End of Year Investment 1 Investment 2 Investment 3 1 $8,000 $11,000 $9,500 2 $9,000 $10,000 $9,500 $10,000 $9,000 $9,500 4 $11,000 $8,000 $9,500 3.

Q: An advertising campaign will cost $300,000 for planning and $30,000 in each of the next five years.…

A: Internal Rate of Return: Projects and investments are evaluated using the internal rate of return…

Q: Gold Mining, Inc. is using the profitability index (PI) when evaluating projects. Gold Mining's cost…

A: PI = PV of cash inflows / Initial Cost

Q: Towson Industries is considering an investment of $496,800 that is expected to generate returns of…

A: In Simple terms, Under IRR Present Value of Cash Inflow = Cash Outflow

Q: A company has two investment possibilities, with the following cash inflows: If the firm can earn 7…

A: We need to use the concept of time value of money to solve the question. According to the concept of…

Q: A $15,000 investment is to be made with anticipated annual returns as shown in the spreadsheet in…

A: The Present value of an investment is the present worth of a future cash flows to be received at a…

Q: A 2-year investment of $2,000 results in a cash flow of $150 at the end of the first year and…

A: Computation of IRR:

Q: Which alternative in the table below should be selected when the MARR = 5% per year? The life of…

A: Given information : Year (A-DN) (B-A) (C-B) (D-C) 0 $ (800.00) $ (500.00) $ (1,200.00) $…

Q: The five alternatives shown here are being evaluated by the rate of return method: If the…

A: Companies have different alternatives to invest their money in, but they should always compare the…

Q: You want to make an investment of $2,000,000 in new equipment which is expected to generate $230,000…

A: Given: Investment = $2,000,000 Revenue = $230,000

Q: For the following table, assume a MARR of 10% per year and a useful life for each alternative of six…

A: IRR in the rate of return a project generates in its lifetime. It is expressed in annual terms. IRR…

Q: Which alternative in the table below should be selected when the MARR= 4% per year? The life of each…

A: Net present value (NPV) It is a capital budgeting tool to decide on the best investment among…

Q: a. Calculate the following Periodic Total Returns on a 5-year investment. To your calculations,…

A: a. Calculate the total return on invest as follows: Selling Cost = 5% Total Return = NCF + Increase…

Q: Management of a firm with a cost of capital of 12 percent is considering a $100,000 investment with…

A: given, r = 12% Initial investment = $100,000 Annual cashflow = $44,524 n = 3 years

Q: A company is comparing two investments. Both require an initial investment of $2,500. Investment A…

A: Initial investment = $ 2500 Investment A returns in eight years = $4,700 investment B returns in 12…

Q: Which alternative in the table below should be selected when the MARR = 4% per year? The life of…

A: IRR is a rate at which NPV of the project is equal to the zero or it can be said that PV of cash…

Q: Illustration: An investment opportunity costs $10,000 and returns $5,000, $4,000, and $3,000,…

A:

Q: You are faced with making a decision on a large capital investment proposal. The capital investment…

A: Given: The annual revenue is provided as $180,000. The annual expense is $42,000 from year 1 to 3.…

Q: An investment of $1,400,000 is made in 5-year MACRS-GDS equipment. Measured in constant dollars, the…

A: “Since you have posted a question with multiple sub-parts, we will solve first three subparts for…

Q: An advertising campaign will cost $500,000 for planning and $50,000 in each of the next five years.…

A: Internal rate of return: Projects and investments are evaluated using the internal rate of return…

Q: You are faced with making a decision on a large capital investment proposal. The capital investment…

A: As per our protocol we provide solution to one question only and you have asked multiple questions…

Q: The introduction of a new product would require an initial investment of $210,000. The forecast…

A: Year Cash flow 0 -210000 1 25000 2 40000 3 80000 4 45000 5 35000 6 15000

Q: You are faced with making a decision on a large capital investment proposal. The capital investment…

A: Concept. Annual worth (Aw) , ERR and IRR are capital budgeting methods used to evaluate the…

Q: An advertising campaign will cost $500,000 for planning and $50,000 in each of the next five years.…

A: Internal Rate of Return: The internal rate of return (IRR) is a financial research indicator that is…

Q: Nu Things, Inc., is considering an investment in a business venture with the following anticipated…

A: Worth of investment means the value which is expected to be generated from the investment. It…

Q: Nu Things, Inc., is considering an investment in a business venture with the following anticipated…

A: Net present value(NPV) is the difference between the present value of cash inflow and present value…

Q: company has a policy of requiring a rate of return on investment of 16%. two investment alternatives…

A:

Q: If Quail Company invests $50,000 today, it can expect to receive $10,000 at the end extra $6,000 at…

