Engineers of a company have $8000 for using as principal (anapara) to invest, and there are 3 options available. If dj dollars (in thousands) are invested in investment j, then a net present value (in thousands) of r(d)) is obtained, where the ri(d))'s are as follows: ri(di)=7d₁+2 (d₁ ≥ 0) r₂(d₂)=3d₂+7 (d₂ ≥ 0) ra(da)=4d3 +5 (d; ≥ 0) r₁(0)= r2 (0) 3 (0) = 0 ngineers can only invest these options with the exact multiples of $1000 ($1000, $2000, $3000...) ow can company engineers allocate $8000 to maximize the income from these investments?

Engineers of a company have $8000 for using as principal (anapara) to invest, and there are 3 options available. If dj dollars (in thousands) are invested in investment j, then a net present value (in thousands) of r(d)) is obtained, where the ri(d))'s are as follows: ri(di)=7d₁+2 (d₁ ≥ 0) r₂(d₂)=3d₂+7 (d₂ ≥ 0) ra(da)=4d3 +5 (d; ≥ 0) r₁(0)= r2 (0) 3 (0) = 0 ngineers can only invest these options with the exact multiples of $1000 ($1000, $2000, $3000...) ow can company engineers allocate $8000 to maximize the income from these investments?

Chapter2: Analysis Of Financial Statements

Section: Chapter Questions

Problem 10PROB

Related questions

Question

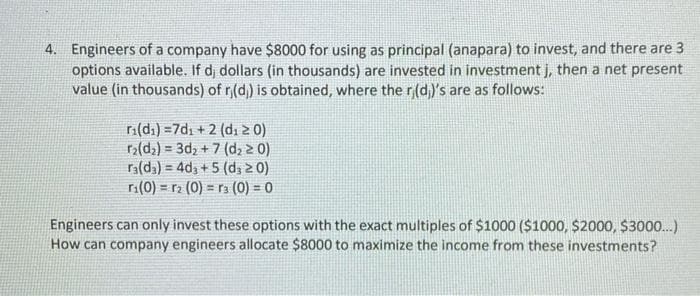

Transcribed Image Text:4. Engineers of a company have $8000 for using as principal (anapara) to invest, and there are 3

options available. If d, dollars (in thousands) are invested in investment j, then a net present

value (in thousands) of ri(d)) is obtained, where the ri(d))'s are as follows:

ri(di)=7d₁ + 2 (d₁20)

r₂(d₂)=3d₂+7 (d₂ ≥ 0)

ra(da)=4d3 +5 (d, ≥ 0)

r₁(0)= r₂ (0) 3 (0) = 0

=

Engineers can only invest these options with the exact multiples of $1000 ($1000, $2000, $3000...)

How can company engineers allocate $8000 to maximize the income from these investments?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 5 images

Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning