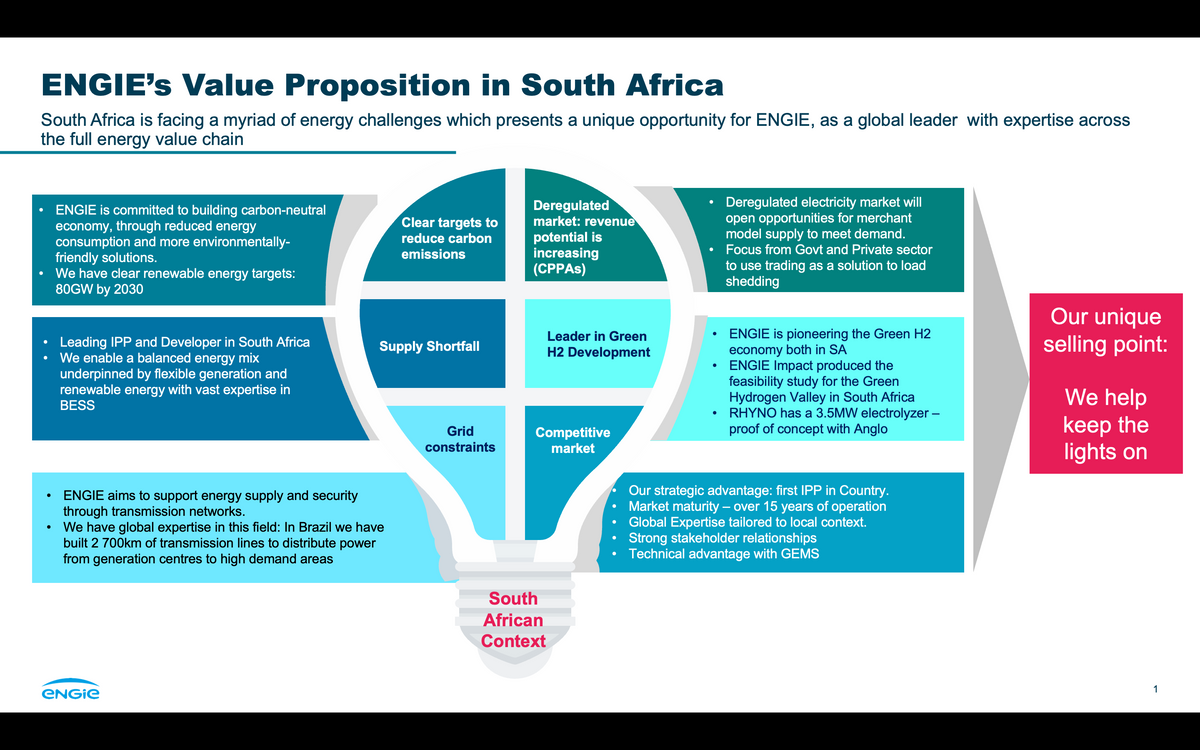

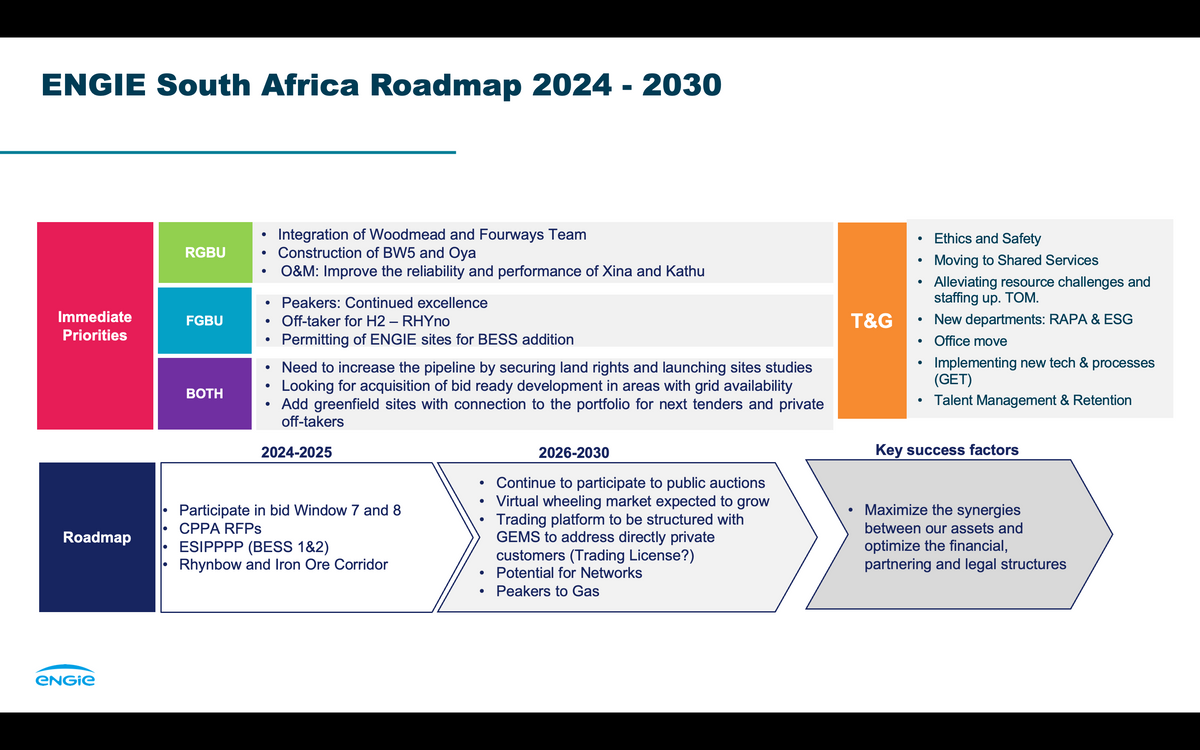

ENGIE's Value Proposition in South Africa South Africa is facing a myriad of energy challenges which presents a unique opportunity for ENGIE, as a global leader with expertise across the full energy value chain • ENGIE is committed to building carbon-neutral economy, through reduced energy consumption and more environmentally- friendly solutions. We have clear renewable energy targets: 80GW by 2030 Clear targets to reduce carbon emissions Deregulated market: revenue potential is increasing (CPPAs) • Leading IPP and Developer in South Africa We enable a balanced energy mix underpinned by flexible generation and renewable energy with vast expertise in BESS • • ENGIE aims to support energy supply and security through transmission networks. We have global expertise in this field: In Brazil we have built 2 700km of transmission lines to distribute power from generation centres to high demand areas ENGIC • Deregulated electricity market will open opportunities for merchant model supply to meet demand. Focus from Govt and Private sector to use trading as a solution to load shedding Supply Shortfall Leader in Green H2 Development Grid constraints Competitive market • ENGIE is pioneering the Green H2 economy both in SA ENGIE Impact produced the feasibility study for the Green Hydrogen Valley in South Africa RHYNO has a 3.5MW electrolyzer - proof of concept with Anglo Our unique selling point: We help keep the lights on