If Quail Company invests $50,000 today, it can expect to receive $10,000 at the end extra $6,000 at the end of the seventh year. (PV of $1, FV of $1, PVA of $1, and FVA of $1) (Use appropriate factor(s) from the tables provided. Round your present value factor to 4 decimals.) What is the net present value of this investment assuming a required 10% return on investments? Cash Flow Annual cash flow Additional cash flow Chart Values are Based on: Select Chart Present Value of an Annuity of 1 Present Value of 1 Present value of cash inflows Immediate cash outflows Net present value n= j= 10 % $ $ = x PV Factor 4.8684 = 0.5132 = Amount 10,000 x 6,000 X Present Value $ 48,684 3,079 51,763 50,000 $

If Quail Company invests $50,000 today, it can expect to receive $10,000 at the end extra $6,000 at the end of the seventh year. (PV of $1, FV of $1, PVA of $1, and FVA of $1) (Use appropriate factor(s) from the tables provided. Round your present value factor to 4 decimals.) What is the net present value of this investment assuming a required 10% return on investments? Cash Flow Annual cash flow Additional cash flow Chart Values are Based on: Select Chart Present Value of an Annuity of 1 Present Value of 1 Present value of cash inflows Immediate cash outflows Net present value n= j= 10 % $ $ = x PV Factor 4.8684 = 0.5132 = Amount 10,000 x 6,000 X Present Value $ 48,684 3,079 51,763 50,000 $

Financial And Managerial Accounting

15th Edition

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:WARREN, Carl S.

Chapter26: Capital Investment Analysis

Section: Chapter Questions

Problem 3CMA

Related questions

Question

100%

What is n= , and the net present value

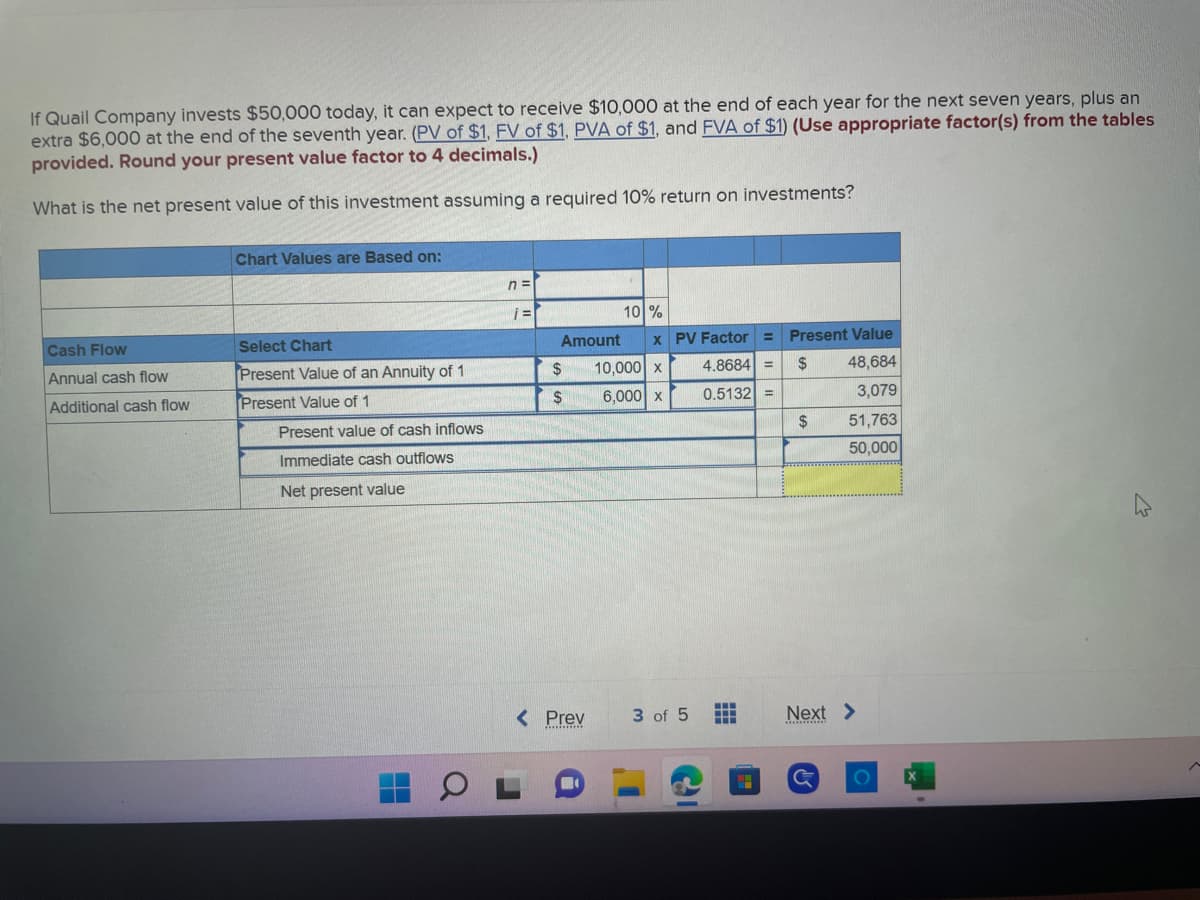

Transcribed Image Text:If Quail Company invests $50,000 today, it can expect to receive $10,000 at the end of each year for the next seven years, plus an

extra $6,000 at the end of the seventh year. (PV of $1, FV of $1, PVA of $1, and FVA of $1) (Use appropriate factor(s) from the tables

provided. Round your present value factor to 4 decimals.)

What is the net present value of this investment assuming a required 10% return on investments?

Cash Flow

Annual cash flow

Additional cash flow

Chart Values are Based on:

Select Chart

Present Value of an Annuity of 1

Present Value of 1

Present value of cash inflows

Immediate cash outflows

Net present value

n=

i=

10 %

Amount x PV Factor

10,000 X

4.8684 =

6,000 X

0.5132 =

$

$

< Prev

3 of 5 ‒‒‒

Present Value

$ 48,684

3,079

51,763

50,000

$

Next >

G

O

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Recommended textbooks for you

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College