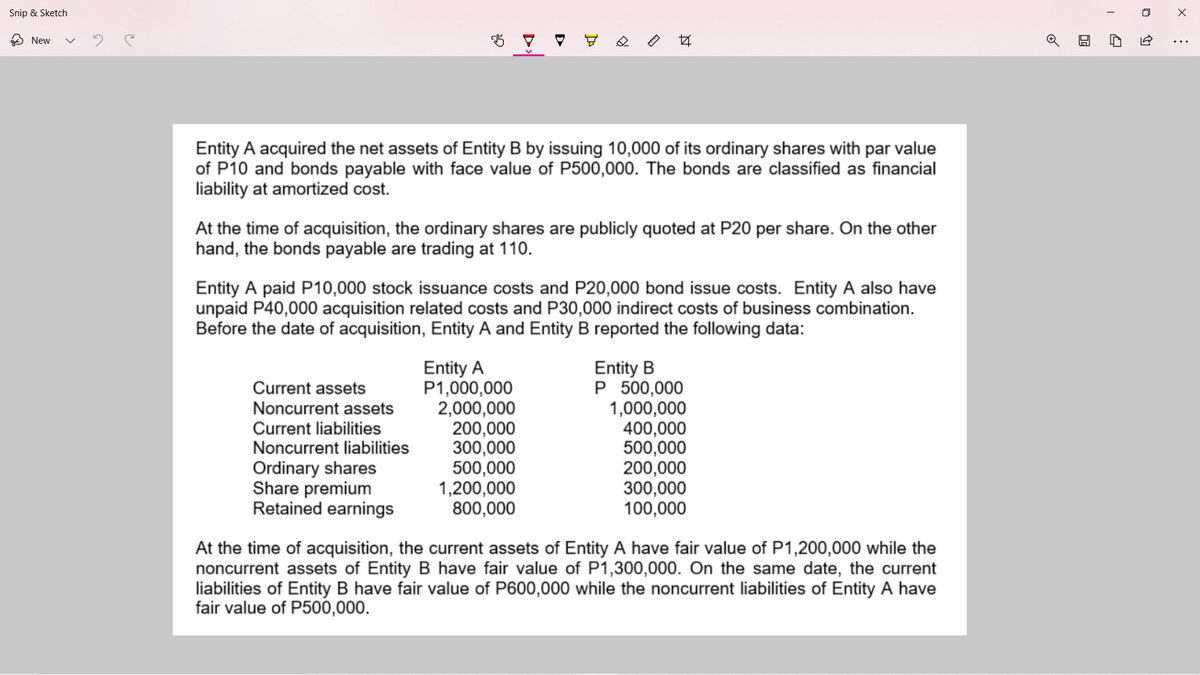

Entity A acquired the net assets of Entity B by issuing 10,000 of its ordinary shares with par value of P10 and bonds payable with face value of P500,000. The bonds are classified as financial liability at amortized cost. At the time of acquisition, the ordinary shares are publicly quoted at P20 per share. On the other hand, the bonds payable are trading at 110. Entity A paid P10,000 stock issuance costs and P20,000 bond issue costs. Entity A also have unpaid P40,000 acquisition related costs and P30,000 indirect costs of business combination. Before the date of acquisition, Entity A and Entity B reported the following data: Entity A P1,000,000 2,000,000 200,000 300,000 500,000 1,200,000 800,000 Entity B P 500,000 1,000,000 400,000 500,000 200,000 300,000 100,000 Current assets Noncurrent assets Current liabilities Noncurrent liabilities Ordinary shares Share premium Retained earnings At the time of acquisition, the current assets of Entity A have fair value of P1,200,000 while the noncurrent assets of Entity B have fair value of P1,300,000. On the same date, the current liabilities of Entity B have fair value of P600,000 while the noncurrent liabilities of Entity A have fair value of P500,000.

Entity A acquired the net assets of Entity B by issuing 10,000 of its ordinary shares with par value of P10 and bonds payable with face value of P500,000. The bonds are classified as financial liability at amortized cost. At the time of acquisition, the ordinary shares are publicly quoted at P20 per share. On the other hand, the bonds payable are trading at 110. Entity A paid P10,000 stock issuance costs and P20,000 bond issue costs. Entity A also have unpaid P40,000 acquisition related costs and P30,000 indirect costs of business combination. Before the date of acquisition, Entity A and Entity B reported the following data: Entity A P1,000,000 2,000,000 200,000 300,000 500,000 1,200,000 800,000 Entity B P 500,000 1,000,000 400,000 500,000 200,000 300,000 100,000 Current assets Noncurrent assets Current liabilities Noncurrent liabilities Ordinary shares Share premium Retained earnings At the time of acquisition, the current assets of Entity A have fair value of P1,200,000 while the noncurrent assets of Entity B have fair value of P1,300,000. On the same date, the current liabilities of Entity B have fair value of P600,000 while the noncurrent liabilities of Entity A have fair value of P500,000.

Financial Accounting

14th Edition

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Carl Warren, Jim Reeve, Jonathan Duchac

Chapter15: Investments And Fair Value Accounting

Section: Chapter Questions

Problem 2E

Related questions

Question

Determine the consolidated amounts at the time of acquisition:

-

- Consolidated Assets _____

- Consolidated Liability _____

- Consolidated Share Capital _____

- Consolidated APIC _____

- Consolidated RE _____

- Consolidated SHE _____

Transcribed Image Text:Snip & Sketch

O New

Entity A acquired the net assets of Entity B by issuing 10,000 of its ordinary shares with par value

of P10 and bonds payable with face value of P500,000. The bonds are classified as financial

liability at amortized cost.

At the time of acquisition, the ordinary shares are publicly quoted at P20 per share. On the other

hand, the bonds payable are trading at 110.

Entity A paid P10,000 stock issuance costs and P20,000 bond issue costs. Entity A also have

unpaid P40,000 acquisition related costs and P30,000 indirect costs of business combination.

Before the date of acquisition, Entity A and Entity B reported the following data:

Entity A

P1,000,000

2,000,000

200,000

300,000

500,000

1,200,000

800,000

Entity B

P 500,000

1,000,000

400,000

500,000

200,000

300,000

100,000

Current assets

Noncurrent assets

Current liabilities

Noncurrent liabilities

Ordinary shares

Share premium

Retained earnings

At the time of acquisition, the current assets of Entity A have fair value of P1,200,000 while the

noncurrent assets of Entity B have fair value of P1,300,000. On the same date, the current

liabilities of Entity B have fair value of P600,000 while the noncurrent liabilities of Entity A have

fair value of P500,000.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Recommended textbooks for you

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning