 A B $ 1,000 $1,000 2,000 1,000 3,000 1,000 (4,000) 1,000 4,000 3,000 Click on the icon in order to copy its contents into a spreadsheet.) What is the present value of each of these three investments if the appropriate discount rate is 9 percent? C $ 5,000 5,000 (5,000) (5,000) 15,000 a. What is the present value of investment A at an annual discount rate of 9 percent? (Round to the nearest cent.) b. What is the present value of investment B at an annual discount rate of 9 percent?

End of Year 1 2 Investment 3 4 5 A B $ 1,000 $1,000 2,000 1,000 3,000 1,000 (4,000) 1,000 4,000 3,000 Click on the icon in order to copy its contents into a spreadsheet.) What is the present value of each of these three investments if the appropriate discount rate is 9 percent? C $ 5,000 5,000 (5,000) (5,000) 15,000 a. What is the present value of investment A at an annual discount rate of 9 percent? (Round to the nearest cent.) b. What is the present value of investment B at an annual discount rate of 9 percent?

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter19: Capital Investment

Section: Chapter Questions

Problem 13E: Buena Vision Clinic is considering an investment that requires an outlay of 600,000 and promises a...

Related questions

Question

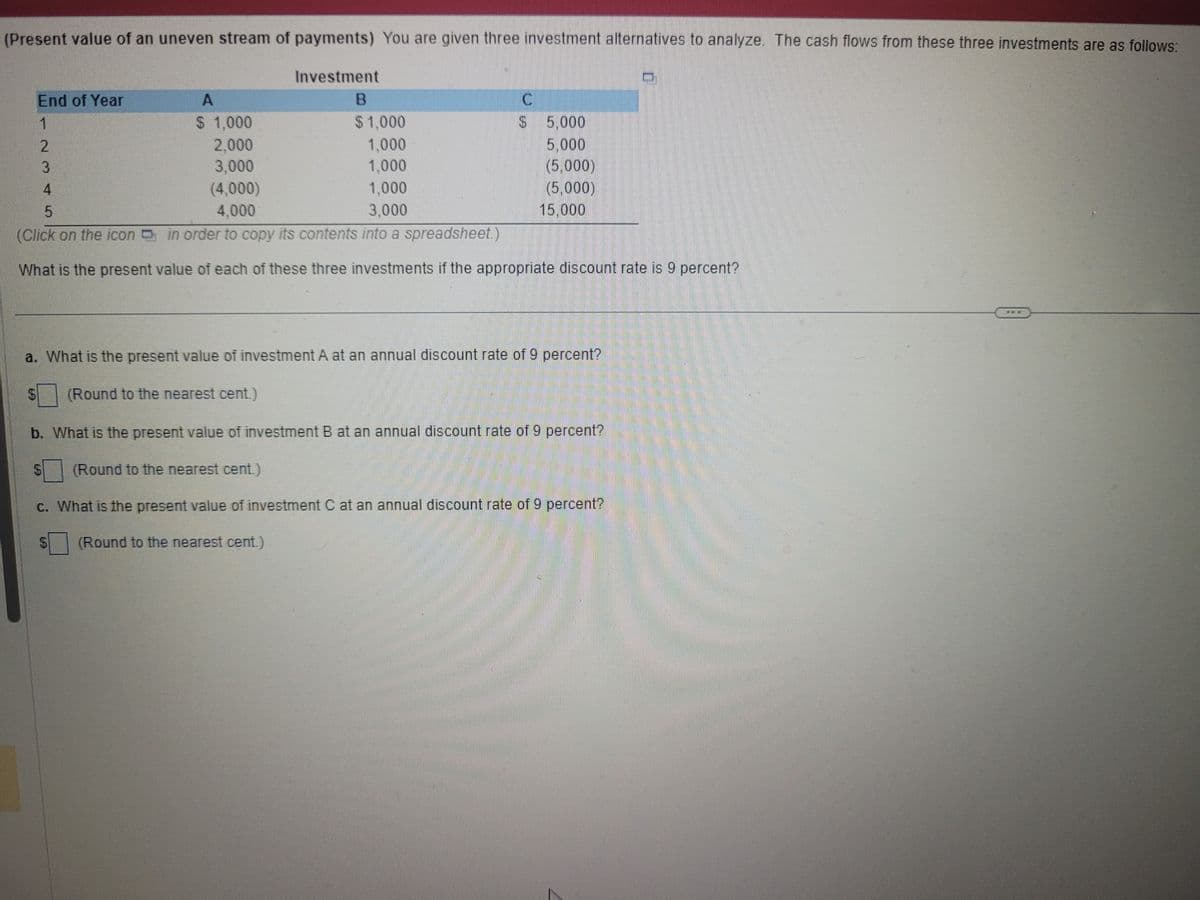

Transcribed Image Text:(Present value of an uneven stream of payments) You are given three investment alternatives to analyze. The cash flows from these three investments are as follows:

Investment

B

A

$ 1,000

2,000

3,000

(4,000)

1,000

4,000

3,000

(Click on the icon in order to copy its contents into a spreadsheet.)

What is the present value of each of these three investments if the appropriate discount rate is 9 percent?

$

End of Year

1

SA

NM

CO

2

3

4

5

$ 1,000

1,000

1,000

C

$ 5,000

a. What is the present value of investment A at an annual discount rate of 9 percent?

(Round to the nearest cent.)

b. What is the present value of investment B at an annual discount rate of 9 percent?

(Round to the nearest cent.)

c. What is the present value of investment C at an annual discount rate of 9 percent?

(Round to the nearest cent.)

5,000

(5,000)

(5,000)

15.000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 5 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College