Ending Balance Orlginal Cost to Transfer at Transfer Price Price Year Herman to Fred 2016 $100,000 $20,000 $80,000 100,000 2017 125,000 40,000 2018 90,000 120,000 30,000

Ending Balance Orlginal Cost to Transfer at Transfer Price Price Year Herman to Fred 2016 $100,000 $20,000 $80,000 100,000 2017 125,000 40,000 2018 90,000 120,000 30,000

Chapter5: Operating Activities: Purchases And Cash Payments

Section: Chapter Questions

Problem 3.3C

Related questions

Question

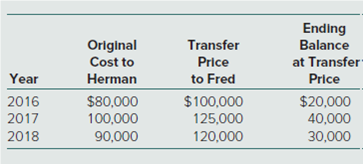

Fred, Inc., and Herman Corporation formed a business combination on January 1, 2016, when Fred acquired a 60 percent interest in Herman’s common stock for $312,000 in cash. The book value of Herman’s assets and liabilities on that day totaled $300,000 and the fair value of the noncontrolling interest was $208,000. Patents being held by Herman (with a 12-year remaining life) were undervalued by $90,000 within the company’s financial records and a customer list (10-year life) worth $130,000 was also recognized as part of the acquisition-date fair value.

Intra-entity inventory transfers occur regularly between the two companies. Merchandise carried over from one year to the next is always sold in the subsequent period.

Fred had not paid for half of the 2018 inventory transfers by year-end.

On January 1, 2017, Fred sold $15,000 in land to Herman for $22,000. Herman is still holding this land.

On January 1, 2018, Herman acquired $20,000 (face value) of Fred’s bonds in the open market. These bonds had an 8 percent cash interest rate. On the date of repurchase, the liability was shown within Fred’s records at $21,386, indicating an effective yield of 6 percent. Herman’s acquisition price was $18,732 based on an effective interest rate of 10 percent.

Herman indicated earning a net income of $25,000 within its 2018 financial statements. The subsidiary also reported a beginning Retained Earnings balance of $300,000, dividends of $4,000, and common stock of $100,000. Herman has not issued any additional common stock since its takeover. The parent company has applied the equity method to record its investment in Herman.

a. Prepare consolidation worksheet adjustments for 2018.

b. Calculate the amount of consolidated net income attributable to the noncontrolling interest for 2018. In addition, determine the ending 2018 balance for noncontrolling interest in the consolidated balance sheet.

c. Determine the consolidation worksheet adjustments needed in 2019 in connection with the intra-entity bonds.

Transcribed Image Text:Ending

Balance

Orlginal

Cost to

Transfer

at Transfer

Price

Price

Year

Herman

to Fred

2016

$100,000

$20,000

$80,000

100,000

2017

125,000

40,000

2018

90,000

120,000

30,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 7 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you