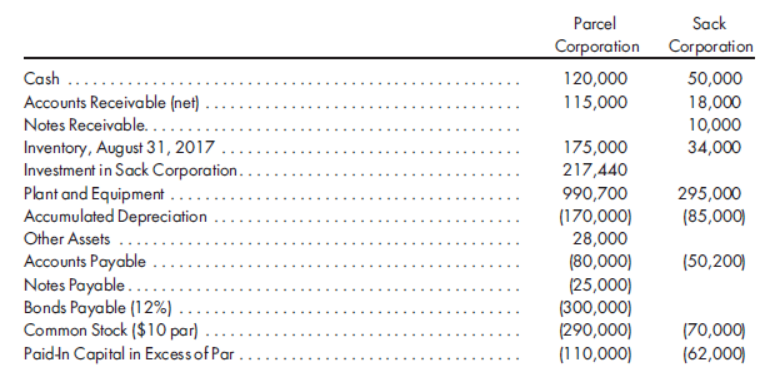

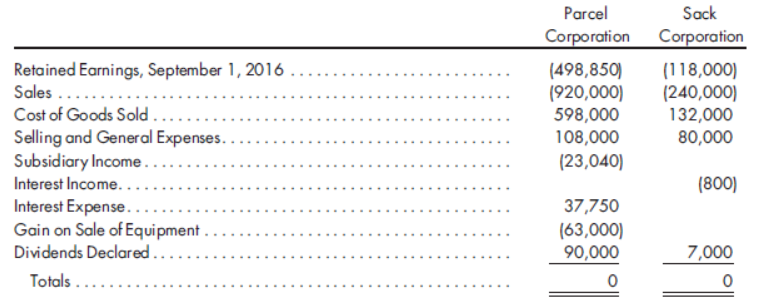

Parcel Sack Corporation Corporation Cash .. 50,000 18,000 10,000 34,000 120,000 Accounts Receivable (net) . Notes Receivable. ..... Inventory, August 31, 2017 Investment in Sack Corporation.. Plant and Equipment .... Accumulated Depreciation Other Assets ... Accounts Payable Notes Payable... Bonds Payable (12%) . ... Common Stock ($10 par) ... Paidin Capital in Excessof Par . 115,000 .... 175,000 217,440 990,700 (170,000) 28,000 295,000 (85,000) (80,000) (25,000) (300,000) (290,000) (110,000) (50,200) (70,000) (62,000) Parcel Sack Corporation Corporation Retained Earnings, September 1, 2016 Sales ..... (498,850) (920,000) 598,000 (118,000) (240,000) 132,000 80,000 Cost of Goods Sold . Selling and General Expenses... Subsidiary Income... Interest Income.... Interest Expense. Gain on Sale of Equipment . Dividends Declared... 108,000 (23,040) (800) 37,750 (63,000) 90,000 7,000 Totals .....

On September 1, 2015, Parcel Corporation purchased 80% of the outstanding common stock of Sack Corporation for $152,000. On that date, Sack’s net book values equaled fair values, and there was no excess of cost or book value resulting from the purchase. Parcel has been maintaining its investment under the simple equity method.

Over the next three years, the intercompany transactions between the companies were as follows:

a. On September 1, 2015, Sack sold its 4-year-old delivery truck to Parcel for $14,000 in cash. At that time, Sack had depreciated the truck, which had cost $15,000, to its $5,000 salvage value. Parcel estimated on the date of the sale that the asset had a remaining useful life of three years and no salvage value.

b. On September 1, 2016, Parcel sold equipment to Sack for $103,000. Parcel originally paid $80,000 for the equipment and planned to depreciate it over 20 years, assuming no salvage value. However, Parcel had the property for only 10 years and carried it at a net book value of $40,000 on the sale date. Sack will use the equipment for 10 years, at which time Sack expects no salvage value.

Both companies use straight-line

Prepare the worksheet necessary to produce the consolidated financial statements of Parcel Corporation and its subsidiary for the year ended August 31, 2017. Include the income distribution schedules.

Trending now

This is a popular solution!

Step by step

Solved in 2 steps