A: calculation of net present value are as follows

Q: The value of an investment comes from its cash flows. Let's say you are intent on receiving $4000…

A: APR (Annual Percentage Rate) is defined as an annual rate of an interest that have been charged to…

Q: Suppose we are considering a capital investment that costs $686,400 and provides annual operating…

A: Net Present value (NPV) is defined as the present value of future cash flows less initial…

Q: Peng Company is considering an investment expected to generate an average net income after taxes of…

A: Net present value method: Net present value method is the method which is used to compare the…

Q: Three mutually exclusive design alternatives are being considered. The estimated cash flows for each…

A: IRR -Internal rate of return It is the discount rate which makes net present value (NPV) of a…

Q: a. Calculate the following Periodic Total Returns on a 5-year investment. To your calculations,…

A: You have posted multiple questions. We will solve the first question for you. The return on…

Q: Year-to-date, Company O had earned a −2.10 percent return. During the same time period, Company V…

A: “Hey, since there are multiple questions posted, we will answer first question. If you want any…

Q: The expected profits from a $165,000 investment are $55,000 in Year 1, $80,000 in Year 2, and…

A: Year Cash flows 0 -165000 1 55000 2 80000 3 120000

Q: Three mutually exclusive design alternatives are being considered. The estimated cash flows for each…

A: MARR = 20℅ Cash flows: Year Project A Project B Project C Reference 0 -28000 -55000 -40000…

Q: NUBD Co. is planning to invest P40,000 in a three-year project. NUBD's expected rate of return is…

A: The present value (PV) factor is used on a future date to calculate the current value of a cash…

Q: For the following table, assume a MARR of 15% per year and a useful life for each alternative of…

A: PW is the current worth of cash flows that are expected to occur in the future.

Q: You are faced with making a decision on a large capital investment proposal. The capital investment…

A: The Internal Rate of Return (IRR) is the rate at which the present value of cash inflows is equal to…

Q: NUBD Co. is planning to invest P40,000 in a three-year project. NUBD’s expected rate of return is…

A: The term "present value" refers to the adjustment of the actual amount with the interest rate to…

Q: An advertising campaign will cost $450,000 for planning and $50,000 in each of the next five years.…

A: Internal Rate of Return: Projects and investments are evaluated using the internal rate of return…

Q: For the following table, asume a MARR of 9% per year and a useful life for each alternative of six…

A: The rate which the investor is expected to generate on its investment refers to the internal rate of…

Q: Your goal is to be able to withdraw $4,800 for each of the next seven years beginning one year from…

A: Amount need to be invested today = Annual amount withdrawal x Present value factor (12%, 7 years)

Q: What is the simple and discounted payback period for this proposal?

A: As per our protocol we provide solution to one question only and you have asked multiple questions…

Q: An investment of $50,000 in R&D results in additional revenue of $28,720 after 5 years and another…

A: Rate of return will IRR of the investment

Q: present value

A: Net present value refers to the difference between the cash inflow and cash outflow in a…

Q: A firm has only $10,000 to invest and must choose between two projects. Project A returns $12,400…

A: In this question, we have to calculate the rate of return in each alternative to choose one…

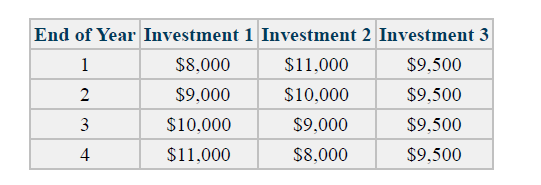

The following three investment opportunities are available. The returns for each investment for each year vary, but the first cost of each is $20,000. Based on a future worth analysis, which investment is preferred? MARR is 9%/year.