South African Context • • • Our strategic advantage: first IPP in Country. Market maturity – over 15 years of operation Global Expertise tailored to local context. Strong stakeholder relationships Technical advantage with GEMS 1 ENGIE South Africa Roadmap 2024 - 2030 RGBU Immediate Priorities FGBU BOTH • Integration of Woodmead and Fourways Team Construction of BW5 and Oya O&M: Improve the reliability and performance of Xina and Kathu • Off-taker for H2 - RHYno • Peakers: Continued excellence • Permitting of ENGIE sites for BESS addition • • Need to increase the pipeline by securing land rights and launching sites studies Looking for acquisition of bid ready development in areas with grid availability Add greenfield sites with connection to the portfolio for next tenders and private off-takers 2024-2025 Participate in bid Window 7 and 8 ESIPPPP (BESS 1&2) • • • 2026-2030 Continue to participate to public auctions Virtual wheeling market expected to grow Trading platform to be structured with GEMS to address directly private • • CPPA RFPs Roadmap . • Rhynbow and Iron Ore Corridor • • Peakers to Gas customers (Trading License?) Potential for Networks • Ethics and Safety • Moving to Shared Services • T&G • Alleviating resource challenges and staffing up. TOM. New departments: RAPA & ESG • Office move • Implementing new tech & processes (GET) • Talent Management & Retention Key success factors Maximize the synergies between our assets and optimize the financial, partnering and legal structures eNGie