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

- part 3 4 solution needed Year Net cashflows 0 -575,000 1 £125,000 2 £248,000 3 £176,000 4 £146,000Particulars 31st Mar' 19 Amt (Rs) 31st Mar' 20 Amt (Rs) Land and Building 3600000 3600000 Cash 400000 320,000 Sundry Debtors 640000 800,000 Temporary Investments 400000 640,000 Stock 3680000 4320000 Prepaid Expenses 560000 24000 Plant and Machinery 1920000 3096000 Total Assets 11200000 12800000 Current Liabilities 1280000 1600000 Loans 3200000 3200000 Capital 4000000 4000000 Retained Earnings 936000 1624000 Statement of Profit for the Current Year 1st Apr to 31st Mar' 20 : Amt (Rs) Sales 8000000 Less: Cost of Goods Sold -5600000 Less: Interest -320000 Net Profit 2080000 Less: Taxes @ 50% -1040000 Profit after Tax 1040000 Profit Distributed 440000 Calculate Gross Profit Ratio Return on EquityParticulars 31st Mar' 19 Amt (Rs) 31st Mar' 20 Amt (Rs) Land and Building 3600000 3600000 Cash 400000 320,000 Sundry Debtors 640000 800,000 Temporary Investments 400000 640,000 Stock 3680000 4320000 Prepaid Expenses 560000 24000 Plant and Machinery 1920000 3096000 Total Assets 11200000 12800000 Current Liabilities 1280000 1600000 Loans 3200000 3200000 Capital 4000000 4000000 Retained Earnings 936000 1624000 Statement of Profit for the Current Year 1st Apr to 31st Mar' 20 : Amt (Rs) Sales 8000000 Less: Cost of Goods Sold -5600000 Less: Interest -320000 Net Profit 2080000 Less: Taxes @ 50% -1040000 Profit after Tax 1040000 Profit Distributed 440000 Calculate Current Ratio Debtors Turnover Ratio Stock Turnover Ratio Return on Total Assets

- A2 1 g Use the following information for Delta Corporation to answer question 1: Year 20X1 20X2 Net sales $1,500,000 $1,656,598 Cost of goods sold 675,000 745,469 Depreciation 270,000 298,188 Interest paid 43,600 44,000 Cash 127,500 140,811 Accounts receivable 450,000 496,980 Inventory 525,000 579,809 Net fixed assets 1,800,000 1,987,918 Accounts payable 375,000 414,150 Notes payable 45,000 50,000 Long-term debt 500,000 500,000 Common stock 1,000,000 1,000,000 Retained earnings 982,500 1,241,368 Tax rate 35% 35% Dividend payout 30% 30% Delta has 600,000 common shares outstanding. The firm is projecting a 20% increase in net sales for the coming year (20X3). Delta uses the percentage of sales approach to plan for its financing needs. In using this approach, the firm assumes that cost of goods sold, all assets (current and fixed), and accounts payable will…Year 1 2 3 Net Income 1,500,000 1,750,000 3,800,000 Depreciation 2,000,000 2,000,000 0 Debt (beginning of the year) 10,000,000 12,000,000 15,000,000 From year 3 on the unlevered cash flow is expected to perpetually grow at 3.00% (that is, the unlevered cash flow of year 4 will be 5% higher than in year 3 and so on). The depreciation will stay equal to 0 from year 3 on, and also debt will stay perpetually at 15,000,000 starting at the beginning of year 3. The debt variations are all scheduled beforehand, hence there is no uncertainty about them. The interest rate is 2.55%, the unlevered return on equity is 7.50% and the depreciation tax shield is as risky as the company’s debt. The tax rate is 40%. a) What is the levered cash flow to equity holders in each one of the first three years? b) What is the levered value of the company’s assets?A2 1 f Use the following information for Delta Corporation to answer question 1: Year 20X1 20X2 Net sales $1,500,000 $1,656,598 Cost of goods sold 675,000 745,469 Depreciation 270,000 298,188 Interest paid 43,600 44,000 Cash 127,500 140,811 Accounts receivable 450,000 496,980 Inventory 525,000 579,809 Net fixed assets 1,800,000 1,987,918 Accounts payable 375,000 414,150 Notes payable 45,000 50,000 Long-term debt 500,000 500,000 Common stock 1,000,000 1,000,000 Retained earnings 982,500 1,241,368 Tax rate 35% 35% Dividend payout 30% 30% Delta has 600,000 common shares outstanding. The firm is projecting a 20% increase in net sales for the coming year (20X3). Delta uses the percentage of sales approach to plan for its financing needs. In using this approach, the firm assumes that cost of goods sold, all assets (current and fixed), and accounts payable will…

- Breakdown 3/30/2022 3/30/2021 3/30/2020 Operating Cash Flow 90,480,000.00 91,630,000.00 76,230,000.00 Investing Cash Flow (17,280,000.00) (15,280,000.00) 17,910,000.00 Financing Cash Flow (80,150,000.00) (93,090,000.00) (68,190,000.00) End Cash Position 11,470,000.00 18,420,000.00 32,160,000.00 Changes in Cash (6,950,000.00) (16,740,000.00) 25,950,000.00 Beginning Cash Position 18,420,000.00 32,160,000.00 6,210,000.00 Other Cash Adjustment Outside Change in Cash - 3,000,000.00 - Capital Expenditure (12,280,000.00) (41,630,000.00) (8,620,000.00) Issuance of Capital Stock - - - Issuance of Debt - 1,880,000.00 - Repayment of Debt - (1,880,000.00) - Free Cash Flow 78,200,000.00 50,000,000.00 67,610,000.00 Can you make this indirect method of cash flow into a direct method of cash flow? Please donot provide solution in image format and it should be in step by step format and asapCompany A Company B Company C Company D Company E December 31, 2019 Assets 162,000 189,000 118,125 121,500 351,000 Liabilities 101,250 135,000 67,500 74,250 ? December 31, 2020 Assets 175,500 249,750 432,000 ? 519,750 Liabilities 85,725 ? 182,250 108,000 202,500 During 2020 Net income ? 33,750 67,500 60,750 81,000 Investments 23,625 40,500 ? 81,000 0 Withdrawals 6,750 10,125 20,250 27,000 40,500 What was the owner’s equity of each of the five companies on December 31, 2019? What was the owner’s equity of each of the five companies on December 31, 2020 What was the amount of net income of Company A for 2020? How much is the liabilities owed by Company B on December 31, 2020? For Company C, calculate the amount of investments. How much is the total assets on December 31, 2020 of Company D? How much is the…ANSWER QUICK!! JUST THE ANSWERS!! NO EXPLANATIOn 10. a)During 20X2, ABC Inc earned $200,000 in service revenue, of which $120,000 was received in cash; the balance will be collected in January 20X3. The company's 20X2 income statement should show which of the following amounts for service revenue? $320,000 $200,000 $80,000 $120,000 b)Assume that a company's financial position on January 1, 2022 was: Assets, $40,000 and Liabilities, $15,000. During January 2022, the company completed the following transactions: (a) paid a “note payable”: $4,000 (without interest); (b) received payment from his client: $4,000; (c) paid supplier debts: $2,000; (d) purchased a truck, $1,000 in cash and $8,000 in Notes Payable. What is the financial situation of the company as of January 31, 2022?Question 9 options: Assets = $44,000 Liabilities = $17,000 Equity = $27,000 Assets = $43,000 Liabilities = $18,000 Equity = $25,000 Assets = $42,000 Liabilities = $17,000 Equity = $25,000 Assets = $42,000…

- A2 1 c Use the following information for Delta Corporation to answer question 1: Year 20X1 20X2 Net sales $1,500,000 $1,656,598 Cost of goods sold 675,000 745,469 Depreciation 270,000 298,188 Interest paid 43,600 44,000 Cash 127,500 140,811 Accounts receivable 450,000 496,980 Inventory 525,000 579,809 Net fixed assets 1,800,000 1,987,918 Accounts payable 375,000 414,150 Notes payable 45,000 50,000 Long-term debt 500,000 500,000 Common stock 1,000,000 1,000,000 Retained earnings 982,500 1,241,368 Tax rate 35% 35% Dividend payout 30% 30% Delta has 600,000 common shares outstanding. The firm is projecting a 20% increase in net sales for the coming year (20X3). Delta uses the percentage of sales approach to plan for its financing needs. In using this approach, the firm assumes that cost of goods sold, all assets (current and fixed), and accounts payable will…a. (1) Current year working capital. 1,090,000 Current position analysis The following data were taken from the balance sheet of Nilo Company at the end of two recent fiscal years: Current Year Previous Year Current assets: Cash 391,000 300,000 Marketable securities 515,000 354,000 Accounts and notes receivable (net) 634,000 426,000 Inventories 368,000 222,000 Prepaid expenses 182,000 138,000 Total current assets 2,090,000 1,440,000 Current liabilities: Accounts and notes payable (short-term) 725,000 600,000 Accrued liabilities 275,000 300,000 Total current liabilities 1,000,000 900,000 a. Determine for each year (1) the working capital, (2) the current ratio, and (3) the quick ratio. Round ratios to one decimal place. b. What conclusions can be drawn from these data as to the companys ability to meet its currently maturing debts?A2 1 d Use the following information for Delta Corporation to answer question 1: Year 20X1 20X2 Net sales $1,500,000 $1,656,598 Cost of goods sold 675,000 745,469 Depreciation 270,000 298,188 Interest paid 43,600 44,000 Cash 127,500 140,811 Accounts receivable 450,000 496,980 Inventory 525,000 579,809 Net fixed assets 1,800,000 1,987,918 Accounts payable 375,000 414,150 Notes payable 45,000 50,000 Long-term debt 500,000 500,000 Common stock 1,000,000 1,000,000 Retained earnings 982,500 1,241,368 Tax rate 35% 35% Dividend payout 30% 30% Delta has 600,000 common shares outstanding. The firm is projecting a 20% increase in net sales for the coming year (20X3). Delta uses the percentage of sales approach to plan for its financing needs. In using this approach, the firm assumes that cost of goods sold, all assets (current and fixed), and accounts payable will…