ENGIE's Value Proposition in South Africa South Africa is facing a myriad of energy challenges which presents a unique opportunity for ENGIE, as a global leader with expertise across the full energy value chain • ENGIE is committed to building carbon-neutral economy, through reduced energy consumption and more environmentally- friendly solutions. We have clear renewable energy targets: 80GW by 2030 Clear targets to reduce carbon emissions Deregulated market: revenue potential is increasing (CPPAs) • Leading IPP and Developer in South Africa We enable a balanced energy mix underpinned by flexible generation and renewable energy with vast expertise in BESS • • ENGIE aims to support energy supply and security through transmission networks. We have global expertise in this field: In Brazil we have built 2 700km of transmission lines to distribute power from generation centres to high demand areas ENGIC • Deregulated electricity market will open opportunities for merchant model supply to meet demand. Focus from Govt and Private sector to use trading as a solution to load shedding Supply Shortfall Leader in Green H2 Development Grid constraints Competitive market • ENGIE is pioneering the Green H2 economy both in SA ENGIE Impact produced the feasibility study for the Green Hydrogen Valley in South Africa RHYNO has a 3.5MW electrolyzer - proof of concept with Anglo Our unique selling point: We help keep the lights on South African Context • • • Our strategic advantage: first IPP in Country. Market maturity – over 15 years of operation Global Expertise tailored to local context. Strong stakeholder relationships Technical advantage with GEMS 1 ENGIE South Africa Roadmap 2024 - 2030 RGBU Immediate Priorities FGBU BOTH • Integration of Woodmead and Fourways Team Construction of BW5 and Oya O&M: Improve the reliability and performance of Xina and Kathu • Off-taker for H2 - RHYno • Peakers: Continued excellence • Permitting of ENGIE sites for BESS addition • • Need to increase the pipeline by securing land rights and launching sites studies Looking for acquisition of bid ready development in areas with grid availability Add greenfield sites with connection to the portfolio for next tenders and private off-takers 2024-2025 Participate in bid Window 7 and 8 ESIPPPP (BESS 1&2) • • • 2026-2030 Continue to participate to public auctions Virtual wheeling market expected to grow Trading platform to be structured with GEMS to address directly private • • CPPA RFPs Roadmap . • Rhynbow and Iron Ore Corridor • • Peakers to Gas customers (Trading License?) Potential for Networks • Ethics and Safety • Moving to Shared Services • T&G • Alleviating resource challenges and staffing up. TOM. New departments: RAPA & ESG • Office move • Implementing new tech & processes (GET) • Talent Management & Retention Key success factors Maximize the synergies between our assets and optimize the financial, partnering and legal structures eNGie

Purchasing and Supply Chain Management

6th Edition

ISBN:9781285869681

Author:Robert M. Monczka, Robert B. Handfield, Larry C. Giunipero, James L. Patterson

Publisher:Robert M. Monczka, Robert B. Handfield, Larry C. Giunipero, James L. Patterson

ChapterC: Cases

Section: Chapter Questions

Problem 5.3SD: Scenario 4 Sharon Gillespie, a new buyer at Visionex, Inc., was reviewing quotations for a tooling...

Related questions

Question

100%

Please assist in writing an executive summary for Engie SA. A company in South Africa.

Clearly state the main elements of the marketing plan.

- 15 years + presence in RSA

- First and largest IPP in RSA with more than 1,6 GW in operation

- 300+ professionals

- Developed, built and operate the first H2 plant in Africa at Mogalakwena mine

- Founding member of the Hydrogen valley initiative with Anglo American and the Department of Science and Technology.

- Operational and Safety excellence across all sites.

- Growth Market for ENGIE

Currently ENGIE adopts a decentralized model for its operations. Each asset has an SPV and an O&M company. Each with its own employees. The COO: ENGIE South Africa has oversight.

Transcribed Image Text:ENGIE's Value Proposition in South Africa

South Africa is facing a myriad of energy challenges which presents a unique opportunity for ENGIE, as a global leader with expertise across

the full energy value chain

•

ENGIE is committed to building carbon-neutral

economy, through reduced energy

consumption and more environmentally-

friendly solutions.

We have clear renewable energy targets:

80GW by 2030

Clear targets to

reduce carbon

emissions

Deregulated

market: revenue

potential is

increasing

(CPPAs)

•

Leading IPP and Developer in South Africa

We enable a balanced energy mix

underpinned by flexible generation and

renewable energy with vast expertise in

BESS

•

•

ENGIE aims to support energy supply and security

through transmission networks.

We have global expertise in this field: In Brazil we have

built 2 700km of transmission lines to distribute power

from generation centres to high demand areas

ENGIC

•

Deregulated electricity market will

open opportunities for merchant

model supply to meet demand.

Focus from Govt and Private sector

to use trading as a solution to load

shedding

Supply Shortfall

Leader in Green

H2 Development

Grid

constraints

Competitive

market

•

ENGIE is pioneering the Green H2

economy both in SA

ENGIE Impact produced the

feasibility study for the Green

Hydrogen Valley in South Africa

RHYNO has a 3.5MW electrolyzer -

proof of concept with Anglo

Our unique

selling point:

We help

keep the

lights on

South

African

Context

•

•

•

Our strategic advantage: first IPP in Country.

Market maturity – over 15 years of operation

Global Expertise tailored to local context.

Strong stakeholder relationships

Technical advantage with GEMS

1

Transcribed Image Text:ENGIE South Africa Roadmap 2024 - 2030

RGBU

Immediate

Priorities

FGBU

BOTH

•

Integration of Woodmead and Fourways Team

Construction of BW5 and Oya

O&M: Improve the reliability and performance of Xina and Kathu

• Off-taker for H2 - RHYno

•

Peakers: Continued excellence

•

Permitting of ENGIE sites for BESS addition

•

•

Need to increase the pipeline by securing land rights and launching sites studies

Looking for acquisition of bid ready development in areas with grid availability

Add greenfield sites with connection to the portfolio for next tenders and private

off-takers

2024-2025

Participate in bid Window 7 and 8

ESIPPPP (BESS 1&2)

•

•

•

2026-2030

Continue to participate to public auctions

Virtual wheeling market expected to grow

Trading platform to be structured with

GEMS to address directly private

•

•

CPPA RFPs

Roadmap

.

•

Rhynbow and Iron Ore Corridor

•

•

Peakers to Gas

customers (Trading License?)

Potential for Networks

•

Ethics and Safety

• Moving to Shared Services

•

T&G

•

Alleviating resource challenges and

staffing up. TOM.

New departments: RAPA & ESG

• Office move

•

Implementing new tech & processes

(GET)

• Talent Management & Retention

Key success factors

Maximize the synergies

between our assets and

optimize the financial,

partnering and legal structures

eNGie

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 1 steps

Recommended textbooks for you

Purchasing and Supply Chain Management

Operations Management

ISBN:

9781285869681

Author:

Robert M. Monczka, Robert B. Handfield, Larry C. Giunipero, James L. Patterson

Publisher:

Cengage Learning

Purchasing and Supply Chain Management

Operations Management

ISBN:

9781285869681

Author:

Robert M. Monczka, Robert B. Handfield, Larry C. Giunipero, James L. Patterson

Publisher:

Cengage Learning